InvestSMART records profit surge as investors flock to robo advice

InvestSMART Group Ltd (ASX: INV), Australia's largest provider of automated investment advice to retail clients and self-managed super funds, today announced its profit had surged in the year to June 30, 2016 as the group expanded its range of robo advice tools and content services.

In a year that was focused on business consolidation, cost restructure and systems development to improve scalability, InvestSMART’s operating profit before tax and amortisation jumped from $131,204 to $2.41 million.

The result, and the focus on improving services to members, set the scene for organic growth in member engagement and revenue in FY2017 as the numbers of investors turning to the group’s sophisticated robo advice tools continues to grow strongly.

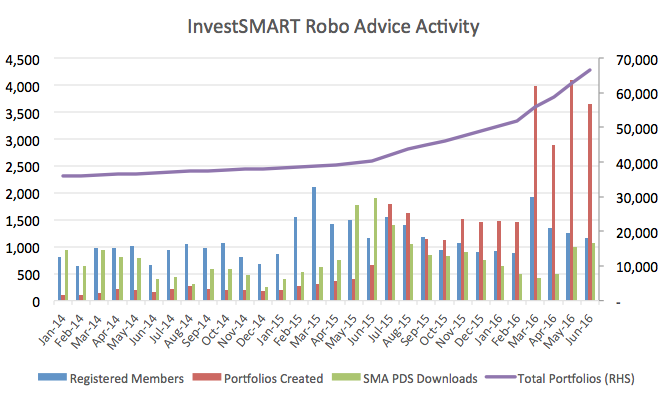

Over the 12 months, the number of users of InvestSMART’s automated software to build and manage their investment portfolios more than doubled from just under 19,000 to around 45,000, while the group’s registered members doubled to more than 700,000 following the acquisition of investment website Eureka Report.

“With over 45,000 members monitoring over 65,000 investment portfolios, InvestSMART has a unique insight into where members may require further value added services,” said group managing director and chief executive, Ron Hodge.

“InvestSMART differentiates itself from all other digital wealth advisers through proprietary software which helps members construct better weighted portfolios against their risk profiles,” Mr Hodge said. “By analysing over 8,000 managed funds, super and listed securities we are able to show members where they are underweight or overweight a particular asset class.

“Members are then able to invest in our low cost direct Australian equity and asset class specific ETF portfolios to better diversify their overall investment portfolio.”

InvestSMART chairman, Paul Clitheroe, said the group’s strong financial results were indicative that more and more Australian investors were demanding high-quality automated investment advice services.

“Our proprietary Portfolio Manager continues to drive our automated investment advice services, filter content, and drive improvements in members’ portfolio construction through the use of InvestSMART and Intelligent Investor proprietary investment funds,” Mr Clitheroe said.

“Further enhancements to the Portfolio Manager over the next six months will provide further automation, better reporting and the ability for members to track their portfolio performance against their investment goals.

“For example, we know our members currently hold more than $1.2 billion in cash, most of which is in term deposits. Providing services that allow our members to easily roll their term deposits at maturity is an exciting project currently underway.

“Our members also hold over $6.5 billion in Australian equities, $1.6 billion in managed funds and $5.3 billion in property. Our members continue to be underweight in international equities and fixed interest, which provide further opportunities for new products and research in these spaces over the next 12 months.”

InvestSMART will officially launch a mobile app in the first quarter, which will provide increased engagement to portfolio manager users and subscribers.

Mr Hodge added that Australia was at the forefront of automated investment advice technologies, and the strong uptake by retail investors, SMSF trustees and professionals including financial planners was indicative that robo advice is gaining good traction.

“InvestSMART was one of the first companies to launch automated online investment advice services in Australia in 1999 and given these financial results, and the rapid growth in users, robo advice is definitely here to stay. With greater uptake by investors we will continue to investment heavily in our technology, which can only improve these types of services and outcomes for all Australians.”

For further information, contact:

Ron Hodge

Managing Director and CEO, at InvestSMART Group

02 8305 6000

Frequently Asked Questions about this Article…

InvestSMART is Australia's largest provider of automated investment advice, offering tools and services to help retail clients and self-managed super funds manage their investment portfolios. It uses proprietary software to help investors construct better-weighted portfolios based on their risk profiles.

InvestSMART's operating profit before tax and amortisation jumped significantly from $131,204 to $2.41 million in the year to June 30, 2016, due to business consolidation, cost restructuring, and the expansion of its robo advice tools and content services.

InvestSMART's robo advice tools allow investors to build and manage their investment portfolios efficiently. The tools provide insights into asset allocation, helping investors identify where they may be underweight or overweight in certain asset classes, and offer low-cost investment options.

As of the latest report, InvestSMART has over 45,000 users monitoring more than 65,000 investment portfolios, and its registered members have doubled to more than 700,000 following the acquisition of the Eureka Report.

InvestSMART plans to enhance its Portfolio Manager with further automation, improved reporting, and the ability for members to track their portfolio performance against their investment goals. A mobile app launch is also expected to increase user engagement.

InvestSMART sees opportunities in international equities and fixed interest, as its members are currently underweight in these areas. The company plans to introduce new products and research to help members diversify their portfolios.

InvestSMART differentiates itself through its proprietary software, which provides unique insights into portfolio construction and asset allocation. This helps members create better-weighted portfolios tailored to their risk profiles.

Robo advice is gaining traction in Australia due to its ability to provide high-quality, automated investment advice efficiently. The strong uptake by retail investors, SMSF trustees, and financial professionals indicates a growing demand for these services.