PS&C: Leverage to further growth at the IT services provider

IT services company PSZ achieved an underlying half year result in line with guidance from January, with earnings before interest and tax (EBIT) of $3 million. One of the reasons PSZ trades on discounted earnings multiples and a micro $57.5m market cap is management have consistently struggled to meet market earnings expectations, even though they usually don't provide formal earnings guidance.

The reported profit was higher due to a one-off $2m deferred consideration adjustment: Basically because they haven't hit earn-out targets, they end up paying less for the acquisition. Revenue was $41.2m with an underlying EBIT margin of 7.4 per cent. The interim dividend of 2.5 cents per share was above expectations, with a payout ratio of 47 per cent.

Although again no full year guidance was provided, management stated: “We remain confident there is enough pipeline and activity in our segments to report a good result for the full year.” The final dividend is also expected to exceed the 3 cents from last year. This suggests a degree of confidence in the full year outlook, given the company policy is to payout 50 per cent of earnings in dividends.

Net debt increased to $11m vs net cash of $1m at June last year, which was partly due to some debt funding of the Bexton acquisition (in October 2015) and Certitude (in January 2016).

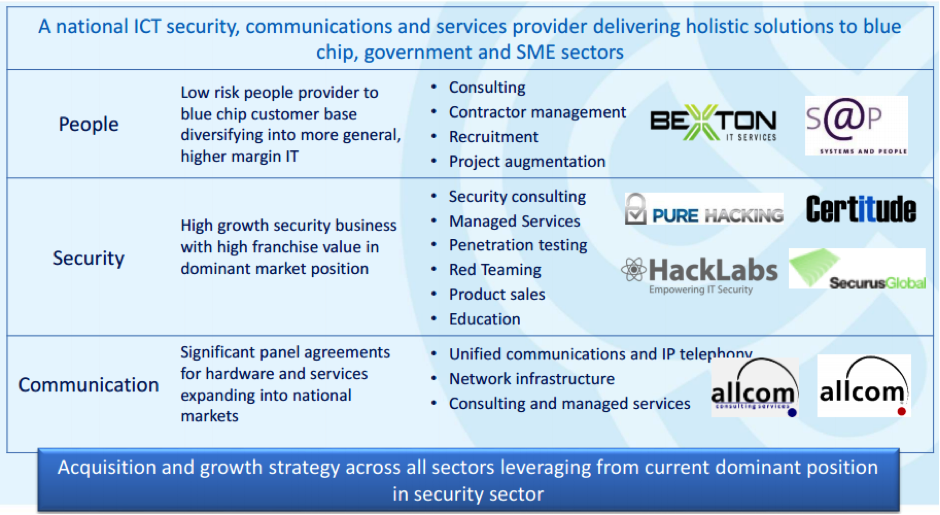

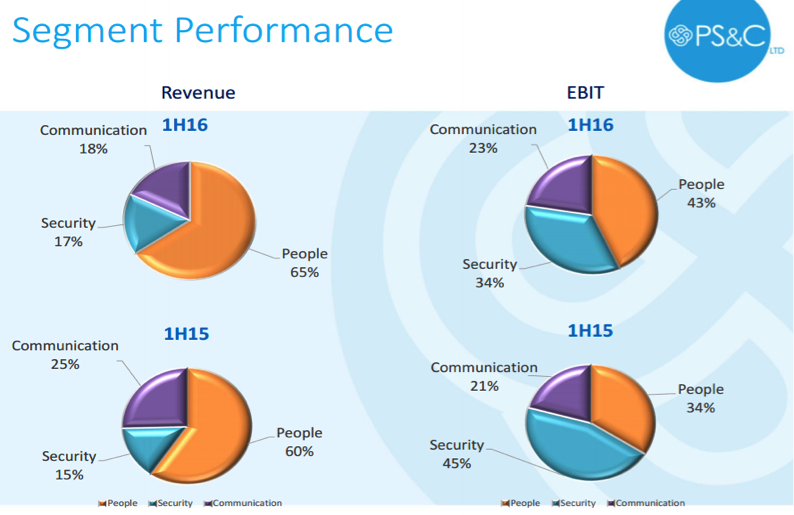

PSZ report in three key divisions – people, security and communication. People is comprised of S&P and the recent Bexton acquisition. The typical work includes consulting, contractor management and recruitment solutions. Security includes Securus, Hacklabs, Pure Hacking and Certitude. The typical work includes security consulting, education and penetration testing. Communications includes Allcom Networks and Allcom Consulting. The usual work includes Unified communication and IP telephony, network infrastructure and consulting.

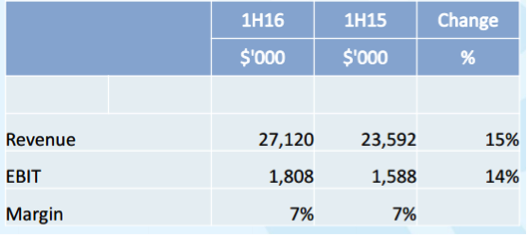

The People division is performing well both organically, and through the acquisition of Bexton. Revenue grew 15 percent and EBITDA 13 percent.

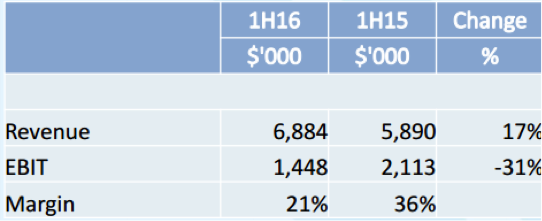

Security revenue was up 17 per cent, but EBITDA was down 31 per cent. This needs to be put into context, given that EBITDA margins last year were not sustainable at 36 per cent. Even after the margin decline this year, it is still by far the highest margin division at 22 per cent. A stronger performance is expected in the second half.

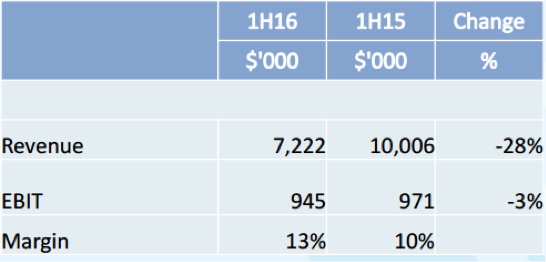

Communication revenue was down 28 percent, but EBITDA was only down 3 per cent with high margin growth. Part of the revenue decline is just cyclical and will be recovered in the second half.

Management made the general comments that they have recruited and retained highly skilled staff across all segments. Additionally have had further panel wins with a strong pipeline of work.

The shareholder structure doesn't encourage liquidity or institutional ownership. Approximately 56.8 per cent of the register is vendors and founders, with only 0.7 per cent institutional. Going forward, management continues to have the option of paying deferred consideration in cash, scrip or a mix of both.

Summary

Although the roll-up nature of the PSZ business involves risk, we are attracted to the higher growth security division and the ability for management to leverage this security offering through the rest of the business.

The nature of the company's work means which project work is reported in June or July is quite unpredictable. This can have a large impact on the final full year results and is the main reason why management doesn't provide detailed earnings guidance.

The stock is cheap, trading on a PE of 8 times FY16, albeit with potential dilution from deferred payments. Also a solid 6.5 per cent yield, based on the assumption of a 50 per cent payout ratio. We maintain our buy recommendation with $1.05 valuation.