Bayer's big transformation

Bayer is one of Germany's largest companies and will generate around €47 billion ($US52bn) in revenues in 2015. Founded in 1863, its first commercially successful product was acetylsalicylic acid or what we know as “Aspirin.” It also pioneered the first widely used antibiotic (prontosil) for which it won the 1939 Nobel Prize.

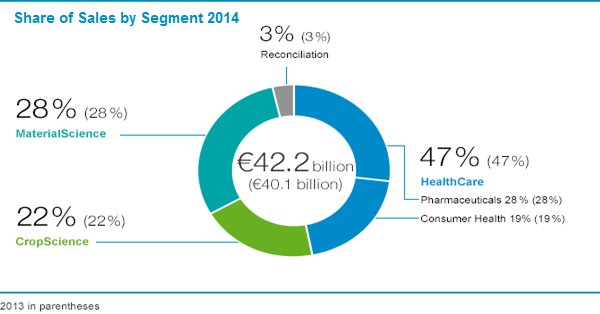

Now Bayer is a global pharmaceutical and chemical company. It has three main business units: Healthcare, CropScience and MaterialScience.

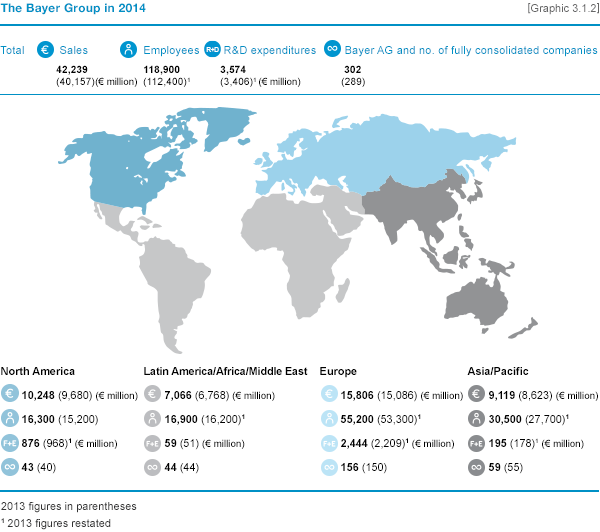

Geographic spread

The company is transitioning itself to a pure life sciences play (and less of a conglomerate), spinning off materials science division in the second half of 2015. In doing so it could generate an earnings per share (EPS) compound annual growth rate (CAGR) of 15 per cent-plus between 2015 and 2020, with earnings before interest, tax, depreciation and amortisation (EBITDA) margins expanding from 20 per cent to 23-24 per cent by 2017.

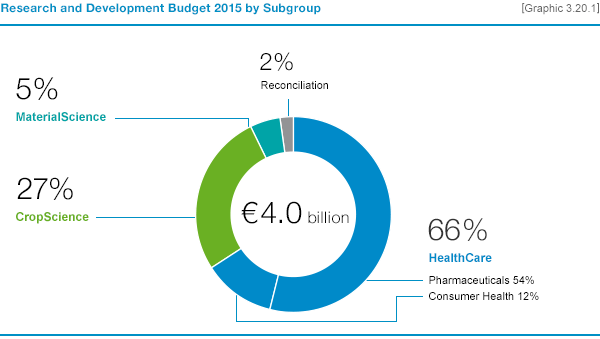

The positive investment case for Bayer revolves around this transition to a higher growth, more profitable company with less cyclicality as well as what I believe to be an unappreciated current pharmaceutical pipeline, a number of promising indications moving into Phase 3 (5 in total), plus some interesting potential blockbusters currently in Phase 2 clinical studies. News flow from the pharma portfolio will drive the shares over the medium term.

The current pharma portfolio has a combined peak sales potential of greater than or equal to €7.5bn between 2015 and 2020 (that's in addition to the pharmaceutical revenues of EUR11.7bn generated in 2014).

The most significant pharmaceuticals to near term growth are the following:

- Xarelto: A leading oral anticoagulant with a clear market share lead among novel oral anticoagulants: (Xarelto: 32 per cent, Pradaxa: 12 per cent and Eliquis: 12 per cent).

- Eylea: Label expansion expected to support growth for diabetic macular edema and age-related macular degeneration. Large target market globally.

- Xofigo: Significant growth expected for castration resistant prostate cancer market.

- Stivarga: Treatment of metastatic colorectal cancer. Most prescribed agent in 3rd-lineplus treatment of mCRC in the US and in Japan.

- Adempas: Encouraging early launch experience. Life-cycle management trials in systemic sclerosis, cystic fibrosis and in PH associated with idiopathic interstitial pneumonias initiated.

