Drillsearch primed for recovery

Old oilfields don't die; they're reborn with every advance in technology, as can be seen in the long life of the Cooper Basin in central Australia and the success of a relatively new player in the region, Drillsearch Energy.

In production since 1969, the Cooper was once the private playground of Santos, Australia's second biggest oil company, and a business close to the government of South Australia which was so keen to see the company remain under SA control that it introduced laws in 1979 to protect Santos from takeover by the WA entrepreneur, Alan Bond.

The government's once tight hold on the Cooper oilfields has broken down with the forced relinquishment of a vast area of land held for decades by Santos, triggering fresh interest in a region which is a major supplier of gas to Sydney and Melbourne.

Drillsearch is one of the new entrants in the Cooper, shifting its focus to the area after years of limited success in Canada, Papua New Guinea and waters off the coast of WA.

While legal and corporate shuffles were underway, two other events occurred which re-kindled interest in the Cooper. The price of oil rose steeply, and new technologies made it easier to discover and extract hidden deposits of oil and gas.

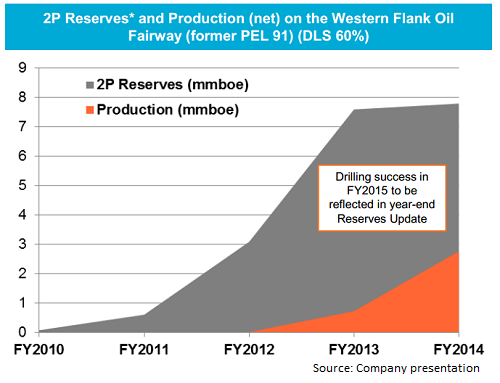

Drillsearch, and a number of other small companies, have been able to capitalise on the changes which have led to the discovery of new oilfields, especially in a region known as the Western Flank, and to have started probing oil and gas trapped in deeply-buried “unconventional” structures more commonly called shale oil and gas.

For investors, what's happening in the Cooper is a chance to revisit a region which is being reborn on a number of levels, though not without its challenges.

In the oilfields, technology advances have made it easier to pinpoint small accumulations of oil and gas while also cutting the cost of drilling and extraction.

For Drillsearch that has meant the discovery of fields such as Bauer in the Western Flank, from which most of the company's current revenue is generated.

Last year's sharp drop in the oil price has hurt Drillsearch (and everyone else in the oil business) but some people see the fall as a temporary event with another WA entrepreneur, Kerry Stokes, showing signs of picking up where Bond failed in 1979.

Over the past few months Seven Group, which is 70 per cent owned by Stokes, has acquired strategic stakes in a number of Cooper oil and gas producers, including Drillsearch and Beach Energy.

Whether Stokes wants to play the game Bond started 36 years ago and consolidate the Cooper into a single pair of hands seems unlikely, though the oil and gas fields of central Australia are a perfect place to start building an energy business thanks to pipeline connections to Sydney and Melbourne.

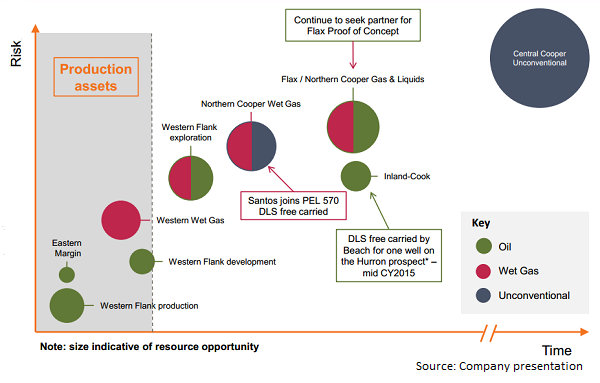

There a number of moving parts in the Drillsearch story, with the company currently reverting back to its roots in the Cooper as a Western Flank oil producer because that's where maximum profits can be generated.

Drillsearch holds a 60 per cent stake in the Western Flank oil fairway together with joint-venture (JV) partner Beach Energy, which holds the remaining interest and operates the oil fields.

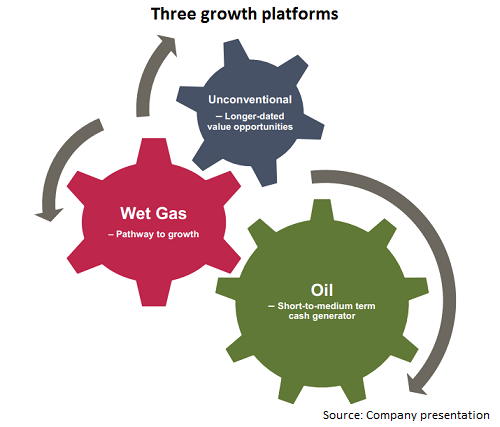

But, while today's focus is on oil because of its relatively high profit margins, gas has not been forgotten, nor has unconventional oil and gas accumulations which have been discovered but which are unlikely at current prices to be extracted profitably.

One of Drillsearch's growth platform's in the medium term comes from extracting wet gas (see the graph below). Wet gas is a natural gas that contains liquid hydrocarbons, condensate and liquefied petroleum gas (LPGs).

Because of its proximity to major markets, and improvement of discovery and extraction technologies, the Cooper will remain one of Australia's most important sources of energy for decades even after 46 years of continual production.

