Your most expensive retirement ever

Summary: Lower interest rates, bond yields and share market returns mean your retirement costs 20-35 per cent more and takes two to three years longer to fund than it did a decade ago. Last week's rate cut and winding back of super contribution limits along with pending tightening of Age Pension eligibility hurts, not helps this. |

Key take-out: Retirement has never been so expensive. I'm not sure those changing super and pension rules appreciate this. |

Key beneficiaries: General investors. Category: Retirement. |

Ultralow interest rates and bond yields coupled with the likelihood of continued lower equity returns means your retirement is going to cost more. How much more? For those wanting maximum security, it costs 35 per cent more to buy a guaranteed income than it did 10 years ago. For those willing to bet on a later recovery in yields and share market returns, they might need a lesser 20 per cent more without being too pessimistic. This means for most coming up with $100,000's more in savings and probably working two to three years longer.

At a time when those saving for retirement need more help, economic pressures are driving the Government and the RBA to do the opposite. I can't recall any of the many opinionating on super changes before the Federal Budget mentioning the squeeze that retirees are under funding a part or full retirement. In last week's rate decision announcement [ http://www.rba.gov.au/media-

Trends in the cost of a guaranteed retirement – looking offshore

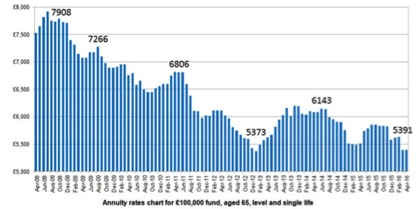

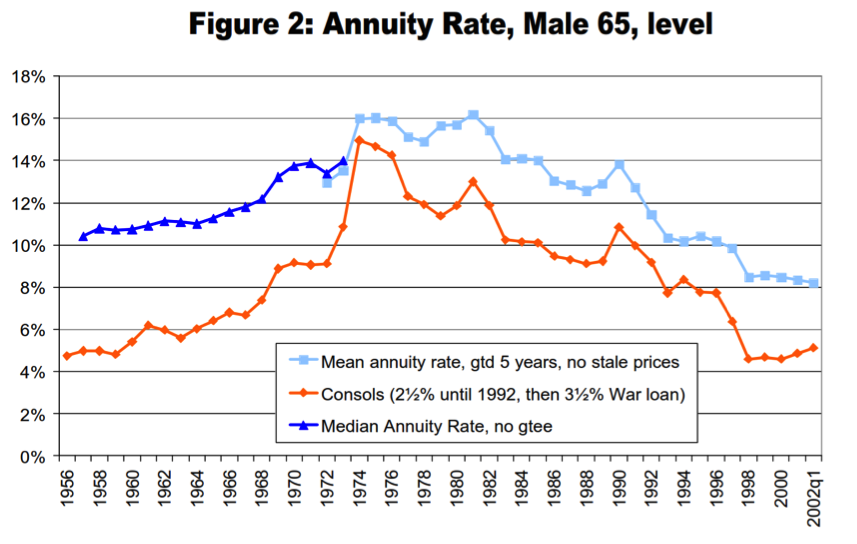

The most definitive way to estimate the changing cost of retirement is to look at the cost to buy a lifetime guaranteed income stream. Australian sales of lifetime annuities have traditionally been very low for various reasons – including lack of government incentive or compulsion, existence of the Age Pension as a back stop, poor past product inflexibility and questionable value especially during previous bull markets. As a consequence local products and manufacturers have come and gone and overseas markets are a better place to observe pricing trends. Figure 1 summarises annuity rates in the UK over the last 8 and 50 years.

Figure 1 UK lifetime annuity rates over the last 8 years (above) and for 46 years 1956-2002 (below) for a single 65 year old male with level, non-indexing payments. In the below chart the blue lines are annuity rates which can be seen to track closely changes in bond yields shown in orange. Source: Sharing Pensions, Cannon and Tonks.

Annuity quotes are often expressed as a per cent yield, or often income paid per 100,000 of capital. To turn this into a capital required to fund a desired spending amount, you simply invert these. Lower rates or yields mean more capital is needed to provide a desired income.

