Screening Netflix's potential

Like a number of high profile international companies that we have recommended in the past for Eureka subscribers, such as Facebook and Amazon, Netflix probably needs no introduction.

Founded in 1999 in Scott's Valley, California, by Reed Hastings (the current chairman and chief executive) and Marc Randolf, it started out as a DVD by mail rental business that gradually morphed into the world's most successful on demand video streaming company.

Netflix is now the world's largest internet television and movie network and by some estimates accounts for up to a third of all US bandwidth usage.

Netflix (finally) expanded into the Australian market in March of this year with a limited offering. All up, it is currently offering its subscription services in over 40 countries with plans to eventually cover over 200 locales by year end 2016.

I visited the company in May 2013 when Netflix was aggressively beginning its overseas expansion and just beginning to offer its “own content” and original programs such as “Lilyhammer”, “House of Cards”, and “Orange is the New Black” and I've been keeping an eye on it ever since.

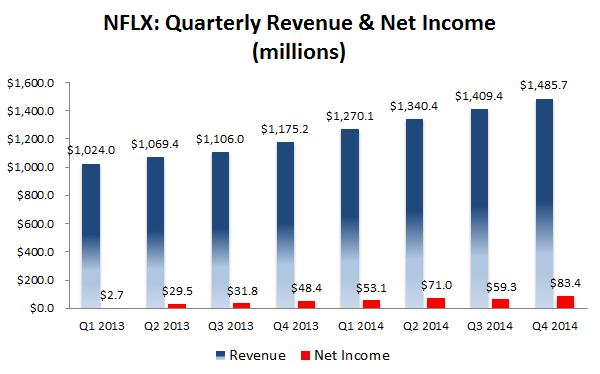

Netflix is a classic disrupter and a pure growth company. For example, during their fourth quarter of fiscal 2014, revenues rose 26.3 per cent to $1.49 billion, while net income surged 72.2 per cent to $83.4 million.

For the year, Netflix saw revenues climb 25.8 per cent to $5.5bn, while net income accelerated over 137 per cent to $266.8m with both measures beating consensus estimates. The company added some 13m new subscribers in 2014, up from the 11.1m added in 2013. By year end 2014 Netflix had 57.4m subscribers globally. Its original business – the DVDs-by-mail service – is still operating in spite of the growth in streaming and has 5.8 million members in the U.S.

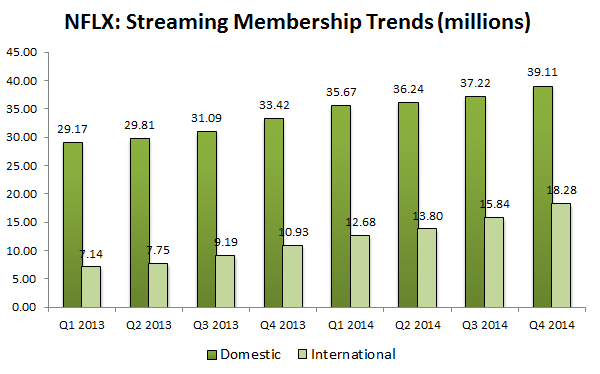

Subscriber growth, domestic and international is trending nicely with domestic growing at 34 per cent over a two-year period and international 157 per cent.

Source: Netflix SEC filings

Netflix announced first quarter earnings on Thursday, April 16, stating that it added 2.3m new subscribers in its domestic business and 2.7m new international subscribers. Both these metrics were well above expectations and guidance of 1.8m for the US and 2.2m for international. Sales were up 24 per cent to 1.57 billion as expected.

The company's guidance was for a continuation of these trends. In markets where Netflix is dominant (US, Canada) profitability metrics are improving. International is of course loss making, and the company has flagged that's where the bulk of its spending will be concentrated over the medium term.

Netflix said it now has some 62m subscribers worldwide as original content such as “House of Cards”, “Unbreakable Kimmy Schmidt” and “Bloodlines” brought in new viewers.

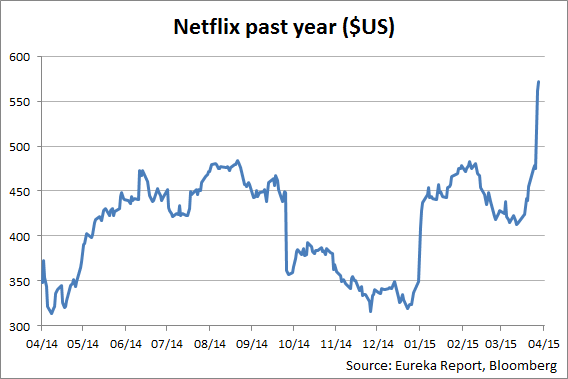

The stock jumped 18 per cent in next day's trading to the $US560 area as analysts raised earnings numbers and target prices.

The bull case for Netflix revolves around its successful OTT businesses (over the top content), the potential for price increases for subscription services($US8.99 is not a big ask for what you get a price increase of another $US1 coming at some point), the huge international expansion opportunity, the proliferation of broadband ready devices including TVs (by some estimates up to 487m of them by end 2016), tablets, gaming consoles, phones, etc. in the wider world, and how disruptive Netflix is to video viewing and the global media landscape – particularly TV and cable.

