Gold portfolio update and results 2015

Recommendation

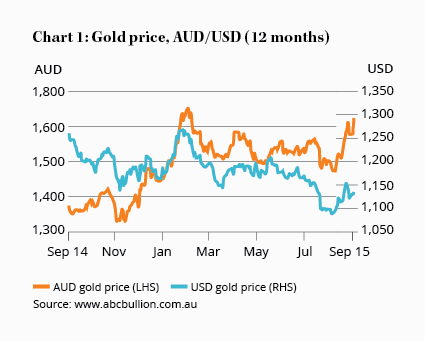

There is a commodities boom underway right now that few are aware of. The US dollar gold price – the one that gets quoted on TV every night – has fallen 10% over the past 12 months to just US$1,100. There is a consensus that gold is being stifled by expectations of higher interest rates and a general commodities rout. That may be true but it is also irrelevant to Australian gold miners and their investors.

For miners with local assets, it is the Australian dollar gold price that matters and it's been soaring. Over the same period that the US dollar gold price has fallen, the Australian dollar gold price has risen 20% to over $1,600 an ounce, not far from the $1,800 an ounce peak reached in 2012.

At that level there is good margin in average mines and excellent margin in above average mines. For Australian miners, there is no gold price crisis. These are boom-time conditions.

Key Points

-

Gold prices are up

-

Margins should be strong

-

Performance has been mixed

You wouldn't know it from the share price, however. Our mini portfolio of miners (see AU, check out this gold portfolio) has performed poorly, registering a small loss which would have been worse if not for a stunning 200% gain from Northern Star Resources.

We recommended taking advantage of the strong share price and selling in Northern Star: take profits (Sell – $2.54). Since then, Northern Star's share price has fallen 23%; the gold price is higher and the miner reported excellent full-year results. Is a Sell recommendation still warranted?

Northern Star

Two things stood out from Northern Star's full-year result: free cash flow of $185m and a return on equity of over 30%. We are unaccustomed to seeing either from a gold miner and this business promises to prioritise both. To date, it has made good on its pledge.

Earlier acquisitions have contributed significantly to both cash flow and production. Northern Star is sensibly focusing on increasing mine life and expanding resources on existing properties rather than compete in a crowded acquisition market.

Northern Star increased its resource base by 44% over the year at a cost of just $19 an ounce, far cheaper than acquisition multiples but it still needs to spend additional cash converting resources to reserves. We see this as a low risk but a risk nonetheless.

The business is an exemplary gold miner and ticking every box except one: it is still a bit dear for us. With excellent financial and operational progress – as well as a decent yield of 2.6% - we're moving to HOLD.

Silver Lake Resources

Current gold prices should deliver a bonanza to Silver Lake but, yet again, the business reported awful results. With grades falling, a requirement for fresh ore and high costs, this is no longer the miner it was.

The business has changed management and released a new plan to limit output to pursue profitable production but that aim has alluded Silver Lake for years and we have no reason to believe it will succeed now.

The business has shrunk considerably and is now reliant on exploration for growth. We have lost patience with the miner and would rather have cash invested in Northern Star than here. It's time to cut it loose. SELL.

Beadell and Kingsrose

Beadell boasts a high quality gold mine with over 5m ounces in resources and 1.3m ounces in reserves. The Tucano gold mine – the third largest gold mine in Brazil – is capable of 180,000 ounces of output a year at low cost thanks to high grades of blended ore and neat sections of iron ore which are sold as credits to offset costs.

With access to cheap power, cheap labour, low taxes and the highest local currency gold prices ever, this should be one of the most profitable mines in the world. Yet it's not.

| Northern Star | Silver Lake | Beadell (HY result) |

Kingsrose (HY result) |

|

|---|---|---|---|---|

| Revenue ($m) | 845 | 310 | 83 | 15 |

| EBIT ($m) | 168 | 0 | (6) | 3 |

| NPAT ($m) | 109 | (94) | (30) | 8 |

| EPS (c) | 15.5 | (19) | (4) | 1.8 |

| DPS (c) | 5 | 0 | 0 | 0 |

| Franking (%) | 100 | n/a | n/a | n/a |

| Op. Cash flow ($m) | 359 | 30 | 9 | 2.4 |

| Production (K oz) | 580 | 124 | 54 | 12 |

After excellent early results, production and profits have stalled following a series of operational problems. As a large open pit mine, Tucano requires bulk mining techniques demanding heavy equipment which tends to get bogged for months at a time during Brazil's wet season. Output and costs have persistently disappointed because of the weather.

Another problem comes from lower iron ore prices, which reduced revenue used to offset production costs. With iron ore prices in a funk, there will be no improvement here.

Financially, the miner's performance has been poor, with a particularly awful tendency for cash flow to lag reported profits. This year, earnings before interest, tax, depreciation and amortisation (EBITDA) of US$15m translated to operating cash flow of just US$3.5m; last year, EBITDA of US$47m produced cash of just US$17m. It has become a big enough problem to raise red flags.

For a resource base this big boasting metrics that, on paper, look appealing, Beadell is cheap. Better operations, adding higher grade pits and a fix to cash flow woes could all result in a significant improvement to the share price but we have shown enough patience for too little reward.

It's painful to do so considering the quality of the asset and operating margins on offer but poor performance cannot be ignored forever. It's time to move on. SELL.

Operating from the Indonesian island of Sumatra, chasing high grade veins of gold around mountains by hand, Kingsrose's mines are unusual. High grades, low tonnages and low capital requirements mean that it is capable of generating strong cash flows and there are no shortage of interesting exploration targets to raise reserves. Production remains small but operationally and financially, there is little to fault.

While Kingsrose's share price remains discounted, quarterly production rates are increasing and exploration has been encouraging. Although this is not the place for new money, there are enough reasons to wait. Higher production rates should be reflected in better financial performance and, as one of the lowest cost mines in the region, strong margins are on offer. HOLD.

Disclosure: The author owns shares in Northerns Star, Silver Lake and Kingsrose.