Zeroing in on the limitations of monetary policy

Is the Reserve Bank of Australia concerned about the zero lower bound and the limitations of conventional monetary policy? Recent comments by RBA governor Glenn Stevens suggest he has plenty on his mind.

Following the global financial crisis, monetary policy changed forever. Decades of conventional policy was turned on its head once Lehman Brothers collapsed and financial markets across the world threatened to follow suit.

The Federal Reserve lowered rates to zero per cent or thereabouts in late 2008; the Bank of England in early 2009; while the inflation hawks at the European Central Bank paid a heavy price for taking too long to join their central bank peers.

The RBA lowered rates from 7.25 per cent in August 2008 to just 3 per cent by April 2009. It is reasonable to say that the RBA was a little late to the party, resulting from an underlying belief at the time that Australia had decoupled from the likes of the United States and Europe.

That turned out to at least be partly true, with demand from China -- combined with domestic stimulus -- proving to be enough to support the Australian economy throughout the crisis. The RBA has never had to resort to the unconventional policies used by other central banks to support growth.

Six years on, and rates throughout the developed world remain at crisis levels. Both the Fed and the BoE appear likely to raise rates over the next 12 months but it could be years before the ECB follows suit.

Those six years have been interesting for the Australian economy: a downturn, followed by the second stage of our unprecedented mining boom and eventually an attempt at rebalancing growth towards the non-mining sector.

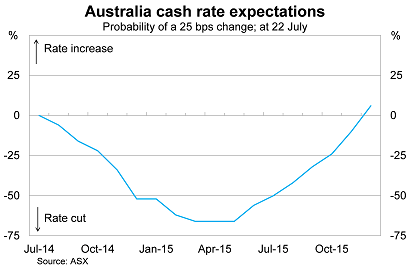

Australia finds itself with a cash rate of just 2.5 per cent -- lower than during the global financial crisis -- and the market expects rates to be cut again. At the close of business yesterday, markets were pricing in a 52 per cent probability of another rate cut by the end of the year.

With the Australian economy facing an ageing population (including declining labour force participation), combined with our terms of trade deteriorating and mining investment collapsing, there is a distinct possibility that rates could tumble towards 2 per cent or even lower over the next couple of years.

It is with that backdrop that RBA governor Glenn Stevens decided to discuss the limitations of monetary policy. What could cause the natural or neutral cash rate (the rate associated with maintaining full employment) to decline?

Stevens notes three possible scenarios:

1. Overinvestment

2. A decline in potential growth

3. Reduction in innovation

4. ‘Animal spirits’

The truth is probably a mixture of all four. Australia’s potential growth rate is certainly set to decline on the back of an ageing population and a structural shift in our terms of trade.

Overinvestment may be an issue for the mining sector, with Australian miners flooding iron ore and coking coal markets with excess supply and reducing prices, but it is certainly not an issue for the non-mining sector.

Its problem is likely tied to a lack of competitiveness and optimism. Firms remain wary of the economic outlook and are waiting for conditions to improve before they commit to new projects. For businesses exposed to international trade and conditions, the high Australian dollar continues to weigh on our mining and agricultural sectors.

I’d also add rising indebtedness to Stevens’ list. With rising levels of debt, particularly variable mortgage rate debt , a 25 basis point tightening should have a considerable effect on the purchasing power of Australian incomes. This factor may not have changed significantly over the past decade but it is no longer being offset by rising demand and strong income growth.

There might be some doubt over the underlying cause but there should be no doubt that the neutral rate is declining across a number of developed economies. BoE governor Mark Carney recently suggested that the neutral rate in England is about 2.5 per cent, while the outlook for the Fed suggests a neutral rate of close to 4 per cent.

Both are well down on estimates of the neutral rate prior to the global financial crisis, but they remain estimates. And as the recovery continues it is possible that these estimates may be revised lower – particularly for the United States.

It seems unlikely that Australia has managed to buck that trend; the neutral rate is almost certainly much lower than the 5 to 6 per cent that was normal throughout most of the 2000s. A more realistic neutral rate is probably close to 3 to 3.5 per cent.

Stevens’ comments suggest that there is not much upside to the cash rate over the next few years. If the RBA does decide to tighten (contrary to my current outlook ), it will take its time. With the neutral rate declining both here and abroad, we cannot easily tolerate the higher levels of interest that were normal prior to the global financial crisis.