Working towards a full recovery

PORTFOLIO POINT: The indicators suggest that, contrary to Roubini’s predictions of another big US downturn, economic growth is trending well and the recovery is on track.

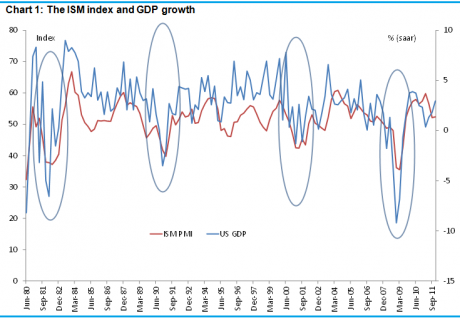

Wall Street's Institute of Supply Management’s manufacturing index is one of the best leading indicators of economic activity in the market. So it matters when the index falls below 50 and stays there for a second consecutive month.

If you want to follow the interpretation of some analysts such as Nouriel Roubini, the index might be hinting that the recent 7% gain on our All Ords is at risk – that it is nothing more than a ‘sucker rally’ and the bear market will continue. Have a look at the chart below.

While by no means perfect, there is certainly a good correlation between the ISM index and GDP over time. So with the recent downturn in the index I have to confess I was preparing to downgrade my US growth forecast. No by anything major; maybe from an above trend pace of 2.7% to something more like 2% or 2.25% (for 2012). Trend growth now would be something like 2.4%.

But it should be said at this point that alarmist claims of another recession, made regularly by economists such as Nouriel Roubini, are just that at this stage. They are alarmist claims. There is no evidence for it. By the way, economists such as Roubini were also suggesting a high probability of double-dip recession in both 2010 and 2011, which obviously came to nothing.

In any case, the above chart shows that you need to see the ISM index fall to 47 or below on a sustained basis (some months) for that to be a credible claim and, as yet, we’re not there. And the thing is, I’m not sure that we will get there.

The US jobs report for July released last week was a pivotal release in my opinion, and has helped firm up my view that the US will avoid stall-speed growth. In fact, growth prospects are very good. It’s not that 163,000 jobs in one month is a large addition or anything. By no means. It’s more about what the recent jobs rebound signals for other releases that had deteriorated as well. It suggests that we were/are simply witnessing some noise, data volatility.

Recall at this point my note of June 25, A Twist of Fortune where I highlighted that analysts, and Roubini is certainly in this camp, seem to mistake all data dips as a clear signal that a recession looms. Fortunately it’s not that simple. Life never is.

The good news for investors is that not only do the jobs figures suggest that the recent deterioration in employment was just noise, they also highlight why the US recovery is on a sustainable path and will likely accelerate.

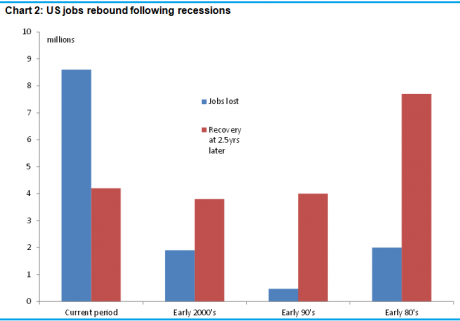

To see this, consider the consensus view that the US jobs recovery to date has been disappointing. Certainly the US Federal Reserve is of this view, yet it’s one which I don’t think fits the facts. Chart 2 shows why.

The red column shows the jobs recovery at a point two-and-a-half years from the trough. This is where we sit now. So, for comparison, I’ve applied the same timeframe to each recession in the modern economic era. As you can see from the chart, just over four million jobs have been created in this recovery, which sits well with previous jobs recoveries. Only in the 1980s did we see a much sharper jobs rebound, but this was more the result of the significant micro economic reforms undertaken over that period.

The OECD underwent significant structural changes through deregulation, and in the US there were sharp cuts to the top marginal tax rate, which fell from 70% to about 50%. It also coincided with a sizeable increase in military expenditure under Ronald Regan. Economic growth consequently was also significantly stronger over this period (growth averaging 6%pa over a three-year period).

