Revamped GWA eyes growth

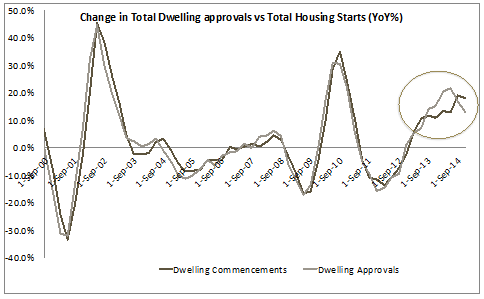

Last week we looked at the housing construction cycle and noted that it is not just house prices in Sydney and Melbourne that are elevated but the construction cycle in general.

We identified the bathroom and kitchen fixture distributor GWA as appearing interesting. Today we outline our investment view.

While it is always exciting to uncover the next big story in the market – the next tesla, Facebook, perhaps Uber – there are often opportunities to make solid investment returns on seemingly less exciting businesses. In the case of GWA their products may not be that exciting but you probably have a number of them in your house today.

GWA has recently gone through a significant divestment and rationalisation of its business. With this largely complete, we expect GWA to deliver double digit earnings per share (EPS) growth to FY17, an improved return on capital profile and a return to paying a dividend in FY16.

Trading on a FY16 price-earnings (PE) multiple of 15, we see limited downside to GWA's share price and do not think that the market is currently pricing in the improved returns and cash generative ability or a return to dividend.

We initiate with a “buy” recommendation and a $2.70 price target. Adjusting for a $0.28 proposed capital return, this implies a 19 per cent return.

Background

Today, GWA is Australia's largest supplier of home fitting and fixtures, primarily focused in bathrooms and kitchens.

Its key brands include Caroma, Dorf and Fowler. Key products include toilet suites, urinals, basins, plastic cisterns, bathroom accessories and baths and shower trays. In addition, the company sells tapware, showers and accessories, stainless steel sinks and laundry tubs.

The company has recently gone through a significant restructuring involving the divestment of a range of non-core businesses as well as the offshoring of manufacturing capacity.

GWA is led by Peter Crowley who has been managing director since 2003. Prior to joining GWA Peter held senior roles in industrial and heavy construction materials businesses.

In addition, the company recently appointed Patrick Gibson as Group chief financial officer, who has previously been CFO at both Brambles and Goodman Fielder.

Business rationalisation should lead to improved returns and cash flow

In recent years management at GWA has been undertaking a significant business restructure. The key changes that have been implemented include:

- Closure of Wetherill Park vitreous china manufacturing facility in 2014.

- Norwood plastics operations being phased out over the next three years.

- Transition to sourcing plastics and vitreous china products from overseas suppliers.

- Sale of Wetherill Park site in April 2015 for $33m. The company will lease back the premise for three years for its warehousing capacity.

- Divestment of Dux hot water for $46m.

- Divestment of Brivis Climate Systems for $49m.

In addition to the above, GWA announced in April its intention to divest its underperforming garage door business Gliderol. GWA acquired this business in late 2010 for $42m when it was achieving earnings before interest, tax, depreciation and amortisation (EBITDA) of $7.6m. In FY14 the business generated an earnings before interest and tax (EBIT) loss of $4m.

Clearly this has been a poor acquisition. Even if management gives this business away for free it will be a positive outcome for both group returns and earnings.

It has been a significant restructure. In summary:

- Divesting poor performing and non-core businesses should improve group profitability and returns as well as freeing up management to focus on the core business.

- Closing manufacturing facilities and importing a range of products will reduce the capital intensity of the business and improve both returns and cash flow.

We view the completion of this restructure as a distinct positive for the investment case.

Cycle remains supportive

Outside of company specific restructuring initiatives, the key driver of GWA's earnings is the new housing and renovations market.

As we highlighted last week, activity levels in the new housing market are more than robust. This in itself should prove supportive of GWA's core earnings.

In addition, we pointed out that the lag between building approvals and building commencements/starts has materially increased this cycle.

The increase in lag between approval/commencement/completion should increase the duration of this cycle and should underpin robust earnings for GWA's core business for the coming years.

GWA is our preferred late cycle exposure to the housing and construction cycle.

Double digit EPS growth to FY17 is achievable

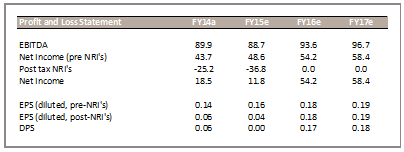

With an accommodative cycle and a significant restructure now behind it we expect GWA to deliver double-digit EPS growth in both FY15 and FY16. We outline our earnings estimates below:

Return profile and cash generation improving

Divesting non-core businesses, closing manufacturing facilities and moving to an import model as well as returning excess capital to shareholders all work to reduce the capital intensity of the business and improve the returns profile.

In addition, we expect this refocusing of the business to improve the cash generative ability of the business and support an improvement in dividend payout ratio in the future.

Capital management and return to dividend likely in FY16

GWA has had some challenges paying a dividend in recent years. It wasn't due to an overly geared balance sheet or lower than expected cash earnings. It was rather a result of the company having insufficient retained earnings and current year statutory profits to pay a dividend (a company needs at least one of these to pay a dividend).

GWA currently has a negative retained earnings balance due to the magnitude of restructuring and impairment charges taken in recent years. This first occurred in FY14 when the company was unable to pay an interim dividend.

Similarly, with the exit of manufacturing bathrooms and kitchens in Australia in FY15, further restructuring charges have been recorded resulting in GWA being unable to pay a dividend this financial year either.

Nevertheless, despite these accounting constraints, following GWA's business rationalisation program the company's balance sheet has significant excess capacity. As a result the company announced an $88m or $0.28 per share capital return in April 2015.

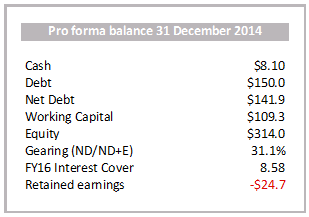

Incorporating the sale of Brevis and Dux and the $0.28 per share capital return the company's balance sheet remains in solid shape. As outlined below post the post the capital return, interest cover (EBIT) will be in excess of 8 times and gearing will be 31.1 per cent.

With such a significant restructuring behind GWA we do not expect any further restructuring charges in FY16. The only risk to this view is that the $7.1m carrying value of the Gliderol Doors business, which is losing money and in the process of divestment. It was purchased in 2010 for $42m.

Nevertheless, with an expected $12m of statutory net profit after tax (NPAT) in FY15 and $55m in FY16, the company should be well placed to return to a positive retained earnings balance and recommence distributing franked dividends in FY16.

Valuation

As GWA puts the recent restructuring behind it, completes the sale of Gliderol, returns to paying a dividend and delivers above market EPS growth, we think the company will trade towards a market PE.

Certainly, at 15 times FY16 EPS there appears to be a limited amount currently priced in for these outcomes occurring.

Adjusting for a $0.28 return of capital, our price target of $2.70 implies a total shareholder return of 19 per cent.

To see GWA's forecasts and financial summary, click here.