Why mining shouldn't shoulder all the blame for construction's woes

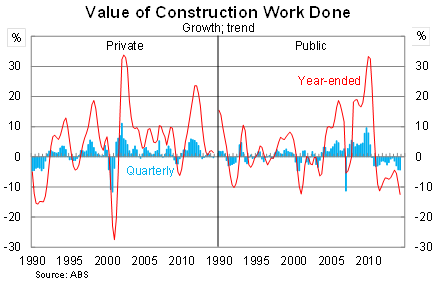

Mining investment is beginning to collapse but we shouldn’t blame the sector entirely for the recent decline in construction activity. Public sector spending continues to weigh on construction and will subtract from growth during the June quarter. By comparison, private residential and non-residential construction will support growth -- albeit to a lesser degree than earlier this year.

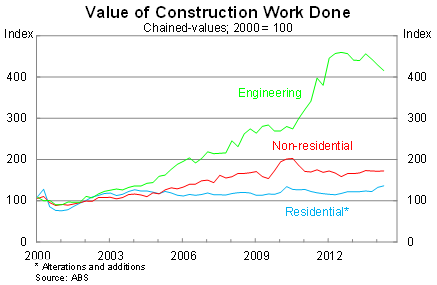

Construction work done fell by 1.2 per cent in the June quarter, missing market expectations, to be 0.6 per cent lower over the year. Building construction continues to surge -- on the back of strong residential activity -- but that was more than offset by a sharp decline in engineering construction.

Residential construction -- a subset of building construction -- rose by 2.9 per cent in the June quarter, to be 11.6 per cent higher over the year. Nevertheless, residential construction continues to be a relatively minor player in the construction sector, with activity accounting for just 22 per cent of total construction during the June quarter.

By comparison, non-residential investment remains somewhat subdued and has climbed just 2.9 per cent over the past year, to be almost 15 per cent below its peak in September 2010. Much of that weakness is in the public sector, with private non-residential construction reasonably strong.

Certainly the pick-up in residential construction continues to be a bright spot for the Australian economy, as developers respond to high property prices and low interest rates. This is one of the transmission mechanisms through which the Reserve Bank of Australia is hoping to rebalance our economy. But we should remember that residential construction remains incredibly small -- at least compared with mining investment -- and will only be a minor factor in a transition that requires greater household activity and exports.

What is particularly interesting this quarter is that mining investment isn’t even the biggest cause of the decline in total construction. That honour goes to public sector construction, which accounted for half the decline in engineering construction and also subtracted from building construction.

Given the federal government and Senate remain at loggerheads, it is awfully difficult to guess what might happen with public sector construction activity. Certainly the Coalition hopes to be the ‘infrastructure government’, which taken at face-value creates some upside risk that activity will pick-up over the next couple of years. A lot will depend on how popular the Coalition’s asset recycling program turns out to be.

Naturally the broader outlook for the construction sector remains weak, with engineering construction set to fall sharply as mining investment collapses. This will be offset to some extent by residential investment, which will continue to grow strongly over the next couple of years. On balance, total construction should fall significantly from its current level and weigh on real GDP growth over the next few years.

Based on the long-run relationship between residential and non-residential construction data and their equivalent in the national accounts, these sectors should support growth during the June quarter. My models suggest that both private residential and non-residential building investment in the national accounts will rise by about 3 per cent. This is somewhat weaker than during the March quarter.

Obviously the contribution of construction to public spending will be much weaker, while we will have a better feel for mining investment when the ABS releases new data on capital expenditure tomorrow. The capital expenditure survey will also provide further insight into the pace and size of the mining investment collapse.

On a whole it’s a mixed report but not one full of surprises. Low interest rates are having their desired effect on residential and non-residential construction but the public sector has yet to join the party. The main story though remains mining investment and equipment construction is set to fall sharply over the next few years and swamp the recovery in building construction.