A Wellcom result

Strong numbers delivering on promise

I am happy to say that marketing and advertising business Wellcom Group Limited (WLL) reported a strong set of full-year financial results on Wednesday afternoon (August 19). The company beat previously provided profit guidance of 10 per cent growth in net profit after tax (NPAT) delivering 14 per cent growth on FY14. In addition the company announced that its board will pay a 12 cent final dividend, taking the full-year dividend to 20.5 cents.

We note that growth was apparent in all geographic segments of the business, at varying rates. The exciting growth aspect of WLL's result is undoubtedly the US business where WLL has recently completed a further acquisition to bolster FY16 earnings. Overall, WLL's financial accounts indicate a healthy business, with strong cash flow and a stable Australian ballast from which to fund growth in international markets.

At 12 cents fully franked, WLL's dividend payout produces a yield near 5.06 per cent (7.23 per cent if you include franking benefits). Given the propensity for the company to grow its dividends in the future I think WLL represents a strong and stable component of our income first portfolio and our confidence is further bolstered by this result. I have revised forecasts higher in light of the strong result and the potential for additional growth in both US and UK markets. This results in a retention of my buy call and a lift in my valuation from $4.30 to $4.37.

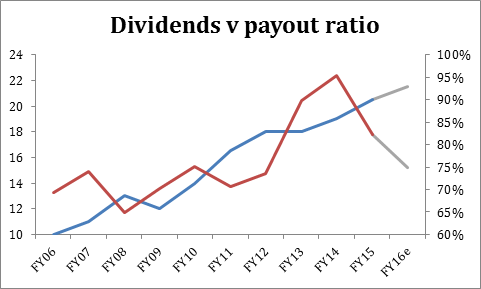

Cash flow and dividend payout

WLL's dividend lifted from 19 cents in FY14 to 20.5 cents in FY15, and in my opinion has the potential to continue to grow as the payout ratio falls. These are both trends that encourage me with respect to the business' value as a dividend payer and the sustainability of yield. The following graph shows that the payout ratio has needed to come down after a period of steady increase and that this result is a step in the right direction. The grey section of the chart reflects our expectation that WLL will be able to bring the payout down towards its 75 per cent target next year with some further growth in dividend payout.

Net profit drivers and segment performance

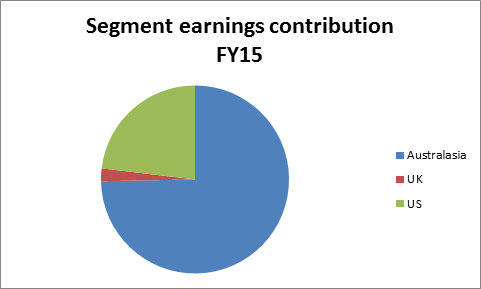

Overall, profit growth was driven by another solid contribution in the Australasian business. Revenue for this segment was up 12.1 per cent, but some margin was sacrificed in order to secure new business in a mature market place. As such the segment result for Australasia was $12.479 million, a 4 per cent lift on FY14 and a drop in margin from 25.4 per cent to 23.5 per cent. Despite this trend towards lower margin, we believe that WLL's performance in this more mature part of the business has again been solid and that margins are likely to remain relatively steady into FY16.

The company's UK operations continued to invest and rounded out a year that could be described as a year of building and investment. Revenue jumped 27.4 per cent to $13.027m, but the segment result was lower after margins collapsed from 10.3 per cent in FY14 to 2.8 per cent this year. As a result the UK was only slightly profitable for WLL. Again, management believe this is attributable to up front investments in the business necessary for new business wins.

Finally, WLL's US operations are performing ahead of management expectations. A full year contribution from theLab LLC which was acquired in early 2014 contributed to a lift in revenue of more than 280 per cent to $19.83m. Pleasing in this result was the fact that margins lifted from FY14's miserable 4.4 per cent, to a more meaningful 19.5 per cent. It is clear from this result that the US is quite an exciting path for WLL. The company's Knowledgewell technology (an end to end marketing platform) and acquired capabilities and relationship are proving to make inroads in a huge market. With FY16 commencing with the announcement of an additional acquisition in the US, we are hopeful that this segment will continue to see growth into the future.

Here is WLL's geographical earnings split after the FY15 result. What it shows is that Australasia remains the key base for this business, but that the US is becoming more meaningful – a trend I hope continues.

Technology – Knowledgewell and integrating with clients

I made mention of WLL's technology in previous discussions. The company invested heavily a few years ago in developing an end to end marketing platform known as Knowledgewell. This tool can be used for a range of functions, including the creation, storage and approval of advertising and marketing content. In addition, the software is used by WLL clients to the extent that it becomes part of client processes. This integration with clients is a key focus of WLL's in recent years that has led to the company's strong recurring earnings base. WLL has made mention that this technology is now being sold into US markets, and the potential for the establishment of recurring revenue in the US is one with a lot of promise.

When I discussed this with WLL recently it was mentioned that WLL's Knowledgewell platform is without peer in the Australian market. Certainly, there are some off the shelf solutions for content creation, but there is no end to end solution that also manages approval processes and the administrative side of marketing and advertising. It is my view that WLL's technology focus, and the market's thirst for high quality digital content and efficient delivery, is likely to continue to provide the business with a strong outlook and the potential to expand further internationally.

Looking forward to FY16

As is customary WLL has not provided any numerical guidance for FY16. That said, the company is well placed for future growth. The acquisition of Dippin Sauce in the US will contribute to FY16, as will new business wins in both the Australasian segment and the UK segment. WLL has established a Hong Kong operation to support global business opportunities, and will look to further leverage the use of its low cost production centre in Kuala Lumpur. With a cash balance of $11.6m at year end, further acquisitions are a possibility.

Overall, the FY15 result was ahead of my forecasts. Pleasingly, growth was apparent in the US beyond our expectations. If I was to pinpoint a negative in this result it would be that margins are being sacrificed in order to expand the business. This is a risk that I will monitor as it may be a developing indicator that competition in the space is rising. For now, we are comfortable that margin weakness is driven by the need to provide incentives to clients when winning new business. I have revised my forecasts slightly higher in light of the strong result, and lift my valuation to $4.37. I retain a buy call on the stock for income investors, and note that the full-year total 20.5 cents of dividend represents a strong yield of 5.06 per cent (7.23 per cent grossed for franking credits).

To see Wellcom's forecasts and financial summary, click here.