Sequencing growth

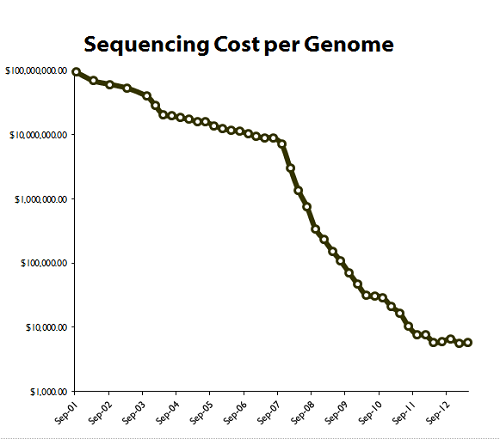

The first human genome was sequenced in 2003 after 13 years of work by teams of scientists all over the world contributing to the Human Genome Project. It cost over US$13 billion.

Today, a human genome can be sequenced in a few hours for a few thousand dollars. Sometime in the next decade it will take an hour and cost US$100.

By unlocking the human genome and its DNA, scientists and medical researchers have made significant advances in medicine and biotechnology. Over the past decade, DNA screening tests have been developed that identify early identification of risk factors for colon and breast cancers. Researchers now have a clear idea of the role played by genes in many other cancers, cystic fibrosis, type 2 diabetes and even autism. Better treatments and in some cases outright cures have resulted.

Genomics is still in its infancy

However in spite of the impressive results to date, genomics is still in its infancy and the real payoff, both humanitarian and economic, is in the future - hence the term “next-generation genomics” Not only will there be revolutionary breakthroughs in a number of serious diseases but also in the treatment of chronic diseases,70 per cent of which are totally preventable!

According to the McKinsey Global Institute in its influential 2013 study “Disruptive Technologies: Advances that will transform life, business and the global economy” the economic impact of next-generation genomics is estimated to be in the range of US$700bn to US$1.6tr a year by 2025, the majority of which would come from “extending lives through faster disease detection, more precise diagnosis, new drugs, and more tailored disease treatments”

Next-generation genomics involves improved sequencing techniques, big data analytics and synthetic biology - the ability to modify organisms. One of the main drivers in next-generation genomics is the rapidly declining cost of sequencing genes and the huge amount of data that is made available for researchers.

High-end computing power speeds up the process of analysing data and finding patterns within, enabling researchers to understand how genes mutate and cause disease. The old research paradigm of lengthy hypothesis driven trial and error testing has been thrown out the window.

Illumina leading the pack

There are a number of public and private companies that are successfully operating in the genomics space, but first and foremost is San Diego, California based Illumina. (You can see Illumina's video, Sequencing the Single Cell - Adventures in Genomics here.)

Illumina is a leading developer, manufacturer, and marketer of life science tools and integrated systems for the analysis of genetic variation and function. Using proprietary technologies, the company provides equipment for sequencing and array-based solutions for genotyping, copy number variation analysis, methylation studies, and gene expression profiling of DNA and RNA.

Illumina's customer base is large and diverse. It includes leading genomic research centers, academic institutions, government laboratories, hospitals, and reference laboratories as well as pharmaceutical, biotechnology, agrigenomics, commercial molecular diagnostic, and consumer genomics companies.

Illumina absolutely dominates the gene sequencing space with a 70 per cent market share and accounts for roughly 90 per cent of DNA data produced. Its newest product, the HiSeqX Ten, is the most powerful sequencer ever created and it can sequence genetic code for US$1000. It sells for US$10m. One of the first purchasers was Australia's Garvan Institute of Medical Research. Management has flagged 20-30 installs of HiSeqX per quarter.

