ALE Property: Result 2015

Recommendation

With long-term bond yields at very low levels, competition among investors for commercial property such as office towers, shopping centres, industrial sheds and pubs is intense. Assets on long-term leases to financially strong tenants are particularly favoured.

So it's no surprise the value of ALE Property's (LEP) 86 pubs – primarily leased on 'triple-net leases' to Australian Leisure and Hospitality (ALH), 75% owned by Woolworths – increased by nearly 10% to $900m during 2015.

As rents increase annually by inflation – at least until the upcoming limited market rent review in November 2018, where any increases (or decreases) are limited to 10% – total rental income increased by only 2%, from $54m to $55m. As such, the decline in the pubs' average capitalisation rate from 6.42% to 5.99% accounted for 79% of their increase in value and helped increase net tangible assets per share by 18%, from $1.93 to $2.27.

Key Points

Falling cap rates continue to increase value of pubs

Distribution increase & one-off capital payment announced

Still a HOLD

While last year's debt restructure reduced annual interest expense by around $7m, the expiry of hedges resulted in an 11% increase in borrowing expense, to $21m. This meant distributable profit declined by 6%, from $31m to $29m.

Despite this, management dipped into prior year undistributed profits to pay an 8.45 cents final distribution (unfranked), meaning full year distributions were 16.85 cents, a 2% increase on 2014.

Masterly inactivity

ALE didn't add to its portfolio during 2015, which is fine by us given the high prices for pubs.

| Year to 30 Jun | 2015 | 2014 | /(–) (%) |

|---|---|---|---|

| Rental income ($m) | 55 | 54 | 2 |

| Borrowing expense ($m) | 21 | 19 | 11 |

| Distributable profit ($m) | 29 | 31 | (6) |

| DPS (c) | 16.85* | 16.45 | 2 |

| Gearing (%) (see Note) | 48 | 51 | (6) |

| NTA per share ($) | 2.27 | 1.93 | 18 |

| * 8.45 cents final dividend (unfranked), ex date already past | |||

| Note: Gearing = net debt / (total tangible assets - cash) | |||

Despite these high prices, we're also comfortable with management not selling any properties during the year. With its pubs initially being under-rented when its leases commenced in 2003, their EBITDAR (earnings before interest, tax, depreciation, amortisation and rent) rising faster than inflation since then and ALH's substantial ongoing capital expenditure on the properties, we think it's highly likely that ALE gains a 10% increase in rents in November 2018.

Importantly, though, with the pubs' current valuations primarily determined using current rather than future rent, this increase in rent is to a great extent not yet reflected in their valuations.

Even so, the 10% increase in value during 2015 means gearing (net debt divided by total tangible assets less cash) has fallen below ALE's target range of 50-55%. To rectify this, management has committed to a 2016 distribution of 'at least 20 cents', giving an unfranked forecast yield of 5.4%, with subsequent distributions increasing by at least inflation.

Capital return payment

Management also flagged a special one-off capital payment upon conclusion of the 2018 rent review, most likely funded through additional debt to ensure gearing remains within the target range upon the likely increase in pub values in November 2018.

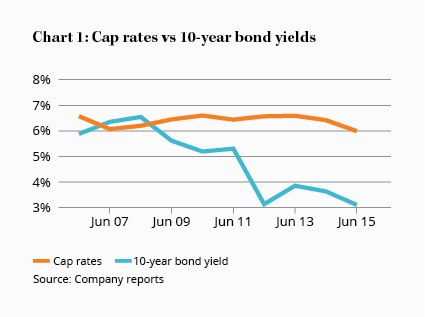

If long-term interest rates remain at current levels or even fall further, capitalisation rates will also likely fall further and management made sure to point out the 'material difference' between the two rates at the moment (see Chart 1).

There are reasonable arguments either way regarding the future direction of long-term interest rates and unfortunately we don't possess any superior forecasting skills in this area. Yet with its long leases to a financially strong tenant in the form of ALH and its total interest rate fixed until its next debt maturity in 2018 (when a relatively meagre $110m has to be refinanced), the main risk of an investment in ALE is the possibility that long-term bond rates return to more 'normal' levels.

Not only would this make ALE's 5.4% unfranked forecast yield less attractive in the eyes of investors but it would also likely flow through to capitalisation rates and hence the value of the pubs on ALE's balance sheet. Using the current value of its pubs, ALE would breach its debt covenants if average capitalisation rates rose to 7.50%, thereby requiring a capital raising or a reduction in distributions.

All that looks unlikely at this stage, though. With ALE's share price down 5% since A-REITs expensive on almost every measure on 31 Mar 15 (Hold — $3.86) but having returned 104% including dividends since we first upgraded it in ALE Property: Down in one on 2 May 12 (Buy for Yield — $2.08), we continue to recommend you HOLD.

Note: Our Income Portfolio owns shares in ALE Property.

Recommendation