Geoff Wilson's mid-cap play

When you Google “listed investment companies” the only two LICs that appear on the first page of results are Australian Foundation Investment Company (AFI), the oldest in the country, and WAM Capital (WAM). It's no surprise these two are the only ones. AFI is as old as Methuselah and dominates the space with its $6 billion market cap, while WAM is the flagship of the most heavily marketed stable of LICs getting around by its front man Geoff Wilson. Wilson's face is widely known by investors and he does a great job of promoting LICs as a whole as well as running three of his own with his team at Wilson Asset Management. He is also a great interview as I found out on my first Eureka Live and Interactive. He wasn't short of a comment and even took care of my job by asking himself questions.

Wilson Asset Management run three LICs: the $833 million WAM Capital (WAM), $195m WAM Research (WAX) and the baby of the stable the $35m WAM Active (WAA). For this article I will be focusing on WAM Research.

WAX has returned to shareholders 14.37 per cent pa net of fees since July 2010 compared with its benchmark All Ordinaries Accumulation Index which has returned 10.6 per cent pa over the same time period. I must point out, just like Cadence Capital when you go to the WAX website do not get caught up on the 19.4 per cent pa number as it too is quoted before fees.

Code | WAX |

Market Cap | $195.4m |

Yield | 6.78% |

Franking | 100% |

Inception | Aug-03 |

MER | 1% 20% performance fee above benchmark |

Benchmark | S&P/ASX All Ords Accum |

Asset Class | ASX mid-small caps |

Investment Style | Fundamental driven long only |

Model Portfolio | Y = 10% initial weighting |

The main difference between WAX and WAM (size aside) is the investment strategy employed. WAM has two separate strategies in the one portfolio, one research driven and one driven by market participation. WAX just employs the research approach which is a bottom up, fundamental based stock picking. The market participation strategy is a lot more active and focuses on shorter term trading opportunities like participating in IPOs, capital raisings, merger arbitrage opportunities, block lines of stock at a discount etc. The average turnover of the portfolio is approximately 500-600 per cent pa (a broker's dream). The average turnover for WAX is a fraction of that at approximately 40 per cent pa.

The early days

WAX didn't get off to the greatest start in life. Its original name when it floated in 2003 was WIL, the Wilson Investment Fund. WIL was the birth child of Geoff Wilson and Matthew Kidman (later to be joined by now chief investment officer Chris Stott in 2006 who with the help of Wilson still runs the portfolio) and the original idea was for WIL to be a companion to the active WAM. WIL's original strategy was to be a small cap version of an AFIC or Argo. A long-term focused buy and hold mentality across a range of mid to small cap stocks. From the start it did not go according to plan with WIL. 2003 was the bottom of the market cycle and the fund was under invested in the first year and never caught back up. Stott admits the long term buy and hold approach “wasn't our bread and butter and the performance lagged a bit”.

WIL marginally underperformed its benchmark after it missed the start by having too much cash on hand in the first twelve months. In 2009-10 the WIL management made the decision to focus on what they were good at; they would keep the stock picking research driven approach but apply a more active management approach. The portfolio was rebadged and brought into line with the Wilson stable and named WAM Active (WAX). This should not be held against management. Yes the performance was not up to their own standards and they made a decision not to forge ahead in the same strategy that had not been working for them but to act in the best interest of shareholders and change to a strategy they were far more comfortable with. This change has seen a dramatic improvement above the portfolio's benchmark to the benefit of shareholders.

