Tatts' High Court loss: Shareholders shouldn't worry

Unsuccessful high court litigation outcome

On Wednesday last week (March 2), the High Court of Australia (HCA) announced that both TTS and TAH were ultimately unsuccessful in their respective legal claims to compensation for the loss of Victorian pokies operator licences.

These claims have been through the court systems for a few years now, and amounts claimed were significant. TTS in particular had won at the lower court (in 2015), as its claim was made upon a contractual agreement. In this light the decision from the HCA was slightly surprising, but certainly still was factored into our expectations as a possibility.

Specifically the decision from the High Court turned on the interpretation of the phrase “grant of new licences”. While the lower court held that this meant TTS was entitled to compensation, the HCA decision overturned this, interpreting the phrase differently.

Despite the result going against them, the company has appropriately accounted for the cash awarded at the lower court, holding a liability on the balance sheet pending this HCA outcome.

Financial impact

As mentioned, TTS has accounted for this outcome in its financials. At the half year, the company held a $540.468 million current liability that will now be repaid plus interest and costs to the State of Victoria.

Since the receipt of this money back in 2014, the company has utilised the funds to pay down debt and lower interest costs. As this amount will now be repaid, TTS will see additional debt funding drawn and interest costs rise for a portion of FY16 and into FY17.

It is worth noting that this amount does not otherwise impact the profit and loss of TTS and the underlying business. However, the increased interest costs will play a part in lowering our forecast earnings in FY16 and FY17 as the company's balance sheet utilises additional gearing.

A final amount payable from TTS to the State of Victoria has yet to be calculated as the amount will include the compensation amount of $451.157m plus interest and associated costs. The previously stated interest amount was $89.310m. We will await further information on any additional interest and costs payable, and note that we have forecast an additional amount payable in order to account for this in our earnings forecasts.

Debt covenants and balance sheet impact

In its announcement to the market, TTS has reiterated that following repayments to the State of Victoria the group's net debt to EBITDA ratio remains comfortably serviceable, and the company's dividend policy will not be impacted.

From a purely balance sheet perspective, the impact of this is that it will shift the company's liabilities from a contingent current liability (the accounting used to accommodate the potential that TTS would need to repay the compensation amount) to additional non-current liabilities in the form of additional debt. Overall, the balance sheet impact is minimal in our view.

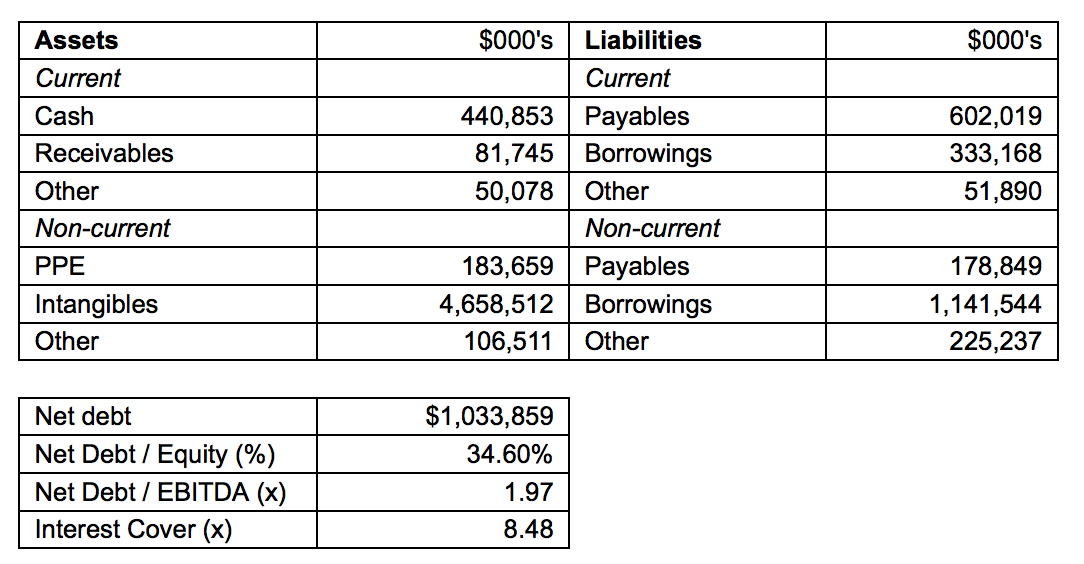

According to TTS' recent financial results, net debt to EBITDA was around 0.98 times at the end of the first half of FY16. Given the need to increase debt to repay the compensation amount we forecast that this will rise to around 1.97 times. In our view this is an acceptable level of gearing on TTS, and is unlikely to cause any major issues. Additionally, we forecast an interest cover ratio of 9 times.

Here's how we see the TTS balance sheet and some key ratios:

TTS was going to distribute the money anyway

TTS has stated that the intention should it have been successful in its claim would have been to distribute the proceeds to shareholders in the most efficient manner possible. From an ongoing underlying business perspective, little has changed.

What has changed is that the prospect of a one off sugar hit has been removed, and any special dividend or capital management in addition to the ordinary dividends is not going to eventuate.

That said, the fact that TTS was comfortable distributing any windfall to shareholders shows confidence from management that the balance sheet is stable despite this outcome.

Valuation adjustment and dividend outlook

Given the additional gearing and the interest costs associated, we have adjusted our numbers to reflect slightly lower earnings in FY16 and FY17. These adjustments have small impact on our forecasts for FY16 and FY17, so our valuation is reduced from $4.12 to $4.00 to reflect higher gearing and interest costs. Given the underlying impacts of this are considered to be slight, when compared to our financial forecasts, we continue to expect a strong dividend yield from TTS. Given the share price reaction saw TTS trade as low as $3.55 on Wednesday, we consider that TTS offers a strong dividend yield from a stable earnings base. No changes to the income first model portfolio have been made and we retain a buy call on TTS.

To view forecasts and financial summary for Tatts Group (TTS), click here.