Our newest LIC purchase: Bailador

Since the last time I sat down with Bailador Technology Investments (BTI) chief executive David Kirk, the IT focused private equity investment company has been on my mind. It appears Kirk and company are getting it right and they are trading at an attractive long term entry point – this is why BTI is coming into the model portfolio at a 5 per cent weighting.

What boxes does BTI tick?

● Significant skin in the game by management

● Experience, with now a five year track record for the portfolio returning approximately 24.3 per cent pa since inception

● No distractions: BTI is the team's only portfolio there are no other portfolios vying for attention

● Proactive in communicating the investment approach with shareholders and the market

If you think back to my management checklist article (you can read it here: LIC managers: Finding your perfect match, February 29, 2016), the above list covers close to every point.

The holdings

What does the team invest in? BTI specialises in selecting expansion phase, unlisted technology companies. The underlying portfolio is not created with the idea of providing venture capital to brand new start-ups. These are established businesses with established revenue streams seeking capital to go to the next level. It is not a matter of “a great idea, but we don't know if they work”. In these cases, we know the businesses work already.

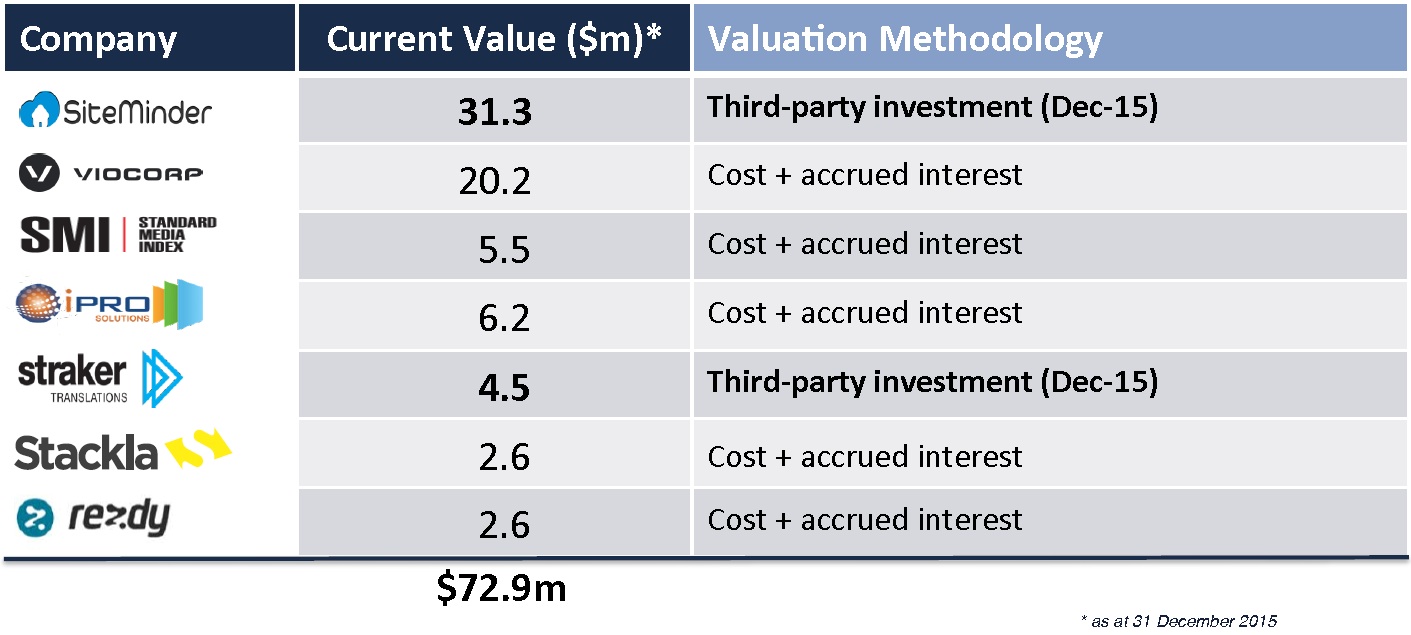

The seven companies currently in the portfolio are spread across ten different countries and employ over 600 employees. Across the seven companies currently in the portfolio are spread across ten different countries and employ over 600 employees. The businesses primarily specialise in software as a service (SaaS). These are businesses across a range of industries but essentially are services that enable wide spread cost efficiencies. Below is a table taken straight from a recent BTI presentation showing all seven of the current holdings. Although it tells us how much of the portfolio is made up of each it does not tell us how much of the total company BTIs holding represents:

The portfolio is currently heavily weighted towards two holdings, SiteMinder and Viocorp. Siteminder is an online tool that helps hotels manage room bookings across multiple accommodation booking websites. BTI's stake in Siteminder is currently valued at $31.3 million, with BTI estimating a value range of $60m - $100m in the next 24 months.