ASIC's MoneySmart website republishes ASFA retirement spending standards and suggests a comfortable retirement costs a single $43,184 annually (and a couple about $59,236 – both amounts I find low).

To fund a $43,184 level income stream for a 65 year old male for his life you would need based on UK rates:

- $800,000 of capital now

- Which is 25 per cent more than five years ago when only $630,000 was needed…

-.. and 50 per cent more than during the “old normal” 2000's when annuities sold on a 8 per cent yield requiring only $550,000

-If you didn't worry about inflation, which peaked in the 80s, you could have also bought a level income stream then for $270,000, but not paying more to tick the CPI indexing payment box would have been financially fatal

- Since these annuities return nil on death, the current little over 5 per cent yield or 5,000 cost per 100,000 is only giving capital back over an average 20 year life expectancy. At these rates investors, are only getting longevity protection, not investment return.

What is causing the cost of annuities to soar? While annuitant longevity is increasing, it's mostly due to low bond yields which drive annuity pricing. A UK Government 10 year bond is yielding lowest ever 1.6 per cent annually, down from 3.5 per cent five years ago. Throughout the 2000s, before dramatic Central Bank interventions, it traded between four and five per cent.

When UK press headlines read “Annuity firms slash rates to worst level EVER” and “Annuity rates crisis puts pensions in 'death spiral' with worst retirement pay outs in history“ what they are also saying is “Retirement has never been more expensive!”

Australian annuity rates

While retiring in Australia is also the most expensive it ever has been, we are so far a luckier country for two reasons: slightly higher interest rates/bond yields (for now?) and a higher after-tax yielding share market after tax (we hope).

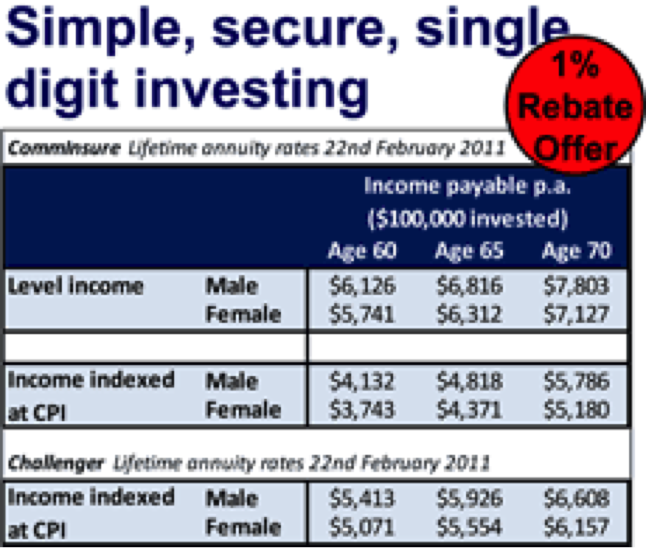

This week Challenger will sell a $43,184 level income to a 65 year old male for $677,000 (with no liquidity at rates: read more here). This costs three per cent more this week than last week following the RBA announcement. CommInsure will provide the same income, and with a 10 year guarantee period, for $743,000 (rates: read more here). Both of these are less than $A800,000 offered to UK annuitants.

Five years ago in February 2011, (see Figure 2) this income would have cost 20 per cent less or $633,568 from CommInsure. A similar but CPI indexed annuity income from Challenger would have cost 25 per cent less. These match the 25 per cent increase in the UK over the last 5 years.

Figure 2 Australian annuity rates 5 years ago from Comminsure (level and CPI indexed, above) and Challenger (CPI indexed only, below).

Going back 10 years, the cost of a guaranteed income now costs 35 per cent more (based on figures provided to me from CommInsure). The only good news is that this is less than 50 per cent more in the UK.

In case you're wondering, a capped $1.6 million would buy a proper CPI indexing, lifetime annual income for a 65 year old of about $70,000.

Unguaranteed retirement funding

Most Australians choose or have no choice but to invest for themselves to fund retirement so it is worthwhile looking at this from an asset class and portfolio returns perspective.

