G8's profit grows, Arena shows upside

Last week kicked off with two more financial results for businesses currently held in the Income First model portfolio. G8 Education reported a solid result, albeit slightly behind our numbers on an underlying basis, but the report shows continued profit growth and conservative forecasts imply that the company is trading on a PE near 12 times FY16 earnings, a discount to the broader market. ARF's report was rock solid, showing the defensive nature of the business and the upside available from development opportunities. ARF upgraded its full year distribution guidance. Both GEM and ARF pay quarterly distributions, so no dividend announcements were necessary.

G8 Education – strong growth, but the market remains unconvinced

Long day care centre operator G8 Education delivered its results for the full year ending December 31 2015, and the financials were generally as expected. Revenue from centre operations was $703.547 million, up 44 per cent on the previous corresponding period (PCP). This was driven by continued acquisitive growth, and delivered a healthy lift in terms of earnings before interest and tax (EBIT) of 51.4 per cent as economies of scale continued to benefit the group. GEM pays a quarterly dividend, which at the moment is 6 cents per share per quarter fully franked. The next dividend will be for the March quarter and I expect a similar amount to be announced in about a month's time.

The real focus for GEM is managing growth in an efficient manner, and keeping an eye on both the balance sheet and cash flow statement. GEM's cash was boosted by the funds raised for the failed bid for Affinity Education, and I note that this left a cash balance of $193.84m. This cash will be deployed this week to redeem some SGD denominated corporate notes, meaning that the transaction is effectively a refinancing.

At year end GEM's balance sheet remained manageable with borrowings of $366.27m and current borrowings of $148.891m. This current amount is the corporate notes that will be repaid at the end of Feb from available cash.

Cash flow for GEM was again strong, with net operating cash flow of $95.052m, up 27.2 per cent on the PCP. This represented a 99 per cent conversion of earnings before interest, tax, depreciation and amortisation (EBITDA) into operating cash flow.

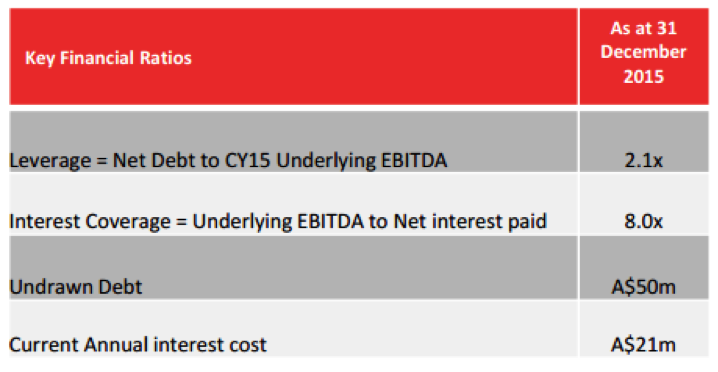

So, things appear stable from a financial perspective at GEM, and the company has provided some key metrics to back this up:

Source: GEM 2015 full year results presentation

CFO Resignation

With the result came the announcement that GEM chief financial officer and company secretary Chris Sacre has resigned to pursue other opportunities in the industry. This is a key loss in my view, as Sacre has a strong level of experience and knowledge of the group, having worked with GEM for eight years through a period of rapid growth and a multitude of acquisitions completions.

Outlook and key take away

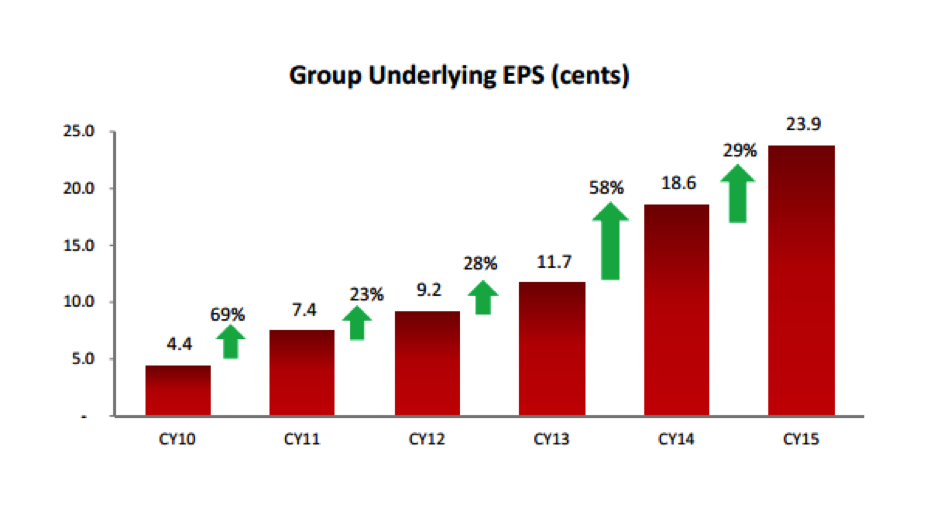

This report shows that the business continues to grow. The rate of growth is slowing, as is the upside in the dividend, but this is a natural maturing of the business. While the net profit result was slightly behind our expectations of $89.1m, it is still compelling, coming in at $88.6m. I expect this trend to continue and GEM has outlined that the company's key objective for FY16 is to achieve double digit earnings per share growth. This is a rate of growth that I believe will be achievable for the group, though I note it would represent the company's slowest rate of growth since the business first entered profitability. Here is a chart from GEM's presentation showing the last 5 years EPS:

Summary and risks

Overall, this was a positive report from GEM. Investors should consider that the business is performing well, and that the dividends are backed by both strong profit and cash flow generation. While the departure of the chief financial officer is a negative, it is worth noting that GEM is now an established operator with a strong track record, and I look forward to the appointment of a new chief financial officer in the near term.

