Wider yuan band is no quick fix for the Aussie

Over the weekend the People's Bank of China announced a widening of the allowable daily trading range for the Yuan from 1 per cent to 2 per cent.

This is the third time it has widened the USD/CNY band, with the last move back in April 2012 where it also doubled the band, from 0.5 per cent to 1 per cent. There are some stark similarities with the last move in 2012, when economic growth had also been weakening and the central bank had started to move the USD/CNY higher prior to the announcement.

The move has been flagged by many, including Chinese officials of course, as an important step towards currency liberalisation. Don’t get me wrong, it is great to see some steps in what is the right direction but the real problem has not been fixed.

The daily central bank reference rate, often referred to as the daily fixing rate or the fix, is still set by the central bank each day. So it can still control the level of the exchange rate, but now it will let it move twice as much away from this rate throughout the day. So if it reaches one end of the band today they set the fixing rate tomorrow at another rate. Given this didn’t happen when the band was 1 per cent, I am not sure what a 2 per cent band will achieve other than allowing for more intraday volatility.

Now let us assume that this is a genuine step towards a free-floating exchange rate and this scenario eventually plays out as many say in the next 3-5 years. What does this mean for the Aussie dollar?

Well for a start many of those global fund managers that currently take positions in the Australian dollar as a proxy to China would go direct, selling out of AUD positions and buying CNY. This would see our currency trade lower and also eventually reduce liquidity in what is currently the fifth most actively traded currency in the world.

On the flipside, a free floating CNY has long been considered to see a higher exchange rate but that was more the case several years ago when demand for Chinese exports was increasing. With the global economy growing at a slow rate nowadays it could actually be the Chinese selling their currency to invest offshore at a faster rate that pushes the Yuan lower -- not export demand taking it higher. This has already been playing out in recent years with Chinese investment into Australian property increasing dramatically, adding support to the Aussie dollar.

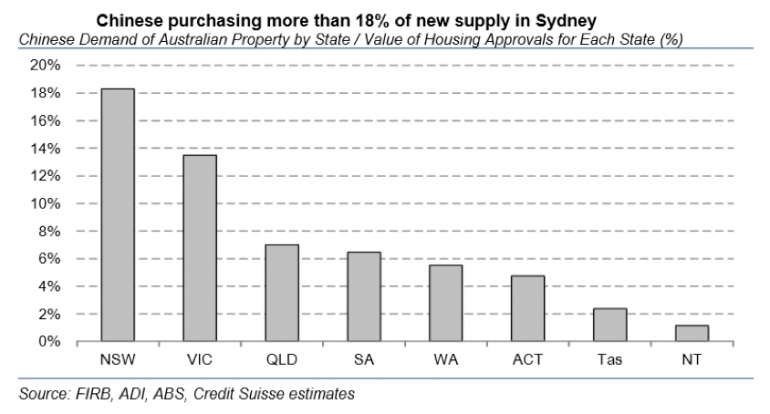

According to a recent report by Credit Suisse, Chinese buyers make up an estimated $5 billion in Australian property purchases annually with more than 18 per cent of new housing stock in Sydney alone being purchased from China.

So while there is much fanfare at the moment around Chinese currency reform I suspect the euphoria will die down soon and it will be business as usual -- that is of course until the PBoC fixes the real issue and removes the peg of the daily reference rate.

Given the effect this could have on Australian property prices perhaps we should be careful what we wish for though.

Jim Vrondas is chief currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".