Closing the door on IOOF

Recommendation

Knowing when to get out of a losing position is one of the toughest problems value investors face. Almost by definition value investing involves asserting a view that you are right and the market is wrong. To flip that around and accept the opposite is particularly hard.

A good rule of thumb is that while the original investment case stands, it's worth hanging on. But if it has changed significantly it's usually a good idea to sell.

After all, if there are only ever a handful of opportunities to invest in at any point in time (we currently have 14 stocks on our Buy list), then what are the chances that one of them changes and yet still falls within that elite group? You don't, as the saying goes, have to make your money back the way you lost it.

Key Points

-

Original investment case broken

-

May still be some value

-

Downgrading to Sell ...

-

... but a dissenting view to be published shortly

When we originally upgraded IOOF Holdings back in 2014 we highlighted the technological and regulatory risks. The company, however, appeared to negotiate the 'Future of Financial Advice' (FOFA) reforms well enough and, coming into the Royal Commission this year, seemed better placed than most.

There was an ASIC investigation in 2015 following media revelations of various compliance shortcomings but these mostly related to the period before (then) current management took charge. And they appeared to be dealt with effectively following a review by PwC.

More significantly, we were expecting 'mid to high single digit' growth from the 53 cents of underlying earnings per share achieved in 2014, before acquisitions. It's been clear for a while that the ANZ OnePath acquisition was the only way the company was going to get anywhere near that.

Then, in August, came the now infamous performance of chief executive Chris Kelaher at the Royal Commission. Again, it appeared the media headlines were driving the price lower while the company hadn't done too much obviously wrong, at least compared with some.

What the market was perhaps picking up on, and what in hindsight we didn't give sufficient weight to, was the poor judgement and arrogance shown by Kelaher. After considerable thought and, with the stock down almost 30% since the announcement of the ANZ deal in October 2017, we made the decision to overlook this red flag.

Broken case

There can be no doubt whatsoever, though, that the investment case changed last Friday, when APRA began proceedings to impose licence conditions on IOOF's APRA-regulated entities and to issue declarations and disqualification orders against five of IOOF's most senior executives: managing director Chris Kelaher, chairman George Venardos, chief financial officer David Coulter, company secretary Paul Vine and general counsel Gary Riordan.

After a board meeting at the weekend, Kelaher and Vernados stepped aside on Monday morning 'pending resolution of the proceedings'. Renato Mota, currently the Group General Manager, Wealth Management, will take the role of acting chief executive and Allan Griffiths, currently a non-executive director, will take the role of acting chairman.

The other senior managers will stay in their roles, but 'will have no responsibilities in relation to the management of the IOOF trustee companies and will have no engagement at all with APRA during this period'.

Griffiths reiterated what IOOF had said on Friday, that 'the allegations made by APRA are misconceived and will be vigorously defended'. The legal detail of the allegations is complex and we haven't yet heard IOOF's side of the story. But, for shareholders at least, it hardly matters.

The simple fact is that, like customers, policemen and deaf grandparents, the regulator is always right. If you want to argue the toss, then fine - but don't push it too far. APRA has some powerful weapons, and if it chooses to use them your business will suffer grievously, whatever the rights and wrongs.

IOOF's senior management has missed this key point. Kelaher and Vernados (at least) must surely lose their jobs as a result, even if they avoid disqualification.

OnePath likely to be blocked

The biggest problem for shareholders arising from these proceedings is the likely abandonment of the deal to buy ANZ's OnePath Pensions and Investments (P&I) business, which we'd been hoping would drive earnings growth for the next few years.

The deal was being considered by the OnePath trustees and their decision was expected imminently. This action changes the landscape. What responsible trustee could approve the transfer to a company whose senior management is subject to disqualification proceedings?

ANZ itself released a statement on Friday, saying it would 'assess the various options available to [it] while [seeking] urgent information from both IOOF and APRA'.

The bank is still keen to complete the deal and the OnePath trustees might approve it if management is changed and relations with APRA are patched up. However, a major part of the attraction was that the acquisition would be integrated by Kelaher and his team, who have, despite anything else, a great track record in this area.

Now, Kelaher et al probably won't be around even if the deal proceeds. Prudence therefore dictates that we should disregard it and the benefits it might have generated.

Personal business

Another problem stemming from APRA's actions is the reputational damage and the impact that might have on fund flows. But financial advice is a personal business that relies on trust with individuals rather than organisations. If clients are happy with what they're getting from their adviser at, say, Shadforth (IOOF has sensibly maintained the individual brands of its adviser businesses) it's unlikely that proceedings against senior IOOF managers will affect that.

The same goes for the Platform business. Investors with money on IOOF's Pursuit platform are unlikely to bother shifting it for the sake of the APRA proceedings. The flow of new money, however, is a different matter; we'd expect this to slow sharply.

Our best guess is that we'll see some small net outflows during the period of uncertainty, but nothing to cause major damage to either the advice or the platform businesses.

Then there's the threat of shareholder class actions, with various lawyers happy to let the media know that they're sizing up cases. This threat can't be removed by a management exodus, although it could be made worse by them remaining. This will surely focus the minds of the independent directors.