Netflix's US business is a direct beneficiary of “cord shaving/cutting” whereby long term customers are reducing exposure to traditional cable (cutting the cord) and millennials aren't even bothering to sign up. There are over 100m cable TV households in the US and Netflix is likely to be included in some of the new low cost bundles offered to keep subscribers. By some estimates 1.3m households will have cancelled their cable subscription in 2015.

Netflix's 2015 content line up is solid and much better than 2014 offerings. Content drives subscriber growth. Netflix will offer eight totally new original series as well as season three of “House of Cards” (recently launched), the latest instalments of “Orange is the New Black” and a large selection of new children's programming. Overall, there will be over 320 hours of new and returning original series. A joint venture with Disney will also provide some special content and subscribers will have access to the Lucasfilm output including the latest “Star Wars”, the seventh instalment in the series.

A recent survey by Wall Street investment bank Cowen & Co. placed Netflix a commanding number 1 in terms of content hours watched and overall customer satisfaction. Based on a survey of some 1,025 consumers (40 per cent of whom were Netflix subscribers), Netflix customers watched on average 7.2 hours a week. The next nearest was Hulu with 4.1 hours, followed by Amazon Prime with 3.1 hours and then HBO Go with 3 hours. On a 1-5 ranking, Netflix scored a 4.1 ranking, well ahead of Amazon Prime and HBO – both at 3.4.

The Netflix international opportunity is full of potential. Currently the company has 61m subscribers most of whom are in the US, Canada, the UK, Scandinavia and the Netherlands. The company is guiding to 120m members by 2020 – a 110 per cent increase. The global addressable market dwarfs that with a 350m subscriber opportunity up for grabs over the next 5-10 years.

Says the Wall Street Journal: “Broadband companies around the world have rolled out the red carpet for Netflix, opening their networks to the US streaming-video company, weaving its app into their set-top boxes and bundling its subscriptions with their service plans.” That's a huge tailwind for Netflix.

Netflix realises that expanding internationally is necessary for future growth but can involve high expenses. For this reason they have adopted the strategy they call “skimming” whereby they use more of their global content and originals as opposed to promoting local content with higher up-front costs. “Skimming” gets them market entry, subscribers and “the lay of the land” without making a big bet.

Australia/NZ has been launched in March and Japan is expected to be online in the fourth quarter of 2015. The total addressable market (TAM) of those regions is about 46m broadband households. Southern Europe, Korea, and Eastern Europe are scheduled in 2016.

Wall Street is divided on the stock. Of the 47 analysts that follow the company, 24 have a buy, 17 a hold, and 6 a sell. Recently there have been two upgrades from UBS and Citi, for much the same reasons that I am bullish on the stock.

Valuation

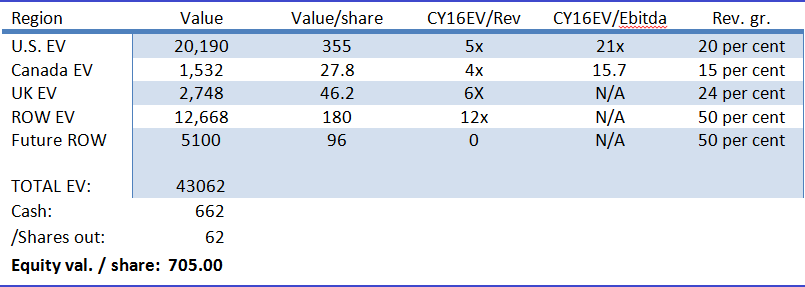

It's always tricky ascribing a valuation to high growth companies with elevated multiples that are still reinvesting heavily (and profitability is low) in the expansion of the business. A sum of the parts (SOTP) makes sense here.

Under a SOTP valuation, we value the company at $US705 per share, with the US business growing revenues at 20 per cent and profits at 40 per cent plus. The rest of the world is growing at 2.5 times the US currently, hence the higher multiple.

The main determinant for Netflix future value is international (Future ROW).

Recommendation

Netflix dominates its industry and will continue to do so in my opinion. If it continues to execute at home and abroad and remains dominant then the stock is a “buy” at current levels with at least 25 per cent upside.

However, as with all high profile and high growth, momentum stocks that have had a huge run, I would recommend patiently building a position starting in the low to mid $US500s area and using negative news flow/market volatility to one's advantage.

The stock has been a stellar performer this year, coming off a low base after subscriber growth in its third-quarter 2014 earnings release disappointed and pushed the stock down over 25 per cent late last year. It was trading in the high $US400s a year ago so it's back where it was and then some.

News flow and markets always provide buying opportunities in stock like these.

Risks

- If Netflix is unable to strike deals with content owners the expansion of its streaming catalogue would be curtailed. Difficulty in licensing third-party content, i.e. any change in content creators' desire to license content to Netflix would be problematic (at least until Netflix has proved its ability to create a regular stream of successful original programming).

- If internet service providers (ISPs) add more restrictive data usage caps, such as bandwidth caps or pay as you go broadband, Netflix usage would be limited.

- Competitors, such as Redbox, Amazon, or Apple might be able to offer more attractive customer offerings and thus take market share.

- Netflix might be unable to solve peering agreements with ISPs, especially as Comcast garners more power in its merger with Time Warner Cable.

- A failure to reach scale internationally. International markets are much higher risk with more uncertainty than domestic. Netflix future value rests on success overseas.

To see Netflix's forecasts and financial summary, click here.