The medium term returns from bonds are certain and they are low. The benchmark Australian Government 10 year bond is yielding 2.3 per cent (0.2 per cent down on the week before). This is about the same yield as from a lower credit quality mix of bonds with an average maturity of a little over 5 years, making up the broader Australian bond index.

Lately, many forecasters have worried about lower long-term equity returns. For instance Blackrock is forecasting (read more: click here) annualised equity returns over 10 years of about six per cent, Vanguard about eight per cent and Research Affiliates (read more here) between one per cent (US) and six per cent (ex-US) real above inflation.

In October 2014 (read more here: Returns in 2024) I provided estimates for future equity, bond and portfolio returns and forecast lower returns. Over the next 10 years I guessed after some later rebound, bond yields might average about 4.4 per cent, not six per cent, and equity returns might return 10 per cent, not 11 per cent. The latter arising from giving back 10 per cent above average share prices, not slower earnings growth that seems to persist.

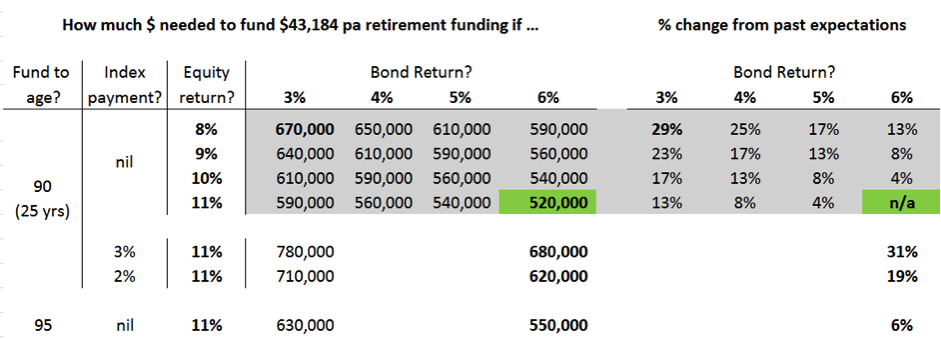

In Figure 3 I summarise estimates of how much capital, in terms of dollar amount and, more importantly, per cent more versus “Old Normal” assumptions are required to fund a level annual income stream of same $43,184 for 25 years - depending on what share and bond returns average over that time. This is based on investing in a 50/50 equity/bond portfolio mix – chosen to be more comparable to an annuity than a higher growth portfolio. As I showed earlier [ER Turek trouble with projections 200809], over long periods of time it's hard to be average, so don't rely on the capital amount, just focus on the per cent increase. Here I've picked 25 years of funding. While male life expectancy is only 20 years at age 65, that is the age when only half die. By 90, 90 per cent of us men will be gone. Self-funded retirees should plan for funding for longer than annuity providers who pool life risk.

Figure 3 Lump sum required to fund for 25 years (age 65 to 90) a level annual payment of $43,184 depending on average annual equity and bond returns; after 1 per cent allowance for costs and taxes. “Old Normal” results for past observed 11 per cent equity and 6 per cent bond returns highlighted in green.

This simple model suggests …

- In the “Old Normal” only $520,000 was needed to fund a $43,184 annual level payment

- Retirement would cost you 13 per cent more or $590,000 if bond yields stay stuck at three per cent (for no change in equity returns)

- If additionally equity returns fell to eight per cent annually, then 29 per cent more is needed ($690,000).

- Challenger and CommInsures' offer to pay this income for $677,000 and $743,000 (latter with a guarantee period) is reasonable, although perhaps only under the most pessimistic scenarios

- While annuities offer important longevity protection, here it is suggested you only need another six per cent or $30,000 more capital to buy another 5 years of income (bottom row)

- Demanding a 3 or 2 per cent annual inflating income (the latter say if cost-inflation is indeed lower for longer) costs another $160,000 or $100,000 respectively. I strongly recommend inflation protection, it's an equal enemy to persistently low returns.

While I expect lower bond yields and equity returns over the next 10 years I think it is too pessimistic to expect them this low averaged over the next 20-30 years. I believe capitalism works and companies will over the long term grow profits at six per cent annually and pay out profits of about five per cent (where the 11 per cent comes from). I also hope one day the cost of money rises to more fairly reward savers, and expect 3 per cent yields might only last for the first phase of a long retirement. So I don't buy the extreme.