Viocorp is a cloud-based platform that hosts and helps distribute video online. BTI's position is currently valued at $20.2m and estimate the position to be worth $30m - $85m in the next 24 months given recent growing interest.

In a recent shareholder presentation BTI had a slide showing the holdings, current value, forecasted value and catalyst to realise that valuation in the next 24 months. The lower end estimated impact on the portfolio's net tangible assets was an uplift of 1.8 times. The bullish case in the unlikely event everything was to go right was an uplift in value of 4.1 times. To view the full presentation click here: BTI Investments.

Hands-on approach

The team at BTI take a hands-on approach with the companies they invest in. BTI will not invest in a business unless they can get a person on the board. This gives great visibility for BTI to the underlying businesses, which is of significant benefit. They are also able to leverage their own knowledge base and the knowledge and expertise of contacts in other businesses partnerships to help the grow their stable of investments.

It is important to also take into consideration the capital structure that BTI enters the investments in. The LIC comes in as a convertible preference shareholder rather than an ordinary shareholder. This gives BTI downside protection in the event of the investment case not playing out as expected, but also the convertible nature allows the team to convert to ordinary equity to capture the full upside potential.

The return profile

The return profile is going to be lumpy, given the revaluation nature of the underlying investments. This can be smoothed out with the payment of dividends, and Kirk has reiterated management's intention to pay out realised gains.

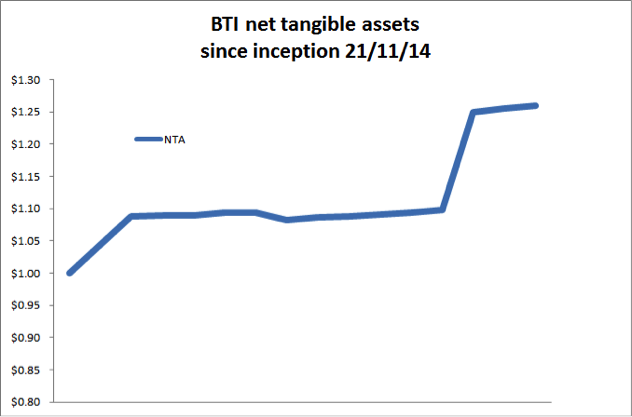

For NTA growth the companies are revalued when another party purchases or sells the businesses or when BTI realises its investment. The business is then revalued to the sale or purchase price, hence the jumps in the net tangible assets.

This does mean between (and after) NTA updates, the share price can go on a random walk for no apparent reason. The current discount to NTA is 13 per cent – taking into consideration the exercising of options, which will marginally dilute the NTA. We estimate approximately 50 per cent of the options on issue will be exercised. This was mostly thanks to Kirk and Wilson exercising their options plus Soul Pattinson (SOL), taking up $20m of the shortfall.

The approximate 13 per cent discount is a big one, but it has been closing. In August 2015 it was as large as 30 per cent. Now with the options overhang out of the way and management with the right attitude to communicating and marketing the LIC, plus the added confidence the SOL's investment brings, we can see the discount continuing to close over time.

Speaking with SOL managing director, Todd Barlow, he said the team at Soul Pattinson had been looking at a lot of private equity technology companies as they could no longer ignore the space but found the screening process incredibly difficult. The team met with BTI and came to the conclusion the best way to enter this growing space was through the Baildor LIC.

The opportunity with BTI is simple. As an individual investor, it would almost be impossible to take advantage of these unlisted businesses. BTI is your gateway to them. Right now BTI is trading at an approximate 13 per cent discount and it has shown evidence of closing that gap to NTA. Continued successes and the commencement of dividend payments will only help close the gap and potentially push towards a premium. For more on BTI click here to watch our recent interview with David Kirk.