Will property slow in 2015?

Summary: Fears over the property market have intensified following two recent developments: the recently tabled Murray Inquiry and the APRA's release shortly after. The common view is that these reports will weigh on property prices in 2015, especially in NSW and Victoria, where investor loans are a higher proportion of total lending, but this is misplaced. The triggers for APRA to think about further action are a long way away and no case could be mounted that the banks lack sufficient capital. |

Key take-out: Despite all the headlines and sabre rattling from regulators, prospects for the Australian property market remain excellent and 2015 will be another good year. I suspect the worst-case scenario of house price growth will be at the 8-9% mark. |

Key beneficiaries: General investors. Category: Property investment |

As we end 2014, fears over the property market have intensified. It's not surprising I guess – policy makers are greatly concerned over its strength, seemingly surprised by the market's vigour following the fall in interest rates to their lowest point in a generation.

And If policy makers want to slow the property market down, then investors need to take note!

Two developments are important in that regard: The recently tabled Murray Inquiry and the Australian Prudential Regulation Authority's (APRA) updated guidance to banks, released shortly after. The common view is that both of these will weigh on property prices in 2015, especially in NSW and Victoria, where investor loans are a higher proportion of total lending.

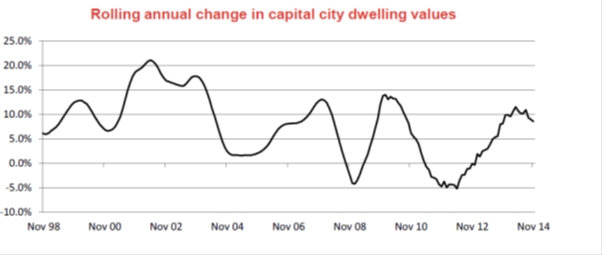

If recent house price data is anything to go by, there may be some truth to that expectation. According to CoreLogic, prices fell 0.3% in November to be 8.5% higher annually. That's still a decent rate of growth – and total returns are closer to 13%. Yet it is down from rates above 10% that we saw earlier in the year and it would appear that the peak has past.

Chart 1: House price growth past a peak?

The first thing to note though is that APRA has not actually taken any steps against property investing or investors. If and when they do it's clear that they are not keen on using macro-prudential controls.

“At this point in time, APRA does not propose to introduce across-the-board increases in capital requirements, or caps on particular types of loans, to address current risks in the housing sector,” the regulatory body said.

APRA instead noted several areas that it will be paying closer attention to:

- higher risk mortgage lending – for example, high loan-to-income loans (LIR), high loan-to-valuation (LVR) loans, interest-only loans to owner occupiers, and loans with very long terms;

- strong growth in lending to property investors – portfolio growth materially above a threshold of 10% will be an important risk indicator for APRA in thinking about the need for further action;

- Loan affordability tests for new borrowers — this should incorporate an interest rate buffer of at least 2% above the loan product rate, and a floor lending rate of at least 7 %, when assessing borrowers' ability to service their loans. Good practice would be to maintain a buffer and floor rate comfortably above these levels.

At the outset it has to be noted that none of these are a trigger for some regulatory assault against property investing. All APRA have said is that these are the three areas that they are paying closer attention to. Importantly, any problems found are only to be an “indicator in thinking about the need for further action.” Not a hard and fast rule for further action.

In any case, even APRA's own data shows we are a long way from any trigger for ‘further thought'. Higher risk mortgage lending is still only a very small subsample of the total. Low doc loans, for instance, are less than 3% of the total, and while interest only loans may be 35% of total of loans – and 42% of new loans being issued – regulators only appear to be concerned with interest only loans to owner occupiers.

Though investors have a strong tax incentive for taking out interest only loans, APRA have not expressed concern on that front. The good news here is that interest only loans to owner occupiers look very stable – up slightly perhaps – but still only about a quarter of total loans, which is little changed from 2008 (pre GFC).

Lastly, high LVR loans have been falling, not rising, and the proportion of loans with both high LVRs and high LIR's are low according to RBA research. From a risk perspective there is no issue here.

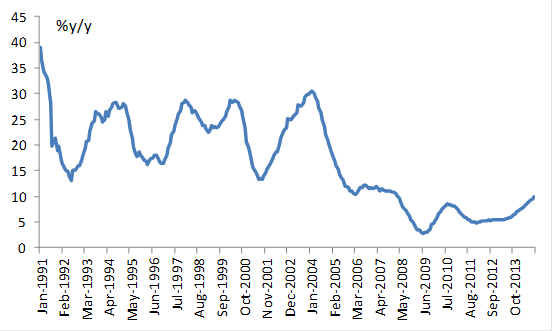

The issue of investor lending appears more contentious. Hysteria is rife at the moment and papers widely proclaim that 42% of all new loans in NSW are driven by investors! That said, APRA have made it clear that it doesn't matter whether 42% of loans are driven by investors in one subset of the market. What matters is the overall exposure in total that a bank has to investment lending – and the growth in that exposure.

At this point, system lending growth to investors remains just below the threshold, with annual growth of 9.9%.

Chart 2: System investor growth is low

There are two issues here. What is APRA's definition of ‘materially above 10%?' and what would they do about it if an institution saw investor lending rise by more than that? Remember they haven't flagged 10% as some magical threshold beyond which they would heap on macro-prudential controls or demand that a bank hold more capital.

It's hard to see regulators taking action against a bank if it could show investor lending was to high-quality borrowers, capable of servicing their debt – as it is now.

Nor do I think they'd want to. None of their rhetoric suggests they are at war with investors, just that they want to protect the financial system from risky lending. Because lending is rising at a strong rate doesn't mean it's risky. This of course is why APRA has only flagged these thresholds as signals for further enquiry and nothing more.

In regards to the Murray Inquiry, the most important thing to note is that no case could be mounted, nor evidence provided, that banks lack sufficient capital. Moreover, momentum to remove negative gearing is not strong.

Consequently, I would be extremely surprised if investors see anything come out of the inquiry which would weigh on the property market.

As a general observation, don't forget that confidence is still very low in this country. That is, we're not seeing any irrational exuberance in the property market or really anywhere at the moment and of course cash deposits still remain very high. Those two factors alone point to some solid upside for the property market in 2015.

I suspect the worst case scenario may be that house price growth will remain around the 8-9% annual mark. If that is the case, this wouldn't indicate a sluggish market or anything – just that the duration of this upswing will be longer.

This would be instead of having 20% growth for a few years or what have you, which would then moderate sharply as the RBA finally got around to hiking rates. Rather what we might see is growth of 8-12% for an extended period of six to 10 years.

Despite all the headlines and sabre rattling from regulators, prospects for the property market remain excellent and 2015 will most likely be another very good year.