Why the Fed isn't worried about inflation

A downgrade to growth in 2014 will have no effect on the Fed’s tapering or when rates rise, but Federal Reserve chair Janet Yellen remains sceptical regarding the recent inflationary surge. In short: very little has changed for the Fed.

At its June meeting, the Fed decided to cut its asset purchasing program by a further $US10 billion. The Fed will now add to its holdings of mortgage-backed securities by $US15bn per month (from $US20bn) and also purchase $US20bn of longer-term Treasury securities (from US$25bn).

The Fed downgraded its outlook for economic growth to between 2.1 to 2.3 per cent in 2014 -- largely resulting from particularly poor weather during the March quarter -- from forecasts of between 2.8 to 3.0 per cent when they met in March. The Fed left its forecasts for 2015 and 2016 unchanged.

Its forecasts for growth in 2015 and 2016 are a little difficult to square away with its improved outlook for the labour market. The unemployment rate has declined more quickly than expected in recent months, prompting an upgrade to the Fed’s unemployment rate forecast. Nevertheless, it does not believe that this will have an effect on growth or inflation.

In part, this may simply reflect the changing composition of participants contributing to these forecasts. This meeting was the first for vice-chairman Stanley Fischer and Governor Lael Brainard.

The Fed noted that activity had rebounded in recent months with data showing that the economy has lost none of its underlying strength. Labour market indicators continue to improve although the Fed noted that the unemployment rate remains elevated. Both household spending and business investment is set to make solid contributions to growth in the quarters ahead.

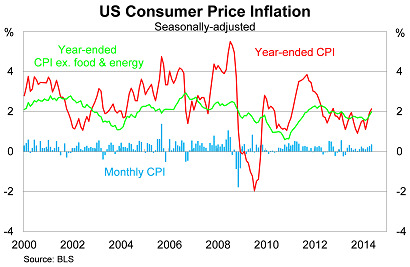

Measures of inflation picked up in May, though Yellen noted in her press conference that it might just be “noise”. Consumer prices rose by 0.4 per cent in May, to be 2.1 per cent higher over the year. Core inflation (which excludes volatile items such as food and energy) rose by 0.3 per cent in the month, to be 2.0 per cent higher over the year.

However, attributing the recent surge to “noise” is a bit of a stretch. The reason central banks use core measures of inflation is to reduce that “noise” and most of these core measures indicate that inflation is pushing to around the Fed’s upper target of 2 per cent annual growth.

In addition to the core CPI mentioned above, the Cleveland Fed produces two separate measures of core inflation. Median inflation rose by 2.3 per cent over the year to May, while its trimmed-mean measure rose by 1.9 per cent.

The remaining measure of inflation and the Fed’s preferred measure (the core personal consumption expenditure deflator) remains well below the Fed’s target and has climbed by just 1.4 per cent over the year.

This provides a sound justification for leaving rates unchanged but I would be reluctant to characterise the recent moves as “noise”. Certainly I can understand where Yellen is coming from, since there is clearly greater slack in the labour market than indicated by the unemployment rate. But the core PCE deflator definitely feels like the outlier here, and I expect that it will converge on the other measures of inflation in the in the year ahead.

The Fed’s outlook for rates remained relatively unchanged since March. By the end of 2016, the median interest rate is forecast to be 2.5 per cent (up from 2.25 per cent in March), although the longer-term projections are a touch weaker. It’s important to note that participants locked in their forecasts prior to yesterday’s inflation result.

It was steady as she goes for the Fed in June but with a few dovish undertones. Yellen was keen to discount the recent inflationary surge but with a stronger outlook for employment, we cannot ignore the possibility that inflation may push a little higher in the coming months.

But the likelihood of a genuine breakout for inflation remains low and consequently there is little need for the Fed to pull the trigger until the labour market improves further and wage growth follows suit.