Media release: ETFs hit fresh peak as investors pour $5.5b into markets

Media release

ETFs hit fresh peak as investors pour $5.5b into markets

-

Inflows to ETFs doubled in July as investor sentiment rebounds.

-

Investors gravitated to global equity ETFs, indicating a return to 'risk-on' sentiment.

-

Gold-based ETFs saw some of the largest outflows in July, further highlighting increased risk appetite among investors.

Sydney (27 August 2025): Leading investment platform InvestSMART says the latest ASX figures showing a $5.5 billion flow of funds into exchange-traded funds (ETFs) in July 2025 are a clear indication of surging investor confidence.

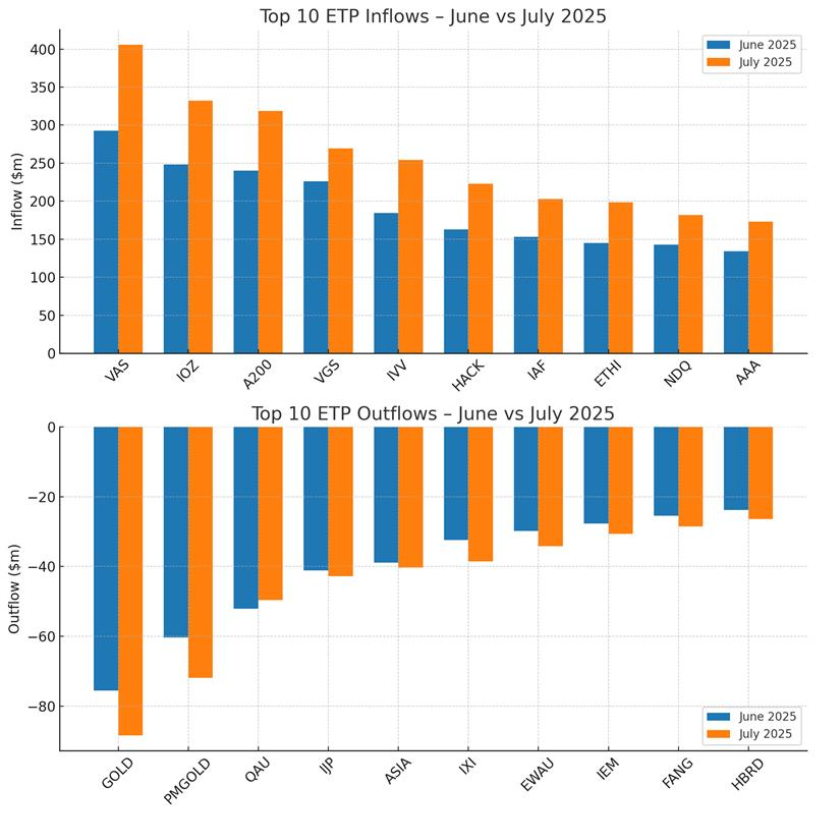

Investor inflows into ETFs more than doubled in July 2025, as sentiment rebounds. Net inflows rose 160% month-on-month from $2.13 billion in June 2025 to $5.5 billion in July.

Biggest winners July 2025

Global equity ETFs dominated investor preferences in July, attracting inflows of $2.52 billion versus just $0.74 billion in June 2025.

Australian equity-based ETFs ran a distant second, recording inflows of $998 million in July compared to $636 million in June 2025.

Interest rate cuts that kicked off in February, with expectations of more cuts to follow, have excited investor interest in Australian Fixed Income, which saw July inflows of $798 million compared to $532 million in June. Global Fixed Income attracted a $382 million inflow in July, more than double the $155 million in June 2025.

"Investors are clearly keen to lock in higher rates on bonds while also benefitting from capital appreciation as bond prices rise," explained CEO of InvestSMART, Mr Ron Hodge. "I would expect, however, that most of the investors shifting money into bond ETFs are retirees locking into higher yields, who will hold the asset to maturity."

The top five ETFs for cash inflows in July were:

|

Rank |

ASX Ticker |

Name |

Inflow ($m) |

|

1 |

VAS |

Vanguard Australian Shares Index ETF |

405.6 |

|

2 |

VGS |

Vanguard MSCI Index International Shares ETF |

332.1 |

|

3 |

IOZ |

iShares Core S&P/ASX 200 ETF |

318.7 |

|

4 |

NDQ |

BetaShares NASDAQ 100 ETF |

269.5 |

|

5 |

IVV |

iShares S&P 500 ETF |

254.4 |

Mr Hodge says, "The latest ASX ETF data is a clear indicator of 'risk-on' sentiment among Australian investors. It's not just about investors embracing local and international equities. The lower interest rate environment has seen investors veer away from cash-based ETFs."

July inflows into cash ETFs were down to $255 million, compared to $314 million in June 2025.

