Lenovo motors forward

Ten years ago, Chinese technology giant Lenovo bought IBM's struggling PC business. Since then it has become a global player not only in PCs, but also in laptops, tablets, smartphones and other digital devices. Last year it purchased IBM's server business and US smartphone manufacturer Motorola Mobility from Google.

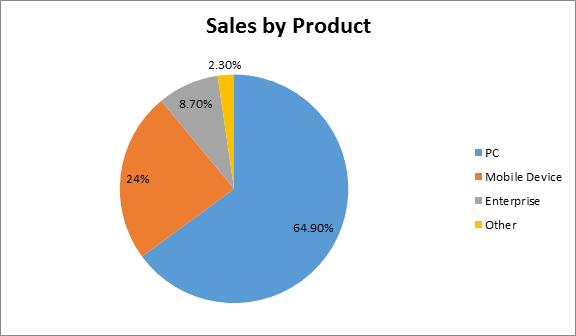

Lenovo's main businesses are PCs and mobile devices. Lenovo is now the world's largest PC vendor with some 20 per cent of the global market. With the Motorola acquisition, Lenovo is now the third largest smartphone maker in the world after Samsung and Apple. Enterprise (servers) is expected to be a greater portion going forward with the expansion of the acquired IBM business.

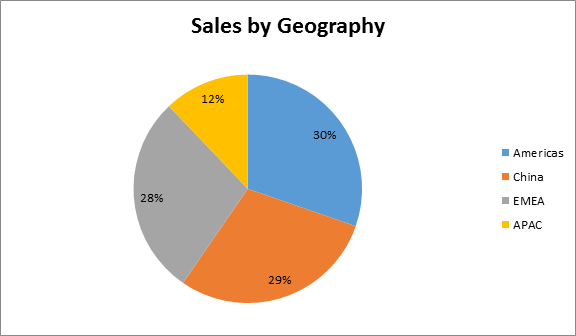

The company is now truly global with a nice geographic balance (see the graph below).

The investment case for Lenovo is predicated on the successful integration of the two most recent acquisitions as well as ongoing market share gains in PCs/ laptops/tablets, new innovative products and significant margin expansion.

Lenovo hosted its inaugural “Tech World” event in Beijing for analysts and investors on May 28. 2015 and articulated its strategy going forward.

Lenovo is building its future business on three pillars – device innovation, connectivity and cloud/infrastructure.

In smartphones the company acknowledged the unique competitive challenges in the Chinese market. Its strategy involves positioning the android based Moto X product as high end with the Lenovo branded products as more a “value proposition”. New offerings such as the revolutionary “projector” phone and dual screen smart watch are also expected to generate interest in the brand. Major players in China include Apple, Samsung, Xiaomi and Huawei.

Enterprise is one area where Lenovo believes there is a great opportunity for ongoing share gains and a significant growth. The company continues to integrate the IBM x86 product line and is expanding its sales force. Hyperscale, a distributed computing environment using open source software, is a key market that Lenovo wants to play in, especially in China. This initiative, if expanded globally, could provide more competition for “Whitebox” data centre vendors and could see a large total addressable market (TAM).

Still, Lenovo plans to firmly remain as a hardware vendor in the enterprise area and will only tackle near-the-box software and services, leaving IT services and core software to its partners.

In PCs Lenovo is flagging a 30 per cent market share (up from 20 per cent currently) as a realistic target in the next three years, in line with expectations of a faster industry consolidation and driven by software upgrades like Microsoft 10. While global enterprise and consumer (ex US) market share are already approaching 20 per cent-plus, Lenovo feels that there is more room to grow in the SMB (small and medium business) space globally.

On a geographic basis, Lenovo plans to spend more efforts in the Asia Pacific market since its market share outside Japan and China remain much smaller.

Recent earnings (FY4Q 2015)

Lenovo reported better-than-expected fourth-quarter FY15 earnings, stemming from lower tax and higher gross margin despite weaker revenues (mainly due to FX translation losses) and higher operating expenditure ( including restructuring costs).

Guidance was mixed and candid. The near-term demand picture has worsened, both for PCs and own-brand smartphones, in addition to higher restructuring costs, which makes FY16 a back-end-loaded year

Restructuring costs will rise in the next two quarters, but profitability targets for Motorola and System x server business are intact. The PC profit pool keeps expanding, with market share gains accelerating.

