Why the golden days of property investment are over

Summary: As we head towards election 2016, property investors face a number of uncertainties: the potential impacts of changes in negative gearing rules and CGT discounts, current low rental yields and softer markets outside of Sydney and Melbourne's periods of unprecedented growth. |

Key take-out: Investors should keep in mind that property prices can not only fall in our major cities, but remain below their averages for a significant period of time – and there are a number of signs the golden age of property coming to an end. |

Key beneficiaries: General investors. Category: Property. |

Australian investors have long been conditioned to believe that housing is always a sound investment. Yet the savvy investor would be wise to look upon the Australian housing market with a degree of scepticism.

Investors outside of Sydney and Melbourne will already understand this. Property hasn't been a great investment outside of our two biggest cities for the best part of five-to-ten years.

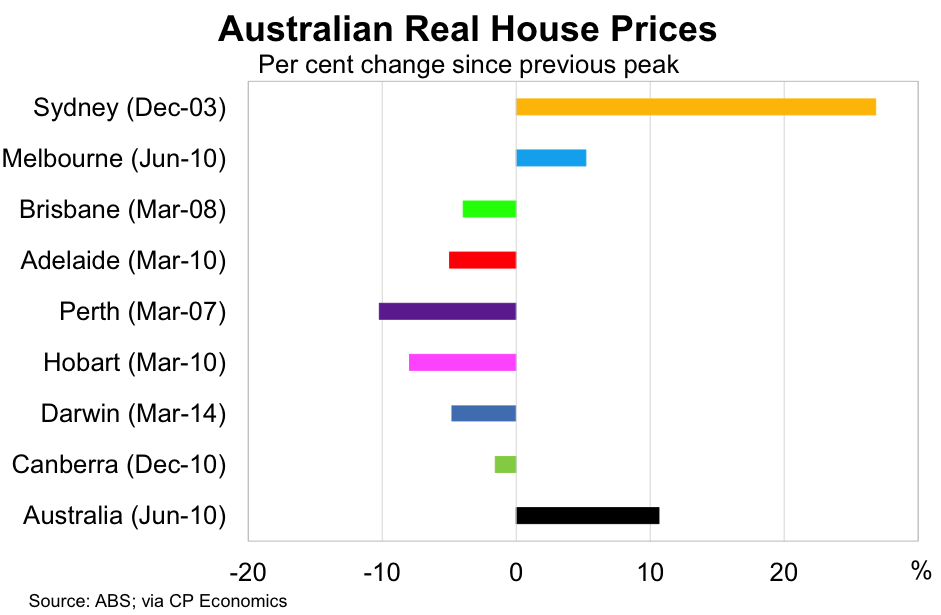

Consider the following: real house prices in Perth are currently around 10 per cent below their peak in the March quarter 2007; real house prices in Brisbane are lower today than they were eight years ago; real house prices in most other capital cities are lower than they were back in 2010.

The situation sits in stark contrast to the experience in Sydney and Melbourne where prices have boomed over the past few years. Low interest rates and seemingly insatiable investor demand has pushed prices into the stratosphere.

The outlook for property investors is increasingly uncertain. Low interest rates continue to support valuations but regulatory intervention has acted to curb investor demand. Real GDP might be growing at an above trend pace, usually a good sign for asset prices, yet national income continues to undermine domestic demand.

Against this backdrop we have an election where housing is front and centre. We have never had an election that is more important for property investors. In the firing line is negative gearing and the capital gains tax discount. Two policies that, in combination, have underpinned Australia's $5.9 trillion dollar property sector.

Proponents of negative gearing and the capital gains tax discount argue that reforming the housing market will result in lower prices, higher rents and reduced investment. Federal Treasurer Scott Morrison believes that these reforms will hurt "mum and dad" investors. Others, such as Immigration Minister Peter Dutton, believe that Labor's proposed reforms will "cripple the economy".

The good news for existing property investors is that you will be protected somewhat from these reforms if the Labor Party wins.

Labor has announced if its wins the election it will:

(A) Restrict negative gearing to new houses and only allow negative gearing tax deductions to be set against other investment income

(B) It will cut the discount on capital gains tax – current 50 per cent for properties held for more than a year – to a new discount of just 25 per cent

By grandfathering these reforms, they have wisely protected those investors who made their investment decisions in good faith.

The one thing we can say with some certainty though is that rental yields must rise for new property investors. The bad news for prospective investors is that most of this adjustment will occur via relative lower prices rather than higher rents.

According to the Grattan Institute, removing negative gearing could reduce house price growth by around two per cent. This seems awfully optimistic to me given the implementation of the capital gain tax discount back in 1999 led to significant upshift in property prices that would at least partially unwind in the event of its reduction.

There remains little evidence that rents will rise under the ALP's reforms despite speculation from the property lobby. These policies will effectively reduce both the demand for and supply of rental property. The former puts downward pressure on rents; the latter places upward pressure. The end result is uncertain and depends entirely on how sensitive rents are to shifts in demand and supply.

It is also worth remembering that we are currently experiencing the weakest rental growth in at least two decades. Income growth remains so soft across the board that it appears almost impossible for rents to rise at anything but a modest pace. Rents aren't determined in a vacuum and are ultimately anchored to the capacity of renters to pay.

So if rental yields are to rise, as they must for new property investors, most of the heavy lifting will occur via either lower house prices or weaker house price growth. Since the market may take a couple of years to adjust, there will be a period where property is an undesirable investment given the prospect of capital losses and negligible rental growth. Eventually rental yields will rise to a level that makes property investment desirable again.

Even in the event that the ALP lose this election, it appears as though the golden period for property investment is over. New housing supply remains elevated and the Australian Prudential Regulation Authority (APRA) is maintaining a close watch on anything might look like excessive investment.

The sheer magnitude of Sydney and Melbourne price growth over the past few years should also act as a warning to investors who fear they need to enter the market before it is too late. Investors would be well advised to take note of the graph above; house prices can not only fall but can also remain below their peak for years on end.