Pental clears the air

After Pental's (PTL) latest half-year result we had a “sell” recommendation on the stock due to concerns around management's ability to achieve sustainable earnings growth. We are now upgrading our recommendation to “hold”, with some further clarity around the company's outlook.

The stock is certainly not expensive trading on a price-earnings (PE) multiple of 10 and dividend yield of 6 per cent.

But the $5.3 million capital expenditure program to improve the efficiency of the Shepparton manufacturing plant had been delayed. Our concern was that this delay would result in a cost blow-out.

After further investigation we are confident everything is on track, and cost savings should be achieved over the next 6-12 months. The payback on this program is expected to be within three years.

The other negative from the first-half result was around the much higher than expected advertising cost. We are now comfortable that this was solely due to the White King television campaign being brought forward to the first half. The advertising cost was $2.55m, which was $1m above the corresponding period.

Excluding the timing impact of the White King advertising campaign, the underlying EBIT was marginally up on last year. Guidance for the underlying full year result is flat on FY14.

The challenge is that the organic business, as it currently stands, is only likely to achieve revenue growth up to 5 per cent with an objective of maintaining earnings margins. Chief executive Charlie McLeish is aware that he needs to achieve earnings growth of at least 10 per cent per year to gain greater interest from the market and increase the share price (it has a current market cap of $54m).

With a manufacturing plant running at improved efficiency, the job then becomes to further leverage the asset and achieve a greater return on equity.

The good news is that after a successful restructure the company is now in a net cash position of $3m with an unutilised $16m debt facility.

We are encouraged by management's attitude towards growth; however, it remains to be seen if they will pursue acquisition opportunities or find alternative distribution channels.

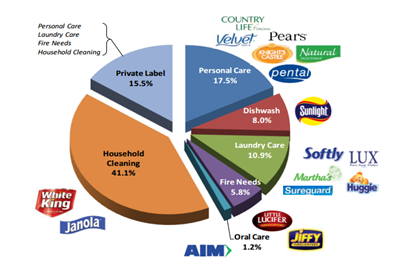

The job of supplying the supermarket chains will remain challenging, but McLeish and his team are doing everything in their power to promote their leading brands as well as provide private label products.

Since McLeish started in early January 2014 he has focused on refreshing the company's marketing and improving the product range. The efforts have been rewarded by the major chains giving them greater shelf space.

They have also successfully aligned themselves with new entrant Aldi, who has been gaining market share. This become evident as one of the reasons behind Woolworths weak quarterly results announced last week.

Capex program

As mentioned, the business has $5.3m of capital projects underway. Management have the view that this will bring their manufacturing operations up to best practice standards within the next 6-12 months and achieve significant cost savings moving forward.

The projects at the Shepparton plant include:

- Increasing automation and flexibility of Bleach Line B to allow for increased volume and improve productivity.

- Replacement of Bleach Line A filler (that had been previously relocated from the Port Melbourne site). This will minimise waste and downtime.

- Undertaking stage 1 of the soap plant modernisation, with the installation of a one-step process.

The installation of a high speed liquid and bulk line, will also enable increased volumes. Existing assets can be utilised until the new equipment is fully commissioned.

Sustainable yield

After the first-half result management re-instated its dividend with guidance of a 60 per cent payout ratio. It is a positive that the company chose to suspend the dividend while it restructured the business.

With the company towards the end of a large capital expenditure program, this dividend payout ratio is sustainable, and the healthy 6 per cent yield should provide some share price support while we wait and see how successful management are in driving higher growth.

Summary

If the growth outlook is at or below 5 percent, then we view a PE multiple of 10 as about right. If this increases to a growth outlook of greater than 10 per cent then a PE of 12-13 would be the target.

For FY15 we are forecasting net profit of $5.4m and earnings per share of 4.2 cents. Therefore, if the company was able to give the market confidence that growth is resuming, a PE re-rating to 13 equates to a share price of 55 cents or approximately 30 per cent upside from the current price of 42.5 cents.

We will be watching for further guidance about the path to growth. For now we are maintaining conservative assumptions with a price target of 45 cents and a “hold” recommendation.

To see Pental's forecasts and financial summary, click here.