Portfolio construction and stock selection

Construction and cash

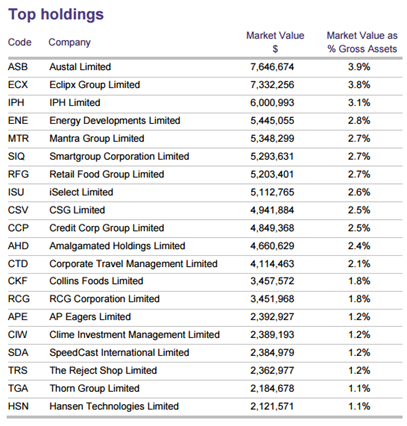

WAX invests in mid- to small-cap industrial stocks with a portfolio of anywhere between 30-70 names at any one time. The reason for holding up to 70 stocks is for diversification as the mid to small cap end of the market can occasionally hold a few surprises and not all pleasant. As a general rule you will not see a stock position exceed 4 per cent of the total portfolio and a new position will generally come into the portfolio at a 2 per cent weighting or if it is below that it is typically being built up towards the 2 per cent mark. The team will then choose to add to the position in time.

The non-invested portion of the portfolio will remain in cash predominantly at call with the occasional term deposit from one of the big four banks or their offshoots. It is important to note as well the portfolio's cash position is not a reflection on a top down macro view. The team are not making broad macro calls. The fund can hold 100 per cent cash if necessary. The increasing and decreasing of the cash in the portfolio is a direct reflection of the team's ability to find investment opportunities in the market. Their default position is cash and you will not see them holding any yield enhancing hybrid securities either: “We're paid to manage equities, not be cute with cash. The last thing you want us to do is play around in illiquid hybrids or exotic enhanced cash vehicles for the sake of an extra percent.”

Investment criteria and management assessment

The investment team at WAX identify investment opportunities from a bottom up, fundamental driven stock picking approach. Key areas of focus are cash flow, industry position, earnings growth, experienced management and a catalyst on the horizon for a re-rating of the share price. These key criteria along with others are individually weighted and go into a proprietary ratings system they have developed. This provides a filter for identifying companies that tick the boxes. Additionally on top of this they look for little to no institutional ownership, so no other fund managers. If they can identify an investment opportunity before larger institutions do, over time as the company (hopefully) continues to deliver it will be noticed and coverage will increase and therefore the share price will also increase with more interested parties. “We like to be the first one at the party, not the last,” Stott says.

The management team behind a stock is one of WAX's highest weighted inputs into their rating system. “We're managing money on behalf of our shareholders and we're handing that on to a CEO of these individual companies. An experienced team is critical,” Stott says. A fund manager looking for “good management” in a stock is almost a cliché these days. You'll find it in 99 per cent of fund managers' selection criteria but how do you actually assess management's capabilities, especially if you as an individual investor can't call up and sit down with a CEO? What WAX look for is the management teams' background in the industry. What have they done in that sector before? Assess their track record of the companies they've been at previously and the results they were able to deliver. Try to find if they have been consistent in what they've said around their strategy for growth. You can do this by looking back through past annual and half yearly reports as well as guidance updates. A good example of this is in WAX's holding Eclipx Group. The CEO and CFO came from Flexigroup where they had a long background of delivering growth. This has given the WAX team confidence in the newly listed novated leasing company.

Looking for a catalyst

Once a stock has ticked the boxes and has come out favourably in their rating system the final step is identifying a catalyst. This is something they think will cause the market to re-rate the company significantly. This could be a new acquisition or an earnings surprise on the upside. Something the market will see and react positively. This is one of the easier aspects to say but one of the hardest to identify and one that may take patience as well from the team. A stock could tick every box as a good company but unless there is something tangible there to move the share price that the rest of the market is missing the team won't buy it.

Looking through the current portfolio you can see some of the catalysts in more recent positions. One of WAX's latest additions has been The Reject Shop (TRS). They are starting to build a position in the stock with the view of the new management team being the catalyst for the re-rating. Effectively the impact of the team's ability to return the business to more sustainable levels of growth and getting the right inventory on the shelves won't be known until early 2016 after their most profitable time of year, Christmas.

It is also important to note WAX's exit strategy. Every stock they bring into the portfolio they do so with a valuation/price target in place. “At any day of the week anything is for sale. We're not emotionally attached to any of our positions. If a stock re-rates and it has hit our price target and we can no longer see a catalyst then we will sell it,” Stott says.