You can come to your own conclusion from Figure 3, but my best guess is the cost to retire relying on investment markets is about 20 per cent more now than 10 years ago. Perhaps in another 10 years if low returns are a thing of the past, then what is old is new, and normal again, and it won't cost more to retire then. As pointed out earlier, there is luck in retirement timing and now is an unlikely time to retire.

Central banks to blame?

Last year [read more: It's time central bankers considered citizens, March 18, 2015) I lamented Central Banks' mandates put giving lenders and depositors a fair rate of return low in their priority list, if at all.

In a widely reported address (you can read it here: RBA) just three weeks ago in New York, RBA Governor Glenn Stevens suggested we need to rethink our assumptions about retirement savings. It will cost more and promises of future incomes may not be met.

But it's not all the Central banks' fault.

Your response to lower for longer?

On an earlier occasion (read it here: RBA April 2015) the Reserve Bank Governor said “Just about everywhere in the world the price of buying a given annual flow of future income has gone up a lot. Those seeking to make that purchase now – that is, those on the brink of leaving the workforce – are in a much worse position than those who made it a decade ago. They have to accept a lot more risk to generate the expected flow of future income they want”.

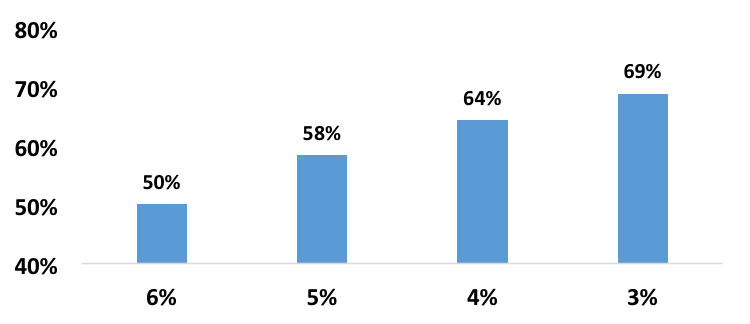

While I don't think the Reserve Bank Governor is giving asset allocation advice, it is hard to not think this means incorporating more equities into your portfolio. In Figure 4 below I calculate how much more equities you would need to add to your portfolio to achieve an old normal 8.5 per cent pre costs portfolio return - depending on how pessimistic you plan on being about very long term bond and cash yields, while still being optimistic long term equity returns don't also falter.

Figure 4 Equity mix (vertical axis) required to generate a 8.5 per cent annual portfolio return for various decreasing cash and bond yields (horizontal axis) assuming unchanged 11 per cent annual equity returns.

This suggests you would need to move from having 50 per cent to 70 per cent in equities in your portfolio if long term yields average three per cent. Based on volatility observed over the last 20 years an investor in such a portfolio would need to tolerate a 25 per cent drawdown over the next 12 months instead of 15 per cent. Many can't stomach that much volatility so close to retirement.

It is also possible that future equity returns won't be this high so the amount of equities is also understated. Note I think we should expect lower returns from property too, so that's not an escape. Aside then from property-equity release, then the only other way to avoid spending less in retirement is to accumulate more savings. This can be done by either postponing retirement and/or saving for longer. Postponing retirement three years would allow a portfolio to grow 20 per cent assuming it earns a modest 6 per cent annually. If in addition to working just to cover expenses, additional savings can be made, this could be cut down to 2 years. So probably for some 67 is the new 65.

While the RBA seems to appreciate the connection between lower interest rates and the high cost of retirement, its recent rate decision doesn't acknowledge this. I am even more convinced the RBA Board needs to include an investor representative. It's also a shame when the Government is paying the lowest cost on its borrowings in its lifetime; it hasn't managed its own financial house more prudently to be able to help investors. Reducing contribution caps from $35,000 to $25,000 and making more distrust super does the opposite. Oh well, more will choose to rely on the Age Pension which has never become more expensive for the Government to fund!

Dr Douglas Turek is Managing Director of family wealth advisory and money management firm Professional Wealth - www.professionalwealth.com.au.