But that was the nature of the growth cycle at the time. Many readers may remember economic growth was much more volatile in the 1970s and 80s compared to the 1990s and 2000s. Macroeconomic policy deliberately sought to contain this volatility – to stabilise it – and up until recently, succeeded. This, by the way, is why comparisons of the current growth recovery to previous ones are really quite disingenuous.

The structure, operation and volatility of the economy has changed so much over the decades. It’s much less volatile now, so that statements suggesting this is the “weakest economic recovery in history” or the “slowest jobs recovery” are overly simplistic and, in the end, misleading. People are not comparing apples with apples.

One way to see this is to compare current trend growth rates with the general trend for a comparable economic period. So, for instance, while it isn’t reasonable to compare growth rates now to say the 1960s or the 1980s, when the economy was completely different, it is reasonable to compare growth now to the average over the previous five or 10 years (maybe the period in between each recession as a guide).

By doing this you are taking into account changes to the economy whether driven by technology, regulation or what have you. I’ve done this in the table below, comparing each post-recession recovery to the growth rates of the preceding inter-recessionary period.

The table shows that growth so far in this recovery at 2.2% has been slightly below the pre-recession period (2001-2007) growth rate of 2.4%. This is a difference of only 0.2% points. It compares favourably to the recoveries in the early 2000s and 1990s where growth (12 quarters into the recovery for consistency) was much weaker when compared to growth in the previous pre-recession period. In the early 90s, for instance, growth in the recovery was at 3.1%, which was a full 1% points below the pre-recession growth rate.

Only in the 80s was growth stronger in the recovery than the pre-recession period. Consequently it is inaccurate for people to claim this is the weakest recovery on record. This recovery actually compares very favourably, as the above table shows. Expressed another way, the economy now is growing at a rate not too far below its capacity. It actually cannot grow too much faster on a sustained basis. But when we are talking a growth differential of 0.2% points below a period when we saw the development of one of the greatest credit bubbles on record, then I don’t think the US is doing too badly.

Returning to chart 2 then, the fact is that over four million jobs have been created since the trough, an average of 155,000 per month. This is solid and compares favourably to average jobs growth from the 2001-07 period (just over 100,000 per month). Jobs growth has normalised and is in fact running at a stronger rate than the pre-recession period. This is the importance of the latest jobs figures. We have returned to this trend, and there is a strong jobs recovery under way.

The stand-out feature from the chart is the sheer magnitude of job losses during the GFC. Over eight million, which is the largest in the modern era. This is why it is taking a while for the unemployment rate to come down. Not because jobs growth is sluggish, but because so many jobs were lost in the first place. It will take time.

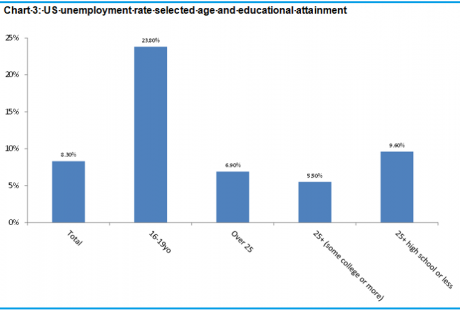

But then look at the skew. The truth is that most of the unemployed are young, uneducated, low incomes earners.

Chart 3 shows that educated people over the age of 25 have an unemployment rate of about 7%, quite a bit lower than the national average of 8.3%. Throw in some college education and the unemployment rate falls sharply to 5.5%. The thing is, the latter group are 54% of the total labour market and comprise 70% of total consumer expenditure.

For the rest of the world, this is extraordinarily important. It suggests that the US consumer is actually well placed to continue making a sold contribution to global growth and that the impact of high unemployment on consumption is limited, due to the fact it is largely confined to younger, lower income people. The big American spenders, educated people over the age of 25, actually have a very low unemployment rate of 5.5%.

This is why people like Nouriel Roubini and Paul Krugman are wrong, in my opinion. Economic growth rates over recent quarters are actually not too far below their pre- recession growth rates (2001-07). Similarly I find jobs growth is actually stronger over the same inter-recessionary period. Then I find that high rates of unemployment are generally confined to younger, lower income people.

Lastly, the groups who are primarily responsible for driving US consumption, actually have very low rates of unemployment.

Consequently, there is no need to be worried about the sustainability of the US recovery.