The promising late stage indications that should movie from Phase 2 to Phase 3 are:

- Finerenone (non-steroidal MR-antagonist) – diabetic nephropathy and heart failure (Ph II data Sep-15)

- Vilaprisan – (oral progesterone receptor modulator) - uterine fibroids

- Vericiguat (sGC modulator) – for worsening chronic heart failure (Ph II data Nov-15)

- Molidustat (HIF-PH inhibitor) – oral anaemia treatment in CKD (Ph II data 1H16)

- Copanlisib (PI3K inhibitor) – blood cancers (Ph II data 1H16)

Bayer's consumer over-the-counter (OTC) health business (20 per cent of revenues) is also worth a mention as Bayer is now actively integrating Merck's OTC business purchased in 2014 for $US14bn .This is now the second largest OTC business in the world.

Globalisation of brands such as Claritin, Dr Scholls and Coppertone should raise the growth profile, as well as ongoing development of Bayer's legacy brands such as Aspirin, Aleve, and Berocca. Confirmed synergy targets post-acquisition are $US400m top-line synergies and $US200m cost synergies by 2017.

Crop Science

The Crop Protection business has broad portfolio of highly effective herbicides, fungicides, insecticides and seed treatment products with chemical or biological modes of action. Bayer competes with the other successful crop science players Monsanto and Syngenta. It's a global business operating in 120 countries.

Crop prices and the weather are the main variables for this business. Sales growth is modest but steady in global markets that are expanding at a 5-6 per cent rate. While 2015 may be challenging with sales down slightly Y/Y due to depressed commodity and crop prices, longer term Bayer is expected to gain market share via product innovation in seeds (especially soybeans and wheat) and herbicides.

Bayer Material Science

The most cyclical of Bayer's divisions, Bayer Material Science (BMS), a polymers and coatings business, is to be spun out as a separate listing in the second half of 2015 so that it can fund its growth via the capital markets. Based on peer averages, BMS should list at roughly 7-9 times 2015 EBITDA (€11-14bn).

The proceeds from this sale will be used to pay down debt, and possibly to raise dividend payouts over the medium term.

R&D 2015- Note areas of emphasis

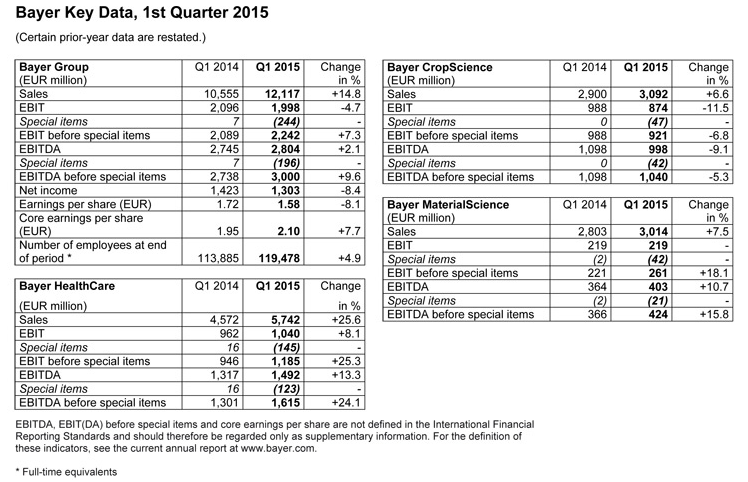

Bayer reported first-quarter 2015 earnings on April 30 of this year and for the most part results were nicely ahead of consensus.

Strong growth in Healthcare ( 25 per cent per cent) was driven solid sales of key newer products such as Xarelto, Eyelea, Xofigo, Adempas, and Sivarga.

Growth in MaterialScience ( 7.5 per cent year-on-year) was decent with polycarbonates, polyurethane, and adhesives/coatings aiding revenues. CropScience ( 1 per cent) was more muted due to low crop prices.

Guidance was positive with Bayer guiding 2015 revenues upward. The company now expects sales between €48 billion and €49 billion (previously €46 billion) in 2015. Foreign exchange movements are expected to have a positive impact on 2015 total sales by 8 per cent (previously 3 per cent).

The company's core earnings are now expected to grow in the high teens as against the previous guidance of low teens. 2015 core earnings are expected to reflect a positive currency impact of 7 per cent.

See below for a breakdown of the results:

Recommendation

Bayer is a “buy” at current levels. The stock has more or less matched the strong performance of the DAX (it is almost 10 per cent of the index) this year with a 20 per cent return. It's not too late, however, to pick up a large, well-capitalised global company that's “reinventing” itself. I have a target price €165 (25 per cent above current price) at 19 times 2016 EPS.

Risks

Near-term risks would include:

- Integration risks around Merck OTC business and rising reimbursement pressures on core franchises including hemophillia, MS and Women's Health.

- New pharmaceutical products don't achieve estimated peak sales (focus near term will be on Xarelto given slowing US Rx growth and rising competition).

- CropScience is subject to generics. Pricing power is highly dependent on grain prices. Low grain prices would have a materially adverse impact on profitability.

- Material Science division is driven by supply/demand balance in its key products polyurethanes and polycarbonates. Weak economic growth of capacity expansion could substantially impact the profit outlook for this division for part of 2015.

To see Bayer's forecasts and financial summary, click here.