Women's Superannuation: Creating an accumulation pathway

Summary: The problem of many women having inadequate retirement balances has been well documented. A new model based on age helps join the financial dots.

Key take-out: A new set of recommendations is around using a range of superannuation top-up measures to ensure individuals achieve a minimum dollar figure in retirement, based on certain assumptions.

David Hetherington describes the widening gap between men's and women's superannuation balances as “a wicked problem” with no silver bullet solution.

David Hetherington describes the widening gap between men's and women's superannuation balances as “a wicked problem” with no silver bullet solution.

However, the co-author of the recently released report Not So Super, For Women says developing an accumulation pathway, and making sure no one slips off, may be an answer.

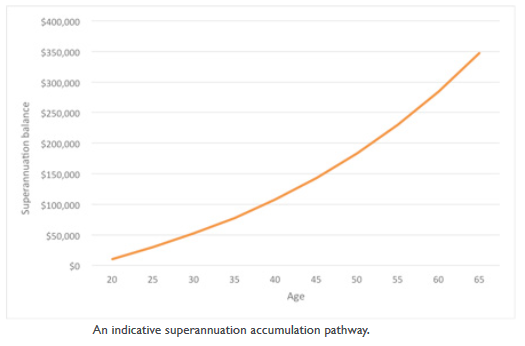

Hetherington says the accumulation pathway concept is about mapping the superannuation balances at any given age that a person should hold in order to achieve a basic living standard in retirement based on a combination of superannuation and the age pension.

Using indicative retirement standards of living developed by the Association of Superannuation Funds of Australia, Hetherington's research team has come up with a dollar figure of $347,000.

That's based on an individual working full-time from age 18 to 65 earning the minimum wage (with zero wage growth) for their entire working life. The other assumptions are that the individual receives standard Superannuation Guarantee contributions (9.5 per cent) and a real return on their super (net of fees and charges) of 3 per cent per annum. The $347,000 outcome allows for annual income of $38,500 until the age of 90.

This calculation creates a superannuation accumulation financial pathway for each age band.

Hetherington says the objective is to use the pathway to identify people with low balances for their age and then look for contribution top-ups from their employer and/or the Government to bring them back on track.

“We're trying to find the people who have fallen behind the path and then give them a hand in getting back to the kind of accumulation pathway that you need in order to hit the mark.

“These include workers who are taking time off for either parental leave or other care responsibilities so that they are still getting contributions while they're off. Because that absence from the workplace means not only missing the initial rate of those contributions but the compounding value of them. That's something that really sets people back.”

Hetherington's report has 20 recommendations, including a superannuation contribution on the government's paid parental leave scheme and a co-contribution top-up of 2.5 per cent of income, paid annually, for accountholders more than 5 per cent below the accumulation pathway.

Some organisations are already taking steps.

“I've been contacted by a number of different super funds and companies saying ‘you're really onto an issue here, and here's what we're doing to think about it', or in some cases ‘here's what we're doing to act to close that gap'.”

For example, Viva Energy (the licensee to the Shell brand in Australia) has become the first company in Australia to offer part-time workers their full superannuation entitlements for up to five years to help address the superannuation gap.

Hetherington also points out that super funds need to look at reducing or waiving fees for workers that are on parental leave or well below the age appropriate balance.

“I guess we feel there's not a single intervention that's going to fix this,” Hetherington says. “It's going to take a set of different actors, each doing relatively small things, to get a cumulative effect that closes the gap for women so that over time their retirement balances are looking more like men's.

“I do see financial literacy as a problem, but I would actually say it's not necessarily restricted to women. I think the system as a whole is problematic in both its complexity and the speed at which it changes.”

Hetherington says the message around building a better system that leaves fewer people behind, especially women, is starting to get traction.

“At this point I'm very confident it's on the radar of politicians and policymakers. It's one of the things that has been bubbling for a couple of years now. A number of organisations within and outside of Government have put out research and analysis that says this is a real problem that needs to be addressed.

“I think it's building as an issue and what we're seeing, which is heartening, is actors outside of the Government taking it upon themselves and being proactive in working to close this gap.”