Will our next boom industries buoy the unions?

Things look pretty bleak for Australia’s trade union movement.

It’s about to receive a public lashing from the government’s royal commission into union corruption. The movement’s key powerbroker and spokesman, Australian Workers Union National Secretary Paul Howes, just resigned. And to top it all off, the movement is staving off criticism it’s losing its relevance due to a dwindling number members.

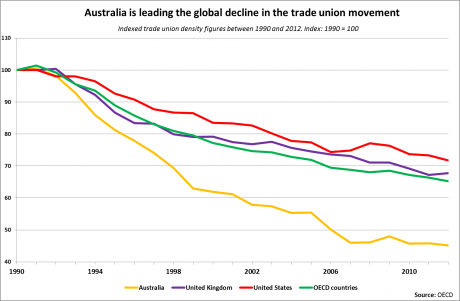

This last point is crucial. While union membership decline is a global trend, Australia’s outfits are shedding members faster than in both the US and the UK.

But there is some good news for the movement buried in the data. And oddly enough, it ties in with another seemingly unrelated news event from today.

On the same day Howes drew focus to the movement by announcing his resignation, analyst firm Deloitte Access Economics announced its findings on the key growth sectors that will fuel Australia's economic future.

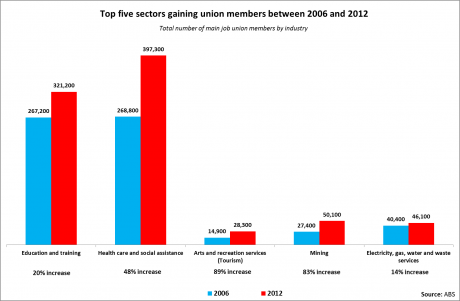

After mining, Deloitte's “fantastic five” growth sectors include gas, agribusiness, tourism, international education and wealth management. It also identified health as one of Australia’s fastest growing sectors for the next decade, due to our aging population.

While it’s not an exact fit, there is a bit of a trend emerging here in what the ABS reveals are growth sectors in the union movement and what Deloitte says are the key future growth areas in the Australian economy.

It’s likely unionisation in Australia will never return to the heyday of past decades. But the data suggests it’s too soon to write it all off just yet, especially in some of our fastest growth pockets.