Will the RBA send the Aussie back to parity?

The recent run higher in the Aussie dollar has many wondering where the rally might end. Most predictions (and I agree it’s still likely) are for a lower currency, putting it somewhere between 80 and 85 US cents over the next 12-to-18 months. But it is also widely expected interest rates are on the way up over this period. We could in fact see the RBA begin to talk this way in coming days.

This may not make sense to many as higher interest rates usually lead to a higher currency, not a lower one. Although I feel the Aussie dollar can head lower longer term, it doesn’t mean it can’t rally further first. In fact I wouldn’t be surprised to see the Aussie dollar take out 95 cents and October 2013 highs around $US0.9750 before it commences its descent. It might even have another crack at parity.

I don’t believe it is China stimulus that will drive it higher still. It won’t be US dollar weakness. It will be the RBA -- that’s right, the RBA -- that will send the Aussie higher.

The hurdle for further interest rate reductions is quite high and we now know the Reserve Bank has reached the bottom of its easing cycle so the markets have started to price in some small interest rate rises. We are in the very early stages of what could be a very aggressive period of monetary policy tightening. The front end of the yield curve hasn’t really got moving yet but when it does it might be in a big way.

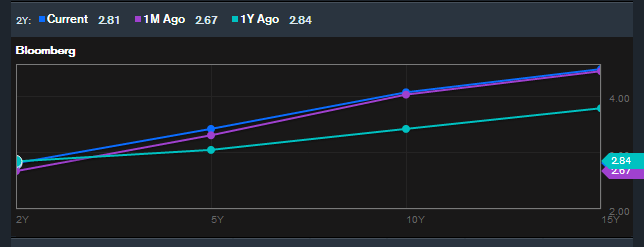

We can see from the chart below that the two-year bond yield has increased from 2.67 per cent a month ago to 2.81 per cent at the time of writing. This is still below what the market was pricing in a year ago (2.84 per cent) but it is on the way up. The five-year yield however is 0.37 per cent higher than it was a year ago and 0.12 per cent higher than a month ago and the further out you go the bigger the jump.

Australian Bond Yields SOURCE: Bloomberg

It is expected the longer end of the curve would move further in this instance as rates have more room to move higher over the longer period and the RBA’s overnight cash rate rate is still of course at a historically low level of 2.5 per cent.

To my way of thinking the market has not yet even begun to price in the possibility of higher interest rates. The central bank could move rates 100 basis points over the next 12 months and the OCR would still only be at 3.5 per cent which is 0.65 per cent lower than the monthly average since February 2008. A full 100 basis point interest rate rise would only go some way towards normalising rates and not necessarily be that tight. If they deem tight policy is required then they may need to raise rates by 200 basis points to 4.5 per cent and still they would have some room to move.

If they feel there is a need to normalise rates then it may not wait until Q4 before commencing the cycle and the first move could come around June or July.

I am not saying the RBA will be aggressive in the size of rate rises but if the markets get a sense that moves of that magnitude, between 100 and 200 basis points, over the next year or two are on the cards then watch the Aussie take off towards parity.

Of course the markets are very forward looking and often overshoot the mark, so an aggressive move in yields and the Aussie dollar would eventually retrace. So a move towards parity would only be somewhat temporary. I get the sense this retracement could coincide with rising US interest rates which, at that point, would have much more room to move higher than ours.

Jim Vrondas is Chief Currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code OFX.