Operations in the Cooper

Drillsearch is the only S&P/ASX200 company that offers pure exposure to these valuable energy sources – oil, wet gas and unconventional – in the Cooper Basin without any operations held elsewhere in Australia or overseas.

According to managing director Brad Lingo, it's not Drillsearch's job to manage and diversify investors' portfolios; rather, he says that's best left to portfolio managers and financial advisers.

Without distractions from other geographies, Lingo and his management team can focus all of their expertise on exploration and developing the best projects in the region.

This focus has helped ensure Drillsearch operations are low-cost and can weather current oil prices, and that its drilling development opportunities remain low risk. Drillsearch has good access to infrastructure on the Western Flank and its partner there, Beach Energy, already runs an efficient operation.

Typically, Lingo targets projects where Drillsearch can take at least a 40 per cent stake to gain voting power and sufficient control, but no more than 60 per cent so it can engage in more projects and remain flexible.

As a result Drillsearch is in a number of JVs with other producers in the Cooper Basin. As well as Beach Energy, its partners include Santos and Senex Energy.

The company's original plan was to double production by FY19 from its current production guidance of 3-3.2 mmboe for FY15, with revenue highly leveraged to oil, gas and natural gas liquids (see graph below).

However, given the current conditions management has flagged that the timing of the growth targets will likely be pushed out.

First-half results

Including its less profitable oil operations along the Eastern Margin, Drillsearch generated strong cash margins of $A77 per barrel for the first half of FY15 at an average realised oil price of $105 per barrel (including a $2.5 per barrel benefit from hedging).

Western Flank operating costs totalled $47 per barrel for the half when royalties and depreciation, depletion and amortisation (DD&A) are included.

Underlying net profit fell 42 per cent to $32.4 million for the first-half of FY15 due to a mixture of lower crude prices and a 13 per cent fall in production compared to last year. It also excluded total impairments of $61.8m for the half as a result of the downward revision to oil price forecasts and asset carrying values.

Drillsearch reported a strong balance sheet, with $146.5m in cash and a net debt position of $4m.

As well as actively hedging through to FY16 to mitigate lower crude prices, Drillsearch has reacted by reigning in capital and operating expenditure.

Though capital expenditure guidance has been tightened to $150-165m from previous estimates of $130-170m, Drillsearch anticipates it to be “significantly lower” in FY16 and FY17. Operating expenditure is expected to be cut by around $10-15m, or roughly 10 per cent.

Capital expenditure is to be prioritised conventional oil and wet gas – its assets with near-term production – and delayed for unconventional shale, a sensible move in the current environment.

The valuation

Our approach to valuing Drillsearch is based on the future cash flows generated from its reserves of oil and wet gas projects as well as a certain level of discovery success. We don't ascribe any value to its unconventional projects.

While oil production is the cash flow powerhouse in the short term – even with lower oil prices – investors shouldn't underestimate the value of Drillsearch's wet gas despite it operating at lower margins.

Outside the South Australian Cooper Basin, which comprises Origin, Santos and Beach Energy, Drillsearch is the largest gas player with proved, probable and possible (3P) reserves of 37.8 mmboe.

The outlook for gas appears bright. There's rising demand from Asia, which is the world's engine for future growth, and from Australia's east coast, where a shortfall in supply is looming thanks gas being redirected for conversion to export as LNG and because environmental protests have slowed exploration for conventional and unconventional gas.

Drillsearch's gas reserves are much larger than its oil reserves, where there are currently 3P reserves of 16.8 mmboe and 3P contingent resources of 8.7 mmboe.

However, we've included some value to oil exploration in the Cooper with our DCF because it's very likely the company will discover more resources in the future and convert them to reserves.

The Western Flank is relatively underexplored, particularly when considering the recent advances in technology. Exploration success rates in the region are currently at over 50 per cent – above their previous 20 per cent – thanks to the introduction of 3D seismic surveying onshore and better drilling techniques.

Assumptions

Our assumption for the oil price is based on consensus forecasts, with analysts seeing a gradual rise over the next few years. Our AUD/USD exchange rate forecast is conservative and doesn't capture any further falls in the $A, from which earnings would benefit.

2015 | 2016 | 2017 | 2018 | |

Oil price ($US/bbl) | 57.7 | 72.5 | 73.5 | 72.25 |

AUD/USD | 0.85 | 0.8 | 0.8 | 0.8 |

Lingo has flagged that 75 per cent of production will be hedged for the remainder of FY15 with $US70 and $US90 puts implemented. This falls to 50 per cent in the first half of FY16 and 25 per cent for the second half, though Lingo says hedging opportunities will continue to be evaluated.

We have a “buy” recommendation on Drillsearch, with a discounted cash flow valuation of $1.21.

Summary

The premise for investing in Drillsearch rests on three main themes: A resurgence of conventional oil production in the Cooper Basin, rising demand for gas from the east coast of Australia and Asia and, last but not least, consolidation in the area.

As the only S&P/ASX 200 oil & gas producer solely based in the Cooper Basin, Drillsearch is the best way to provide investors with direct exposure to the region and its fortunes. It is deeply integrated with the other major players there through JVs – if a consolidator were to pick up Beach, for example, Drillsearch would be the logical next step.

Further, the market appears to have overreacted to the fall in the oil price and the downtrodden prospects of unconventional shale, with shares in the company falling by 40 per cent over the past year to Friday's close of $0.99.

To see Drillsearch's forecasts and financial summary, click here.