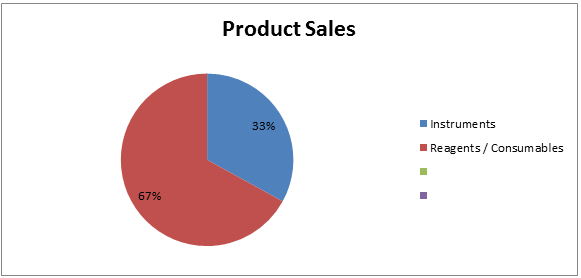

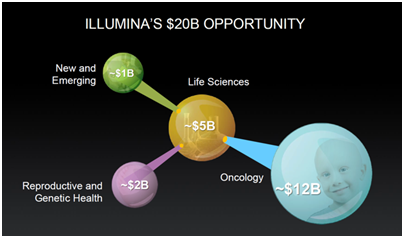

The addressable market for genetic sequencing and future growth opportunities is impressive. Illumina sells the sequencing machines, necessary consumables, and software to analyse the data. As well, Illumina maintains a service business that consists of whole human genome sequencing as well as non-invasive prenatal testing - both high growth areas.

investment case for Illumina revolves around the size and structure of the total addressable market opportunity (see chart above) and the company's demonstrated ability to capture and maintain significant share in the rapidly expanding genomics market.

Short term growth prospects

Catalysts and drivers for Illumina over the next 12-18 months include:

The establishment of new clinical standards toward NGS (next generation sequencing) billing and coding which will increase usage significantly in the largest addressable market of all for Illumina-Oncology. This market is growing at 35 per cent year on year for Illumina.(2Q 2015)

Continued expansion of the NIPT (non-invasive prenatal testing) market. Non-invasive prenatal testing will be one of the primary drivers of growth for the company, with usage in the average-risk setting ramping into 2016 as insurers adopt more accommodative policies as per Anthem's (a major health insurer) recent decision to deem NIPT medically necessary for most pregnancies. NIPT revenues grew 50 per cent year on year in the most recent quarter.

Growing interest in broad population testing. Illumina is well placed with its NextBio clinical and research platforms that allow for the gathering and interpretation of large scale genomic population data.

Long term growth prospects

Longer term, Illumina will directly benefit from the proliferation of so-called “personalized medicine” in which patient treatment is specifically tailored to their individual genetic makeup.

The potential growth in the consumer market prompted Illumina to create a new company, called Helix. Formed in August 2015, Illumina joined forces with two major venture capital providers - this consortium will provide financing commitments in excess of US$100m. The Mayo Clinic and LabCorp (a leading Life Sciences company) have signed on to help develop applications and provide analytical infrastructure to Helix.

At first glance, Helix seems like a way to aggregate massive amounts of genomic information on a large number of individuals, which could eventually give consumers exclusive access to their genomic data. This in turn then be linked to their electronic health records.

Helix should enable Illumina to meet one of its main goals by providing affordable sequencing and database services for consumers - a nascent but growing market.

Illumina has a market capitalization of US$27.9bn and has grown earnings at a 27 per cent CAGR over the past seven years. Analysts forecast 20-25 per cent revenue growth and a 25-30 per cent earnings CAGR to 2017. As you would expect, it sports a nosebleed-inducing PE ratio of 50 X 2016 EPS and has been a stellar performer.

The recent market correction however, has thrown up a buying opportunity for Illumina, as it is now some 20 per cent off its year high of US$240 which it reached on July 20 of this year.

When valuing a unique and dominant high growth asset like Illumina, a DCF makes more sense. Using a discount rate of 7 per cent, a terminal growth rate of 4 per cent, a sustainable EBIT margin of 37 per cent and 148m shares outstanding , I get a target price of US$240 or roughly 25 per cent upside from here.

Risks

Downside risks include:

Greater than expected reductions in academic research funding in the life sciences/genomics area;

Competition from potential disruptive sequencing technologies;

Execution risk tied to the suite of new product introductions;

Negative regulatory/reimbursement policies impacting the market opportunity for NextSeq 500 or MiSeq in clinical applications;

Sequencing technologies are significantly more complex than technologies and methods that the FDA and health insurers are used to dealing with today.

To see Illumina's forecasts and financial summary, click here.