Stock updates: Pental, Tox and CTI Logistics

Pental (PTL)

The fast-moving consumer goods (FMCG) market remains highly competitive in Australia and New Zealand, and Pental is having to increase capital expenditure as it attempts to improve efficiency and grow earnings on relatively weak sales growth.

During the first half of this financial year domestic sales in the Australian market grew 2 per cent, with Pental brands overall maintaining their market positions and steady growth coming from private label.

In the New Zealand market competition has further intensified with gross sales declining 2.5 per cent. This was further compounded by the deterioration of the New Zealand dollar in the first half.

Underlying earnings before interest and tax (EBIT) of $2.92 million was $0.974m below the previous corresponding period mainly due to moving the White King television advertising campaign to the first half, where advertising costs increased by $1.1m. Advertising costs for the second half will be considerably lower.

As part of the upgrade in facilities at the Shepparton manufacturing plant there is $5.3m of capital projects now underway. With these due to be completed in the next 6-12 months, management has suggested there is the chance to achieve significant cost savings moving forward.

Given the headwinds in the sector, significant cost savings will need to be achieved just to maintain the current level of profitability. Its home and personal care brands are under continual pressure from private label, and discounting remains an issue as competitors attempt to maintain market share.

Despite the significant investment in facilities and the large advertising cost, Pental is targeting flat earnings for the full year. To match FY14 net profit after tax (NPAT) of $5.3m Pental will need a much stronger second half given its first half NPAT was only $1.8m.

The balance sheet is strong with $3m cash, no debt and a $16m unused banking facility. A dividend payout ratio of 60 per cent has been maintained moving forward. In December last year there was a 1 for 15 share consolidation.

With an earnings per share forecast of 4.3 cents per share, Pental is currently trading on a PE of 9.5 times. Although it is certainly not expensive we are concerned that the structural issues of supplying the major supermarkets are going to be too large a hurdle to achieve consistent earnings growth.

We are downgrading our recommendation from “hold” to “sell” with a valuation/target price of $0.35.

ToxFree Solutions (TOX)

ToxFree Solutions' recent interim result was in line with expectations, with EBITDA of $37.4m up seven per cent. The share price of the integrated waste management and industrial service provider has started to recover from a period of weakness after the full-year results last year that failed to meet expectations.

The company is trading on an FY15 price-earnings (PE) multiple of 17 times. The growth outlook is becoming less certain in recent times mainly due to margin pressures. The reasons for this include the following:

- Increased competition.

- A proportion of revenue relating to construction phase projects.

- The acquisition of Wanless, with integration issues and increased east coast commercial and industrial exposure.

Much of Tox's growth has been achieved by targeting resource based towns where the company could set up barriers to entry by obtaining hazardous waste licenses and then cross selling its other waste services. This strategy has led to 85 per cent of revenues been from Western Australia, Northern Territory and Queensland.

This strategy has also heavily relied on acquisitions, as the company has transitioned from being a small waste services business operating in niche markets to a full service waste management company with a national footprint.

Although the majority of its resources exposure is through operating projects, the downturn in the sector has still been a drag on earnings. Also, growth by acquisition may be more difficult from here, as the national footprint means the company already has exposure to most of the key regions.

In the second half the wet season and recent cyclone in Queensland could impact earnings. The first half weakness in cashflow should improve with a $20m increase in receivables set to reverse. First half gearing (net debt to equity) of approximately 40 per cent should reduce to 30 per cent.

Our forecasts assume average earnings growth of 10 per cent over the next three years and our $3.40 valuation is reduced to $3.20. We maintain our “hold” recommendation.

CTI Logistics (CLX)

As expected and pre-announced late last year, CTI Logistic's interim result was particularly weak. Operational conditions are certainly challenging with a majority of logistics and transport earnings exposed to the slowing Western Australian market.

The downturn in minerals and energy work is no surprise, but the weak demand from the warehousing client base prior to Christmas was not anticipated.

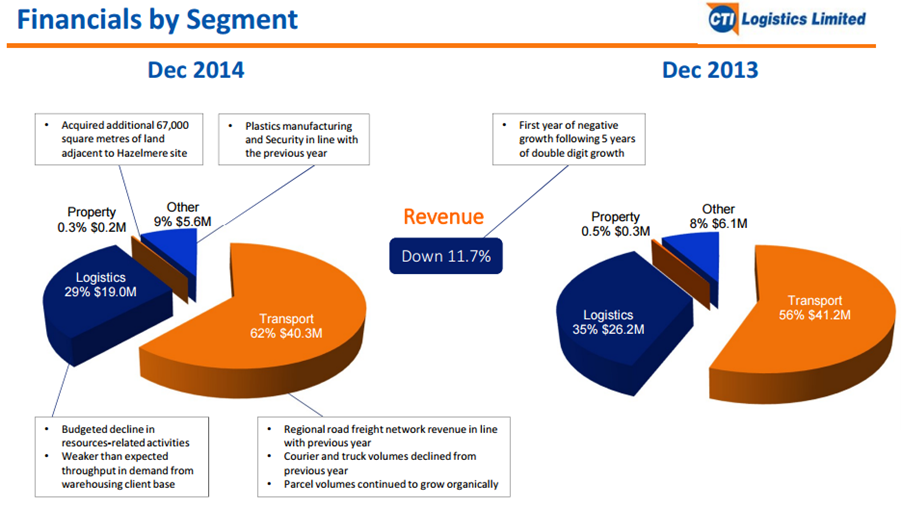

Revenue was down 11.7 per cent for the half, and EBITDA was down 24 per cent. This comes after five years of double-digit growth, and a track record of being able to grow earnings through weak market conditions.

Although conditions are tough, management is still investing in the business and targeting a couple of key growth initiatives that will ensure they come through the current downturn in better shape.

Specifically, the roll out of the regional road freight network is continuing as planned. Management has also invested in additional land at the Hazelmere warehouse and distribution centre. For a purchase price of $20m, a further 67,000 square metres of land was acquired, taking the total site to 154,000 square metres.

Management has highlighted an objective of targeting earnings accretive acquisitions with due diligence to commence shortly on a number of opportunities in the eastern states.

After providing transport and logistics services to the Western Australian market since 1974, it is not the first time the experienced management team has had to manage its way through a downturn.

Most of the weakness was in the logistics division, with a small decline in revenues resulting in a much larger decline in profit. The transport division actually performed well, with growth in parcel volumes and improvement in regional road freight offsetting a decline in couriers.

Although we expect the growth initiatives to benefit CTI in the long term, we are not anticipating a short term improvement in earnings or the share price.

In the near term the FY15 PE of 12 times is about right. But despite the lack of a short term catalyst there may be a deep value opportunity for the patient long-term investor.

After reducing FY15 and FY16 forecasts by an average of 20 per cent our valuation is reduced to $1.70 and we maintain our “hold” recommendation.