New management

Everything points to the end of the current management team and the installation of a new one. That could solve many of the problems, but it could also cause a few of its own. Kelaher et al were a major part of the original investment case. Not only is their judgment now in question, but new managers will lack the detailed knowledge of a complicated group.

Image rebuilding may also be more expensive than anticipated. Last Tuesday, management estimated remediation at just $5m-10m. That's a surprisingly low number given the experience of others and it could rise significantly, particularly with new managers perhaps erring on the side of paying more rather than less.

On top of all this are the broader regulatory threats from the Royal Commission and ongoing margin pressures in the industry. The most significant threat is the possible banning of vertically integrated structures, whereby a company like IOOF provides products and advice. In our view, this remains unlikely but with emboldened regulators, fired up by an angry public, nothing can now be taken for granted.

So the investment case is now clearly broken, and our default position should be to move on. But before we do, we should examine whether there might be a new case to buy.

Scrap value

The first point to note is that with recent events casting doubts on the sustainability of IOOF as a business model, any new case can't be based on IOOF achieving growth as a consolidator of the wealth industry. Instead, we're looking for scrap value.

The best kind of scrap is cash and, assuming that the ANZ OnePath transaction doesn't proceed, IOOF could have around $400m of it.

There are also some quality advice businesses. Shadforth, for example, employs around 150 salaried advisers focusing on high net worth clients. Purchased in 2014 for $664m, it made $36m the year before it was acquired but, after synergies, managed $59m in 2016. $431m of goodwill is attributed to it in the accounts but, given doubts over industry profitability, we'll knock that down to $300m.

Next is IOOF's 70% stake in the Ord Minnett stockbroking business. We estimate that Ord Minnett has doubled its net profit over the past few years to about $17m. It's worth maybe eight times that, giving IOOF's stake a value of about $100m.

Then there are IOOF's existing aligned adviser groups and the three new groups recently purchased from ANZ. Individually these are barely profitable and their value is more in the scale and the platform fees they can deliver. With the entire group structure in doubt, there's no scrap value here.

The trustee business has less to fear from the Royal Commission and has been growing profits steadily in recent years, to $8m in 2018 (excluding the $1m of profits that recently disappeared with the AET Corporate Trust business). We'd say it's worth $100m.

Putting all that together perhaps gets us up to about $900m. Given the current market value of $1.5bn, this leaves only $600m to be split between the platform and investment management divisions.

These are arguably at the greatest risk from the Royal Commission, with any forced break-up potentially cutting off their flow of funds. Yet in 2018 they produced $117m of underlying net profit between them. So, at the current rate of profitability, it wouldn't take them long to pay their way.

Further risks

So, there is a value case to be made. Unfortunately, there are also a few ways it could be derailed.

For starters, none of the above calculations allow for corporate costs, which are running at about $38m. There's some justification for that if we're thinking in terms of a break-up - but there's no sign of that at the moment, so that leak is unlikely to be patched. And at 2.5% of the company's market value, it's a big one.

More worrying is the potential for increased customer remediation. It's hard to see any incentive for Kelaher and his team to have underestimated this, because it will surely all come out in the end. But it wouldn't be the first thing from IOOF that we'd failed to see coming. The net cash of $400m is a key plank of any new investment case, but it could be whittled away quickly if customer remediation escalates.

Finally, there's the unquantifiable threat of class actions. Who knows what these could amount to, but they're sure to be a major distraction.

Dissenting view

These uncertainties are enough to undermine our confidence in any new investment case. As a result, we're going to fall back on our rule of thumb, which is to Sell as a result of the broken thesis.

That is by no means an easy decision, though. Indeed, there were one or two members of our research team - who perhaps carry less baggage with the stock than I do - who were in favour of hanging on. James Greenhalgh was one of them and, to help members form their own decision, we'll publish some of his reasoning later this week.

The majority view, though - one backed by myself, an IOOF shareholder - is to Sell, and that will be our official recommendation.

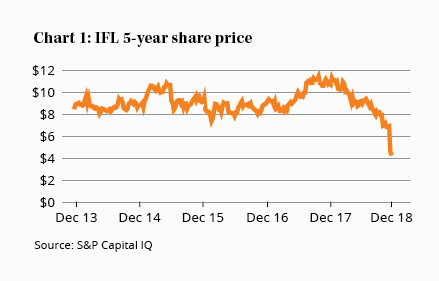

Unfortunately this means logging a 47% capital loss since our original upgrade in 2014 (which falls to 19% after the inclusion of dividends). Those that bought on our more recent upgrade, in April last year, however, will be down 53% after the one dividend received.

We'll keep watching the stock and may return to it if the clouds clear. But, for the time being, given the uncertainty, we're going to leave it without a price guide. We're also reducing our maximum portfolio weighting to 4%. SELL.

Disclosure: The author owns shares in IOOF Holdings but plans to sell once members have had an opportunity to do so.

Note: The Intelligent Investor Model Growth Portfolio is selling its entire holding of 9,468 shares in IOOF at $4.43 a share to raise $41,943.24, while the Model Income Portfolio is selling its entire holding of 9,734 shares at $4.43 a share to raise $43,121.62.