Will fortune favour Europe's bold investors?

Influential investors have Europe in their sights.

Hedge fund manager John Paulson, who profited billions from the subprime mortgage crisis that gripped America, is looking at Greek banks. Taking a broader approach is Asia’s richest man, Li Ka-Shing, who is selling Chinese assets to fund European investments.

If you follow the thesis US and Australian equities offer minimal upside from here, the challenge facing investors is where to put their money. It really only leaves the eurozone and emerging markets, both with extremely different underlying economic conditions to negotiate. At this stage, the eurozone is the frontrunner as emerging markets look too susceptible to downside risk when the Federal Reserve actually begins tapering.

Europe is marching out of a recession and the change in attitudes towards the monetary union is largely focused on the falling credit risk. The yield on 10-year Spanish debt has fallen to 4.3 per cent after nearly touching 6 per cent at the end of last year. Similarly, the yield on Greece’s 10-year debt has halved to 9.3 per cent from highs reached only in the past year.

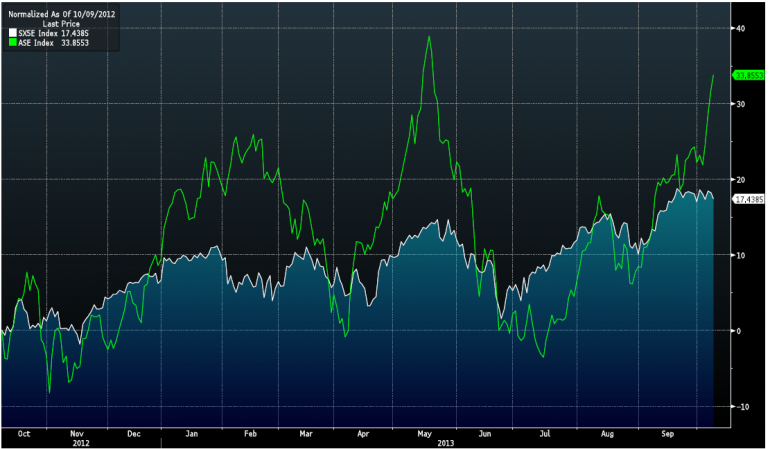

The past year has seen the Greek index, the Athens Stock Exchange (green line) gain a staggering 33.8 per cent. In comparison, the Euro Stoxx 50 Index (white line), covering 50 blue-chip stocks from 12 eurozone countries, has only gained 14.4 per cent.

We can establish from the flow of positive data from eurozone that the core is in the early stages of expansion, albeit very fragile. For the periphery, fundamentals have surged in the past 12 months, suggesting they could be further along, perhaps even looking at contracting in the near future.

Based on where Europe is in the business cycle and overlaying global economic trends, consumer discretionary and financials are the sectors to pursue.

Investors beyond Paulson are enthusiastic when it comes to the eurozone banks. Italian bank Monte dei Paschi is up 11.9 per cent in the past week, even after acknowledging it will need to raise an amount close to its current market capitalisation of €2.73 billion. Dilutive capital raisings don’t seem to be enough to deter investors.

While there is plenty of interest in the financials, the eurozone still has problems. August Germany factory orders unexpectedly fell, confirming the fragility of the economic recovery. However this could be a reflection of broader global conditions as the future of Europe and Germany is very much leveraged to what happens in other markets.

The outlook for the eurozone has dramatically improved over the past year as credit risk has subsided, but problems still exist. Demand is still finding its way and unemployment is uncomfortably high. It is expected the European Central Bank will continue to keep monetary conditions accommodative as long as inflation poses no threat, which will help the monetary union continue in its growth struggle.