Commodity and mixed assets boom...

Inflows into commodity and mixed assets ETFs inflows exceeded $100 million in July.

This was more than ten times the June levels, with mixed-asset ETFs recording a dramatic rise to nearly $200 million in inflows for the month of July.

...but investors dump gold for growth assets

July saw persistent outflows from gold-based ETFs.

GOLD, PMGOLD and QAU topped the outflow lists in both June and July.

"This is further evidence that investors believe gold is now overpriced relative to opportunities that lie within local and international equity markets," concluded Mr Hodge.

The top five ETFs for cash outflows in July were:

|

Rank |

ASX Ticker |

Name |

Outflow ($m) |

|

1 |

GOLD |

Global X Physical Gold |

-88.4 |

|

2 |

PMGOLD |

Perth Mint Gold |

-71.9 |

|

3 |

QAU |

BetaShares Gold Bullion - Currency Hedged |

-49.6 |

|

4 |

IJP |

iShares MSCI Japan ETF |

-42.8 |

|

5 |

EWAU |

iShares MSCI Australia ESG Leaders ETF |

-40.3 |

Contact

Ron Hodge

CEO & Founder, InvestSMART

📧 r.hodge@investsmart.com.au

📞 0404 878 824

Frequently Asked Questions about this Article…

The recent surge in ETF investments, with $5.5 billion flowing into the market in July 2025, is driven by a rebound in investor sentiment and a shift towards 'risk-on' assets like global equity ETFs. This indicates growing investor confidence and a preference for growth opportunities.

The recent surge in ETF investments, with inflows doubling to $5.5 billion in July 2025, is driven by a rebound in investor sentiment and a shift towards 'risk-on' assets like global equities. This indicates growing investor confidence in the market.

Investors are moving away from gold-based ETFs because they believe gold is overpriced compared to the growth opportunities available in local and international equity markets. This shift is part of a broader trend towards riskier assets as investor confidence rebounds.

Global equity ETFs are popular because they attracted $2.52 billion in inflows in July 2025, reflecting a 'risk-on' sentiment among investors. This suggests that investors are optimistic about global market opportunities and are seeking growth assets.

In July 2025, global equity ETFs saw the highest inflows, attracting $2.52 billion. Australian equity-based ETFs followed with $998 million, and Australian Fixed Income ETFs also saw significant interest with $798 million in inflows.

Interest rate cuts that began in February have increased investor interest in Australian Fixed Income ETFs, which saw inflows of $798 million in July. Investors are keen to lock in higher rates on bonds and benefit from capital appreciation as bond prices rise.

Interest rate cuts that began in February have increased investor interest in Australian Fixed Income ETFs, as investors seek to lock in higher rates and benefit from potential capital appreciation as bond prices rise.

The top ETFs for cash inflows in July 2025 were Vanguard Australian Shares Index ETF (VAS), Vanguard MSCI Index International Shares ETF (VGS), iShares Core S&P/ASX 200 ETF (IOZ), BetaShares NASDAQ 100 ETF (NDQ), and iShares S&P 500 ETF (IVV).

The top ETFs for cash inflows in July 2025 include Vanguard Australian Shares Index ETF (VAS) with $405.6 million, Vanguard MSCI Index International Shares ETF (VGS) with $332.1 million, and iShares Core S&P/ASX 200 ETF (IOZ) with $318.7 million.

Investors are moving away from gold-based ETFs, which saw significant outflows in July 2025, because they believe gold is overpriced compared to growth opportunities in local and international equity markets.

Cash-based ETFs are seeing reduced inflows due to the lower interest rate environment, which has led investors to seek higher returns in equities and other growth-oriented assets.

Commodity and mixed asset ETFs saw a boom in July 2025, with inflows exceeding $100 million. Mixed-asset ETFs, in particular, recorded a dramatic rise to nearly $200 million, indicating a growing interest in diversified investment options.

Commodity and mixed asset ETFs experienced a boom in July, with inflows exceeding $100 million. Mixed-asset ETFs, in particular, saw a dramatic rise to nearly $200 million in inflows, indicating a growing interest in diversified investment strategies.

Cash-based ETFs experienced a decline in inflows, dropping to $255 million in July 2025 from $314 million in June. This suggests that investors are moving away from cash-based options in favor of equities and other growth assets.

The ETFs with the largest outflows in July 2025 were gold-based, including Global X Physical Gold (GOLD) with -$88.4 million, Perth Mint Gold (PMGOLD) with -$71.9 million, and BetaShares Gold Bullion - Currency Hedged (QAU) with -$49.6 million.

The 'risk-on' sentiment implies that everyday investors are becoming more confident and are willing to take on more risk by investing in equities and other growth assets. This shift could lead to higher potential returns but also comes with increased market volatility.