Nearly there with Nearmap

Recommendation

What do Crowded House, pavlovas, and Phar Lap have in common? They're all Australian success stories that didn't originate in Australia.

Another that you might not have heard of is Nearmap, which has taken aerial imagery that was popularised in the US and now it's trying to beat the Americans at their own game.

When most people think of aerial imagery they immediately think of Google Earth, a free service that gets the job done for most people. But its low resolution and infrequent updates make it woefully inadequate for commercial users, and that's where Nearmap comes in.

Key Points

-

Dominant Australian provider

-

Attempting to expand in the US

-

Put on your watchlist

Nearmap sells subscriptions for higher resolution imagery that's updated frequently, so subscribers save time and money by viewing a site without physically visiting it. Engineers use it to view construction sites; insurance customers view the properties they're insuring; and solar power installers use it to inspect roofs and site access. The list of customers goes on and on.

Nearmap's images are so rich that as little as 2.5 cm of the earth's surface is captured into each pixel. Users can even see how a location has changed over time (with images dating back to 2007), and new oblique technology has even enabled 3D imagery.

The model

Creating and updating an image library involves specialised camera-mounted planes that make regular flights. This is a fixed cost that resembles the operating costs of an airline, in that it doesn't change whether the business has one customer or 101.

Fixed cost models like this are great when the business is growing because each additional customer contributes incrementally greater earnings. But as the first century of aviation shows, it's a disastrous model when revenue falls short of expectations.

| Half year | 2H15 | 1H16 | 2H16 | 1H17 | 2H17 |

|---|---|---|---|---|---|

| Revenue ($m) | 12.2 | 13.6 | 16.1 | 17.7 | 18.6 |

| Gross profit ($m) | 10.6 | 12.3 | 14.7 | 16.2 | 16.6 |

| Gross profit margin (%) | 87.1% | 90.0% | 90.1% | 91.2% | 89.4% |

| Sales and marketing expenses ($m) | (3.0) | (3.7) | (4.1) | (4.2) | (4.0) |

| Administration expenses ($m) | (1.4) | (1.5) | (1.2) | (1.8) | (1.8) |

| Australian EBITDA (before group costs) ($m) | 6.3 | 7.9 | 8.6 | 11.1 | 9.8 |

| EBITDA margin (%) | 51.6% | 58.0% | 53.1% | 62.5% | 52.8% |

Nearmap is a good business because its revenue isn't limited to the number of plane seats like an airline's. In fact, a big market exists for aerial imagery, and Nearmap has just 15% of it in Australia so it has the opportunity to be multiples of its current size.

Current margins are strong, as you can see from Table 1 – but imagine what they'd be like with twice the number of users.

Chartering a plane to photograph the earth might sound easy, but it isn't. Doing what Nearmap does requires lots of specialised intellectual property.

Early capture technology could only cover 300 square kilometres per day. But current technology allows planes to travel faster and at higher altitudes so they capture 67 times as much today. Automated software is used to weave terabytes of raw images into a seamless map so that users can view it in their web browsers in days instead of months.

Satellites can do this too but the image quality doesn't come close to Nearmap's.

The power of scale

Nearmap's technology gave it the lead in Australia but its large size is now an equally powerful weapon against competition.

Nearmap initially used banner advertising to generate revenue until it converted to a paid subscription model in 2012. This was an important change that has unlocked its potential.

A subscription model is a powerful deterrent to competitors because the value of an individual customer is low in relation to the upfront costs of operation. This means a new entrant would need deep pockets to withstand years of losses.

Nearmap spends around $3.5m each year creating its Australian content and it sells annual subscriptions for around $5,500 on average (although subscriptions range from $400 to $50,000). It took Nearmap four years to sign enough customers to cover its annual content costs, and more still to cover its marketing, technology and other operating costs. A new entrant would likely take the best part of a decade to break even with a cost of many tens of millions of dollars.

Nearmap could even reduce its subscription price to make life very difficult for new entrants, reducing its own short-term profitability for the sake of long-term industry dominance.

These dynamics suggest the industry is likely to end up with a regional monopoly. If it is the cheapest for one provider to serve the industry then one is likely to eventually do so, and Nearmap is the best placed.

It does have a credible Australian competitor in Spookfish (ASX:SFI), which has good technology and the backing of Nearmap's founders. But it's hard to see it catching up any time soon.

US expansion

If you needed an example of how unhelpful price-earnings ratios can be, then look no further than Nearmap.

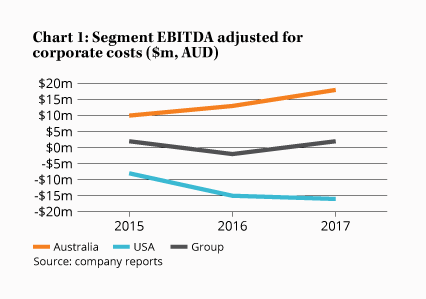

It loses money on the surface but that tells you little about its underlying value creation. Underneath you will find a highly profitable Australian business that is bankrolling a US expansion. There's also a timing discrepancy because Nearmap incurs 100% of its customer acquisition cost in the first year, even though customers stick around for 10 years on average (in Australia or five years in the US).

Nearmap's big upside potential comes from the US expansion. Unlike many Australian companies that expand abroad, Nearmap has a decent chance of success because the US market is highly fragmented and yet to widely adopt a subscription model. Nearmap has also put the lessons of its Australian expansion to good use by signing more customers in its first four years than it did in Australia.

There are strong competitors, such as Eagleview, which is much bigger than Nearmap and has established relationships with customers. There were concerns that Eagleview's technology was lagging, but they addressed that recently by partnering with Spookfish. So it's not going to be a walk in the park for Nearmap.

If the US expansion is a flop, investors will at least be left owning the Australian business having paid an enterprise value to earnings before interest, tax, depreciation, and amortisation (EV/EBITDA) multiple of 10 times for it. It would, however, take many years before management ran up the white flag and there would no doubt be significant closure costs.

If it succeeds in the US, then the company could be worth multiples of the current price. The trouble is that in an emerging industry like this it's very hard to judge the chances of success. On that basis, we'd want to see a greater margin of safety before investing. However, the stock is worth a spot on your watch list. We won't put a price guide on at this stage, but we're initiating coverage with a HOLD.