Sandfire on solid footing

The warning golfers sometimes see on a round of their game was what hurt Sandfire Resources late last year when it was forced to hang out a sign reading “ground under repair”.

Just as golfers avoid a patch of grass with that warning so did investors avoid Sandfire as it was forced to repair water-damage to its primary asset, the DeGrussa copper mine in WA, after an underground flood.

Apart from an excess of water in the mine Sandfire was forced to battle copper-market headwinds as the price of the metal sagged under the pressure of a slowing global economy and fears that China has come to the end of its metal-intensive phase of growth.

The net result of lower copper prices, flooding which caused a temporary delay to mining, ongoing concern about the life of the DeGrussa mine and the need for Sandfire to make a meaningful discovery was a sharp fall in the share price.

What that run of negative issues did to our view of the stock is contained in the updated Sandfire valuation (below).

Any excess water in an underground mine is always trouble, both physically to project infrastructure, and financially because water is expensive to pump.

News of the water problem was instantly damaging to Sandfire. On the day before it was reported on November 20 the stock was trading at around $5.38. Within two days of the announcement it had fallen to $4.75, and by January 15 it reached a 12-month low of $3.74.

Since the share-price slide Sandfire has been in repair mode in more ways than one and the price is back up to $4.27.

In the mine, flooding was quickly stemmed with extra pumps swung into action, permitting underground operations to re-start on December 12.

In the December quarterly report released last week Sandfire said that while mining had been effected ore-processing on the surface had not thanks to the availability of stockpiled material.

The key to Sandfire's future, as it is for most small copper miners, is the price of the underlying metal and the potential for discovery to either make a meaningful extension to the life of DeGrussa, or for a fresh strike nearby to ensure a supply of ore for the processing plant.

The copper price is well beyond the company's control. All it can do is take the best price on offer and keep costs as low as possible, a process aided by the high-grades of DeGrussa ore and by a steady, albeit modest, increase in the mine's resource base.

If it can hit its production target for FY15, and avoid problems in the mine or at the plant, Sandfire should have a reasonably successful year with its chief marketing point being production stability and high ore grades.

But what management wants and what investors are hoping for is discovery news, either from near-mine exploration or from the extension of the search for more copper into ground it has joint ventured with Talisman Mining, or from other opportunities in the greater Doolgunna region.

Operations

Sandfire met its production guidance for the first half of FY15, despite having to temporarily suspend its mining operations during the quarter as it resolved the issue of increased water flows into the conductor 4/5 decline.

December quarter production, despite the flood, was a respectable 15.35 tonnes of copper, plus 9,058 ounces of gold at an attractive $US1.18 per pound of copper, comfortably below the current copper price of $US2.50/lb.

Production of contained copper for the six months to December 31 came in at 31,414 tonnes, in line with Sandfire's estimate for around 30,000 tonnes. The company achieved the result by feeding stockpiled ore into its mill.

The full-year production guidance range has been tightened to 65,000-68,000 tonnes of contained copper, compared to the previous range of 65,000-70,000 tonnes.

A stronger second half is anticipated, with the newly installed pebble crusher, grinding mill and column flotation cell forecast to lift recovery rates to 90-92%.

We have kept our full-year forecast of contained copper production at 67,500 tonnes, at the upper end of the revised guidance.

Sandfire reported C1 cash operating costs of $US1.18/lb for the second quarter, below the previous quarter's $US1.24/lb. The drop reflected the shutdown in mining operations, though $7.7 million in rectification works due to the water problems weren't included.

The miner estimates C1 cash operating costs will fall more throughout the year, and has set guidance of between $US1.05-1.15/lb – below its previous forecast of $US1.15-$1.25. Along with the mill improvements, the decline in the Australian dollar and weaker oil prices will assist in reducing costs.

Valuation

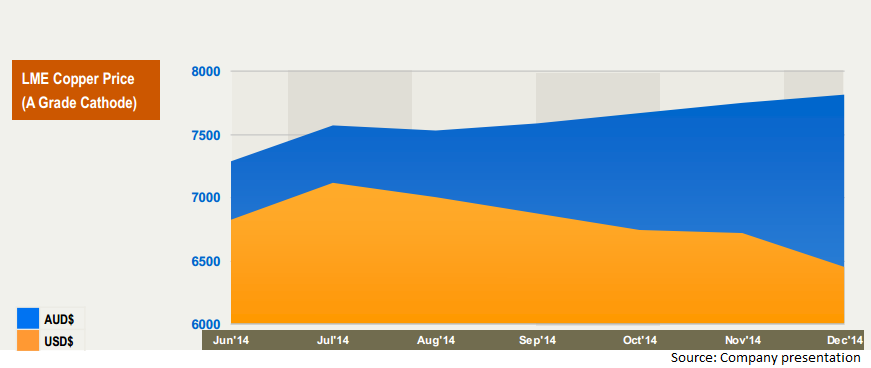

As with nickel miner Mincor, which is also covered in today's edition, Sandfire has largely negated the harm from a weaker commodity price to earnings through the lower AUD/USD exchange rate.

“We understand our share price will often move with global sentiment – particularly being a copper company – and it moves closely with the USD copper price, but we are still seeing very good operating cash flow and surplus generated at these prices,” said chief financial officer Matthew Fitzgerald during Sandfire's conference call.

Fitzgerald said the company has, in Australian dollar terms, sold copper concentrate at a roughly stable price of $A7,000/t despite the USD copper price falling to a five-year low of around $US5,400 in mid-January.

In line with changes to consensus estimates, we have lowered our copper forecast by 12% to an average of $US6,000/t for FY15, with the market anticipating a rise in the price of the metal throughout the second half of the year. Prices of $US6,800 per tonne and $US7,000 per tonne are pencilled in for 2015-16 and 2016-17 respectively.

However, we now predict the Australian dollar averages US85 cents during FY15 and 80US cents in the ensuing years, down from the previous assumption of US90 cents. Given the Australian dollar is trading around US77 cents now with downward momentum, our forecast may prove conservative.

Sandfire has also extended DeGrussa's mine life to mid-January and lowered its average copper grade estimate of 4.4% from 4.9%. While the longer mine life had already been factored into our model, we have had to reduce our average grade forecasts in the later years.

Summary

We maintain our “buy” recommendation on Sandfire, with a revised discounted cash flow valuation of $6.22 on the stock.

Weak global sentiment surrounding copper, and to a lesser extent operational challenges, have harmed the stock in the first half of FY15. But with the water issues resolved and the falling Australian dollar offsetting the soft copper price, the company remains in an excellent position to drive healthy cash flows ahead.

To see Sandfire's forecasts and financial summary, click here.