Will the RBA make the right rate call?

Should the Reserve Bank cut rates in February?

It wouldn't be conventional -- the RBA has not signalled a move in any publication or speech -- but that shouldn't prove a deterrent.

Anyway, unconventional is in vogue for central banks these days -- the Swiss National Bank dropped a bombshell earlier this month, the Bank of Canada surprised market watchers just last week and the Bank of Japan has taken bond purchases to an unprecedented level.

So much for that forward guidance revolution, huh?

Which brings us back to the RBA; it believes strongly in forward guidance and the idea that it should provide a signal to the market before it announces a shift in policy. That's a sound approach for the most part -- at the very least it reduces market volatility and eases uncertainty for businesses and households.

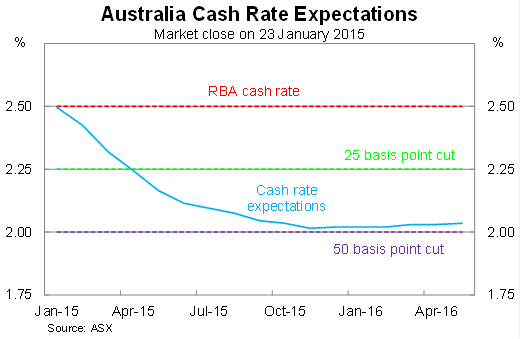

But what's the downside to making a decision now that the market has fully priced in by April? The Australian dollar would take a hit -- an outcome the RBA wants -- and the domestic sharemarket will also receive a boost. It's a win-win situation.

Within the RBA there will be discussions about credibility. Basically they will ask -- will the credibility of the bank be harmed by making a decision that takes the market by surprise? Credibility matters in the world of central banking but I'd argue that the RBA's credibility is tied more strongly with Australia's economic record -- for which it receives disproportionate credit -- than the bank's communications policy.

For example, few will remember how long it took the RBA to realise that the global financial crisis was actually a thing. It increased rates twice in 2008 -- in February and March -- to 7.25 per cent, with hawkish views heard frequently until the moment Lehman Brothers collapsed.

Why don't we remember that episode as clearly as we should? Because courtesy of federal government stimulus and China, we avoided a recession and kept our unprecedented period of growth intact. In the end it was only the recession that mattered, the communication was irrelevant.

Fast forward seven years and the RBA has once again been complacent. The Australian economy is in the middle of the most significant economic transition in decades -- a transition that hasn't gone as planned -- and the RBA has done nothing but give speeches for 17 months.

Back in June I laid out the rationale for cutting rates again (How the RBA got it wrong on rates, June 16). Beyond a few date changes, those arguments remain intact. The dollar might be weaker and oil prices have collapsed but neither should be the impetus for cutting rates in February.

As I noted then, “despite its best efforts, [the RBA] hasn't got the timing perfect and there is growing evidence that the economy has peaked too early and may be poorly placed as mining collapses over the next two years”.

Household spending growth peaked early last year and has moderated on the back of soft wage growth and subpar employment. Entering 2015, the property market has consumed most of the benefits of lower rates, pushing house prices higher, but providing minimal support to household spending or business investment.

Residential construction has been the one bright spot -- with the boom in building approvals proving more persistent than I initially thought -- but unfortunately only accounts for a small share of domestic activity.

Government spending will remain subdued for the foreseeable future with lower commodity prices weighing on the budget balance at both the state and federal level. Budgets in New South Wales and Victoria will also be at risk if house prices begin to moderate, given the importance of stamp duty as a source of revenue.

That leaves exports, but China is also in the midst of their own transition; a transition that has weighed on demand for iron ore and coking coal and seen commodity prices fall more rapidly than most analysts predicted. Our mining sector has clearly over-invested and low prices will result in a bloodbath for a number of junior miners in the year ahead.

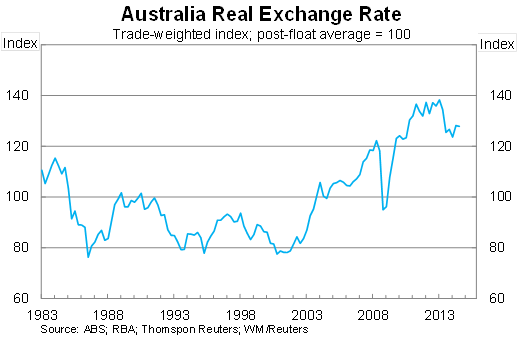

The best chance that the RBA has for navigating the next couple of years is to lower rates further -- at least another 50 basis points -- and get the dollar into the 70-75 cent range as quickly as possible. The real exchange rate -- which adjusts for differences in inflation across countries and therefore approximates international competitiveness – remains elevated and was around 27 per cent above its post-float average in the September quarter. It would have lowered since then but still has a long way to go.

Make no mistake there are also risks associated with lowering rates. Will it cause house prices to overheat? A move by the RBA puts further pressure on the Australian Prudential Regulation Authority to enforce its new macroprudential policies (Property investors should heed APRA's warning, December 10) and the federal government to introduce a raft of reforms from the Murray inquiry (Murray's glaring omission, December 8).

In an ideal situation, lower rates would coincide with measures to direct a greater share of lending activity towards the business sector and away from unproductive investment in Australia's existing housing stock. In the absence of such measures, some of the benefits of lower interest rates will be wasted.

The housing market will only complicate the RBA decision when it meets in February. It has put its credibility on the line by remaining steadfast to the idea that “the most prudent course was likely to be a period of stability in interest rates” long after it has become clear that this is no longer the case.

The RBA will be worried about its credibility should it lower rates without first signalling its intentions to the market. But its credibility will take a greater hit should it be cautious in the face of mounting evidence that it simply has not done enough.

This is the toughest challenge that the RBA has faced in the interest-rate targeting era. The fundamentals say that it should definitely cut -- as it has for the past six-to-12 months -- and I suspect that it might do so. But don't be surprised if the central bank takes a more cautious approach in February and sets up a cut for March.