Dividends

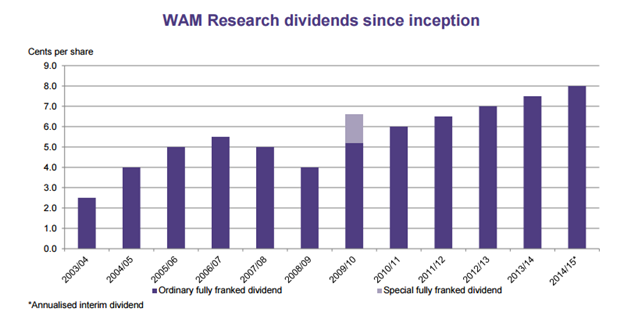

WAX's dividend policy has been a simple one: consistently pay and grow a stream of fully franked dividends over time. And they have. One key area to highlight about LICs in general is their profit reserves and ability to pay a dividend from them. At the end of April WAX's profit reserve was 26.7 cents per share, minus the 4 cent dividend paid in May. Add any profit they have made over the last few months and you get a good sense of what their profit reserve is and their ability to maintain the growth and payment of their dividend going forward. This gives you visibility of three years' worth of dividends going forward. It's now up to WAX to generate franking credits to go with them. The stock is currently on a 4.75 per cent cash yield, or 6.78 per cent grossed up – dividends are fully franked.

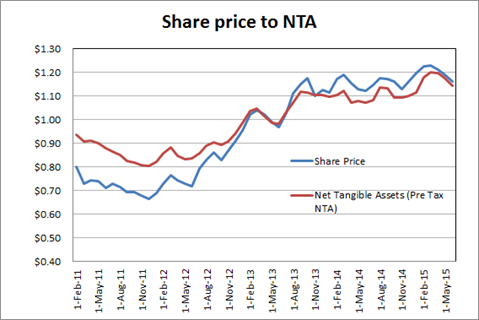

Premium/discount to NTA

Recently WAX had options expire and off the back of that the share price has returned to a premium. “What we tend to find is if you've got options on issue people have the ability to trade on two different types of securities and it tends to weigh on the headstock and any premium that was in the price tend to come out,” Stott says.

Lately it has drifted back in line with the share price and at the time I started to consider WAX as a mid-small cap exposure it was trading at a 1 per cent premium. WAX has a solid history of paying increased dividends and since the change in strategy a solid history of performance as well. Combine that with a proactive portfolio manager when it comes to the media in Geoff Wilson and you can expect WAX to trade at a premium in time.

Outlook

There's been significant PE expansion over the last three years with a lack of earnings growth to back it up. What WAX are looking for to become more positive on the market is for earnings to pick up and this reporting season that is coming up will give everyone an update as to where the companies are. “Companies have really been growing profits from taking costs out rather than growing revenue line,” Stott says.

Their view on the mid-cap space given we've got balance sheets in good shape and the cost of debt is incredibly low, they are anticipating a heightened level of M&A activity over the next 12 to 18 months as companies look to consolidate and look for other alternatives for growth but generally valuations in the midcap space are slightly above their long term averages.

Why it fits in the portfolio

Let's take a look at the portfolio as it stands. We've got global coverage with a slant towards the US in Magellan Flagship Fund. We have Asia covered with PM Capital Asian Opportunities Fund. Cadence Capital takes care of a number of areas including mid- to large-cap Australian shares and international stocks with a momentum driven investment strategy which will tie in nicely with a large-cap Australian portfolio with a long-term value focus. WAM Research slots in nicely to provide small to mid-cap coverage from a manager with a long and successful track record. It will be added to the portfolio at a 10 per cent weighting. I know I've kept the weightings pretty simple, bringing each one in at 10 per cent so far. I am doing so with a view to add to them further on price weakness. Remember we do not need to be too clever with our weightings here. We're paying the clever people a management fee.