Will the Aussie dollar drop over the capex cliff?

Since the Australian dollar rallied to reach US90 cents two weeks ago, volatility in the Aussie has been relatively subdued. While this may have provided some relief for businesses, this week’s capital expenditure (capex) survey could kick off another move lower in the Aussie dollar.

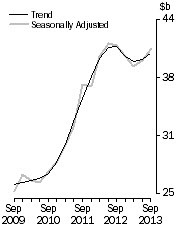

The fourth-capex survey, to be released on Thursday, measures actual investment decisions for the quarter and also provides some forward looking information on private business 2014-2015 investment plans. After starting 2013 on a negative note (-4.7 per cent) in Q1, subsequent quarters - Q2 ( 4 per cent) and Q3 ( 3.6 per cent) - saw a recovery in capex, defying expectations of a decline.

This week’s result is expected to see the year finish as it started, on the negative side with a decline of 1 per cent.

Should mining-related business expenditure show a greater-than-expected decline, then I suspect we could see the Aussie dollar trading around the 87 US cent mark by the time the Reserve Bank meets next Tuesday.

New Capital Expenditure (volume)

SOURCE: www.abs.gov.au

The main risk to this view comes from offshore, with US Durable Goods (Thursday) and Preliminary GDP (Friday) both looking like disappointments. The latter would hold more significance, and should US economic growth be downgraded from an annualised rate of 3.2 per cent to 2.5 per cent or lower, the Greenback will come under some selling pressure and provide some support for the Aussie dollar.

The market will also place some emphasis on business appetite for increasing investment over the next year or two, especially from the non-mining sector which is being relied on to pick up much of the slack from a decline in mining. On this note, the survey will give the Reserve Bank an important update on the performance of both the mining and non-mining sectors of the economy, with many expecting confirmation that the long anticipated mining “capex cliff” has arrived.

Whilst I expect to see some short-term weakness and downside risks persisting, I still hold on to the view that a move in the Aussie dollar to 85 cents or lower is more likely in the second half of 2014.

Jim Vrondas is Chief Currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".