Server business starting to make profits, but turning around top-line momentum still requires work. Management remains firm on its Motorola and enterprise business turnaround targets

Lenovo expects a soft June quarter (revenue and pre-tax profits likely flattish Q/Q due to PC demand push-out, ongoing restricting in Lenovo own-brand smartphones, and higher restructuring costs. As a result, growth is likely to pick up only in the second half of FY16 (the second half of calendar 2015)

The PC market

Why would I be recommending the world's largest PC vendor when the product is assumed by many to be in decline – a twentieth century relic supplanted by tablets and smartphones? The fact is, while the market no longer grows at 8-12 per cent, there is still the potential to reverse the tablet induced declines of 2013/2014. Some industry analysts are forecasting a flat 2015 followed by 2-3 per cent for the next three years based on:

- Aging corporate PCs in emerging markets are in an upgrade cycle

- Tablet cannibalisation is diminishing. Tablet markets reaching saturation point.

- Microsoft Windows 10 and XP expiration are also driving PC upgrades.

Lenovo's commercial PC brand is the legendary “ThinkPad” brand, which has the longest history of any existing PC brand and is known for reliability. On the consumer side, it sells under the “IdeaPad” label, which is positioned as “cool and unique” according to the company. With defined positioning and aggressive R&D and marketing spend Lenovo is positioned to outgrow the market and gain share.

The company's PC product is perceived as high quality. Lenovo has a competitive cost structure through in-house manufacturing. While other PC original equipment manufacturers (HP, Acer, Dell) rely on outsourced original design manufacturers for manufacturing, Lenovo is still 50 per cent in-sourced. In an environment in which NB ODMs are consolidating and are regaining pricing power, Lenovo is well positioned in that it can leverage its in-house manufacturing and enormous scale to achieve the best cost structure.

Smartphones

The MMI (Motorola Mobility) acquisition gives Lenovo a significant footprint in the Americas and a foothold in Western Europe. Motorola Mobility, at the time of purchase, was the number three Android smartphone manufacturer in the US and number three overall in Latin America. The Moto brand should also gain traction in China and Asian markets via Lenovo's sales channels (7,000 stores).

Lenovo will soon release its latest camera-centric smartphone “VIBE Shot” featuring a 16 MP rear camera with OIS (optical image stabilization) and tri-color LED flash, priced competitively at RMB1,799 ($US290) versus peers at $US650.That it inhabits a cost vertical ($US300.00) is also a positive in terms of competition (see spec chart below).

New products like the “Vibe Shot” and “Smart Cast” should drive a second-half recovery in smartphones.

Part of the turnaround in this business will be on the cost side with Lenovo's purchasing scale and local manufacturing expertise resulting in lower procurement costs. Lenovo expects MMI to break even in early 2016.

Enterprise

Traditionally Lenovo's server business was less than 5 per cent of total sales and served mostly the low end of the market. With the IBM acquisition and the x86 product range, Lenovo can offer a more comprehensive product range: more of a “one stop shop” and thus gain share. The two product ranges also provide a more complementary geographic footprint with Lenovo's products strong in Asia Pacific and the IBM x86 dominant in US and Europe, the Middle East and Africa. As in the smartphone business, component costs will fall as scale expands.

Stock price and peers

Lenovo is up 12 per cent this year in local currency (HKD). Its near competitors in PCs, servers, laptops and tablets are struggling. Hewlett Packard is down 19 per cent and its Asian rivals Acer and Asustek are off 29 per cent and 16 per cent respectively. Clearly the market is already giving Lenovo a bit of credit for its strategy and early execution.

Valuation

Lenovo is reasonably valued for a technology company, trading at 13.3 times 2017 earnings per share (EPS) (we are in FY16 now).

Recommendation

Lenovo is a“buy”at current prices given my belief that the company will meet its medium term targets of business integration, margin expansion, and gain market share. As with any company in transition it comes down to execution.

My price target is HKD15.00, based on 14.5 times 2017 reported EPS. 14.5 times is the average PE that Lenovo has traded at since 3Q 2009 when it first turned a profit. That's 30 per cent upside for a large, well managed, innovative global company.

Street view

There are 21 buys, 12 holds, and 5 sells.

Average target price HKD13.7.

Risks

- Weaker-than-expected global PC demand.

- Worse-than-expected operating margin performance due to slower turnaround of the smartphone business.

- Disappointing cost control if restructuring and resource integration are protracted.

- Intensifying competition in the Chinese market that causes price pressure.

To see Lenovo's forecasts and financial summary, click here.