Risks to GEM's future must not be ignored and these include funding cost risk, occupancy risk at childcare centres, the growth of supply in the childcare industry and the potential for regulatory change. At present I am are comfortable that management is across these risks. I note specifically that peak occupancy rates are softer than expected, signalling that new supply in the childcare space may be having some impact. While this may take some profitability out of the business, the overall investment theme is not likely to be materially impacted in the short term.

Currently, GEM's 24 cent dividend rate (6c per quarter) appears stable. This is indicative of a dividend yield of around 7.3 per cent (10.4 per cent if you include the value of franking credits). I maintain a buy recommendation for income first investors, and an unchanged valuation of $4.12.

Arena REIT – Rock solid with upside

Arena REIT reported strong financial results last week, with the bonus of an upgrade to the full financial year's distribution guidance. This will see the quarterly dividends in March and June come in at 2.775c per quarter, up from the previous level of 2.675c. While it is a slight upgrade on previous guidance, it indicates that the business is stable, with strong foreseeability in terms of distributable income. Additionally, the upgrade is enabled by the company's work on development projects, which contribute additional distributable income to the group.

Distribution guidance is now for 10.9c in FY16, but the second half run rate implies a full year dividend of 11.1 cents, indicating that additional dividend growth in FY17 is a reasonable expectation, even without further development contributions. ARF pay quarterly distributions towards the end of each quarter, with the next expected distribution to be for the March quarter, and expected to be announced in about one month's time.

In terms of the company's financial performance, net operating profit was higher by 20 per cent to $12.6m, ahead of our expectations. This bodes well for the full year result, and I have upgraded our forecasts.

Financial overview – strong foreseeability continues

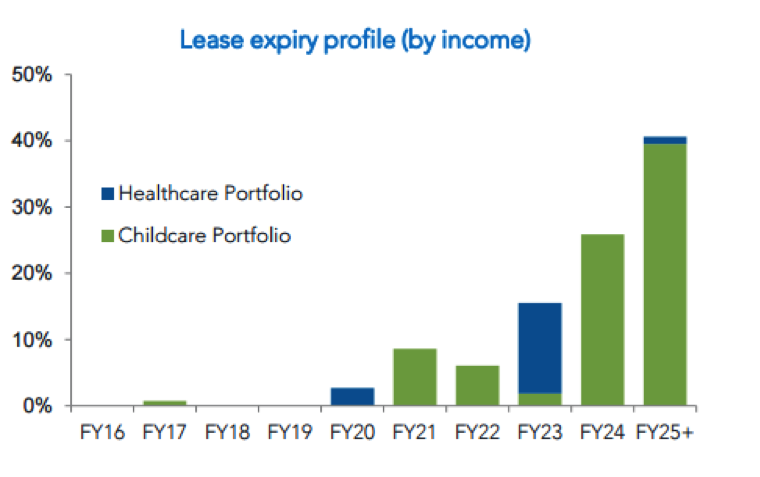

One of the key attractions of an investment in ARF is the strong ability to see rental income into the future. This continues to be well supported with a weighted average lease expiry (WALE) of 8.8 years, and less than three per cent of the portfolio due to expire before 2020. Additionally, ARF divested two unoccupied properties during the period, and successfully leased another unoccupied property, resulting in a period-end occupancy of 100 per cent. Here is the lease expiry profile from ARF's results presentation:

With this strong base lease income well bedded down, the outlook for rental income is very stable. That said, there is additional upside from rental reviews, with 87 per cent of portfolio income set with fixed or CPI rent reviews, and with 46 per cent of the portfolio income subject to reviews in 1H16. These reviews achieved a 2.5 per cent growth in income. In 2H16, a further 29 per cent of the portfolio income will be subject to similar reviews. Finally, 13 per cent of the portfolio income is subject to market rent reviews, and this is where Arena can potentially achieve higher rental growth rates. There are still 11 reviews outstanding from the first half, and 20 further reviews to be negotiated in the second. These market reviews are generally subject to a cap and collar, limiting the price change to a range between zero per cent and 7.5 per cent.

Given the reviews, ARF is in a good position to grow rental income from existing premises above the current rate of inflation, producing some real growth for the income statement.

Of course, there are risks, including but not limited to the potential for regulatory changes to impact operator businesses, property valuation risks, development risks and the potential for lower than anticipated rental reviews.

Key take-out: Upside apparent

What has become more apparent from this result is that ARF is a stable business with underlying organic growth above the rate of inflation, and there is potential upside from development projects. During 1H16, two childcare centre developments were completed ahead of time, at a total cost of $5.6m and an initial yield of 9.2 per cent pa. This has provided some upside to ARF's distributable income for the balance of FY16, and is a good indicator that the successful management and completion of new development projects is likely to be accretive to distributions in coming years.

During the half, the company signed a contract with the State of Victoria to develop six Early Learning Centres (ELCs), with the terms offering a 26 year leasehold interest to ARF at peppercorn rental. This means ARF will design and construct the premises, lease them for a nominal amount, and then sub-lease them to YMCA for the same 26 year term on triple net leases. These leases are subject to annual 3 per cent increases with market reviews every five years. With five of these centres due for completion in January 2017, I believe that these developments will provide additional upside to ARF's distributable income in the second half of FY17.

Summary

The ARF share price has performed well since its inclusion in the Income First model portfolio. At the current distribution run rate of 2.775 cents per quarter and a share price near $1.84, the forecast yield is a touch over 6 per cent, though no franking benefits are available. Given this yield is still quite strong, and the risk in the business appears to be low, I am encouraged by the outlook. Following the report I have upgraded ARF's valuation from $1.82 to $2.01 to take account for what is a more buoyant upside now that I have more confidence in the company's ability to deliver distributable income growth through is development projects. We retain a buy call.