Capitol Health pounces again

Last Tuesday January 13, Capitol Health announced its second acquisition in as many months, with the binding agreement to acquire Imaging @ Olympic Park (IOP) for a price of $25m.

The announcement is further evidence of MD John Conidi delivering on his strategic plan of growing via earnings accretive acquisitions.

The purchase is instantly accretive as it is expected to be completed in February. In FY14 IOP achieved revenue of $10.4m and EBITDA of $3.3m. The acquisition multiple of 7.5 times EBITDA is very reasonable, and cheaper than the recent multiple for the Southern Radiology Group acquisition (see Capitol Health leaps into NSW, December 15, 2014). Further, the 31.7% EBITDA margin is a large increase on the existing group margin of 16%.

The transaction will be funded by a combination of debt and equity. We are assuming $15m of equity is raised through the discounted Share Purchase Plan (SPP) for existing holders.

About IOP

IOP is located in Melbourne's AAMI Park sporting precinct and is Australia's first stand-alone Imaging and Treatment Day Procedure. The key focus is on the diagnosis and treatment of musculoskeletal conditions, and the centre offers access to high quality imaging specialists and equipment.

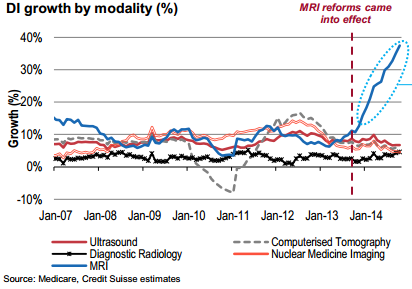

Significantly there are also two licensed MRI machines, adding to the group's existing licenses.

Similar to past acquisitions, IOP has a high quality group of radiologists who will be retained under Capitol Health's ownership. They specialise in providing diagnostic imaging services to patients with sports-related injuries.

The strong branding within Melbourne's sporting community has led to strong revenue growth and EBITDA margins. The existing Capitol Health network should provide further growth for IOP.

Share Purchase Plan

Existing shareholders (January 12 record date) can apply for up to $15,000 of new Capitol shares at a 7.5% discount to the volume weighted average price from January 6 to 12.

Earnings impact

We are forecasting FY15 net profit of $4m for IOP with one-third of that contributing to Capitol Health due to the transaction completing in February.

Our FY15 earnings per share forecast has increased to 1.74 cents, and our FY16 forecast has increased to 3.34 cents.

Risks

The two major risks are changes to government policy around a cut to health care costs, and also integration risk.

For now all evidence suggests the government remains supportive on enabling greater access to affordable higher quality scans. With Capitol's exposure to community and non-hospital radiology it relies on the Medicare-funded GP referrals.

So far all acquisitions have been integrated on time and with the expected synergy benefits. It is important this track record remains intact for both our current earnings forecasts and the company's opportunity to continue growing from further acquisitions.

Summary

Our revised earnings forecasts have included the impact from IOP, partly offset by dilution from the capital raising, and higher interest costs from additional debt.

With two recent acquisitions and one being the first entry into NSW, management will have a busy six months focusing on successful integration. This may lead to the share price consolidating, with the market waiting to see evidence of the accretive earnings impact.

As we have a positive long-term view of Capitol Health's ability to achieve high earnings growth we would recommend buying on any share price dips.

Our previous 86 cent valuation is increased to 92 cents and we maintain our Buy recommendation.

To see Capitol Health's forecasts and financial summary, click here.