Why it pays to choose the losers

When choosing a managed fund, investors should look at a manager’s history, investment strategy, reputation and key personnel — but for most investors sitting at home that’s far too difficult. It’s easier to look at past performance and assume a fund that ranks near the top among peers will carry on as usual. Besides, all they are really interested in is capital growth.

The trouble is, that’s exactly the wrong thing to do.

BLINDED BY TRIUMPH

A recent study of the US mutual funds market has found the strategy of picking past winners is “180 degrees wrong”. Instead, higher returns can be expected if funds are selected for their relative underperformance.

To test the theory that investors would be better off picking last year’s losers, the researchers assumed three groups that followed discrete strategies.

The first group, which followed a “Winner Strategy”, divided its money equally among the top 10% of funds when ranked by most recent three-year benchmark-adjusted returns. Three years later the same process is repeated, with the 10% of funds with the highest three-year returns sharing the entire capital equally.

The second group followed a “Median Strategy”, where money was invested equally among funds that performed in the middle 10% when ranked by three-year performance, with the same allocation process occurring every three years.

The last group — the “Loser Strategy” — turned the world upside down and invested equally among the 10% of funds with the worst returns of the lot, and then repeated the process every three years. Their bet was that these funds would “mean revert”, or recover after a short period of rare underperformance.

Three years was chosen as a typical holding and evaluation period.

WRONG WAY GO BACK

The authors noted that the “Winner Strategy” is pretty much how wealth management platforms in the US assemble their “buy” or “recommended” lists for investor clients. The “Loser Strategy”, they wrote, would “generally be funds that are not on any recommended list and are actively being eliminated from client portfolios by financial advisors”.

The researchers used Morningstar data starting in 1994 and reallocated funds every three years to the end of 2015. Funds that ranked in the top 10% by expense ratio were excluded from the study as expensive funds have been shown to be consistent underperformers, the authors pointed out.

WHERE LOSERS ARE WINNERS

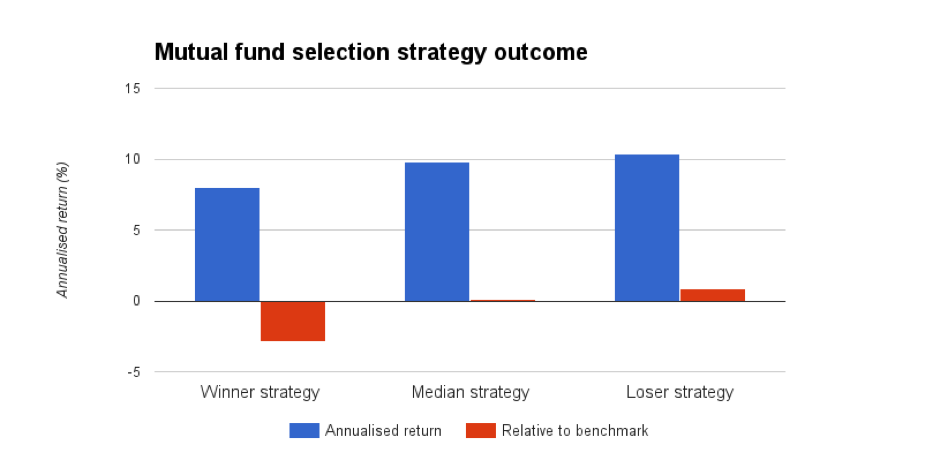

Guess who won? The losers, with an annualised return of 10.40%. In second place was the Median Strategy, with 9.77%, and last of all was the Winner Strategy, with 8.04%.

Measured against appropriate benchmarks, the Winner strategy returned -2.87%, the Median strategy 0.1% and the Loser strategy 0.89%.

“The superior return to investing in ‘Loser’ funds over ‘Winner’ funds is statistically and economically large,” wrote survey authors Bradford Cornell, Jason Hsu and David Nanigian of the California Institute of Technology, Anderson Graduate School of Management and The American College respectively.

“Hiring recent outperforming managers and firing recent underperforming managers turns out to be 180 degrees wrong.”

Their conclusion is that the result provides evidence of “mean reversion”, where outperformance is likely to be followed by underperformance, and vice versa. Instead of concentrating on past performance, they say, investors should look for funds that follow a consistent strategy.

ALTERNATIVE ROUTE

Another solution is to avoid all effort in the investment selection process and leave it up to someone else. The InvestSMART model portfolios are managed by an investment committee who only rebalance when they think a change is warranted. To keep costs down, exchange-traded funds are used for local and international equities holdings.

With evidence showing that large cap Australian equities funds struggle to beat the ASX200 index, a better way to hit a long-term savings target may be to hand over the investment selection process to an independent team of experts.

Frequently Asked Questions about this Article…

Choosing investment funds based on past performance is not advisable because studies have shown that past winners often underperform in the future. Instead, funds that have underperformed may experience 'mean reversion' and offer better returns.

The 'Loser Strategy' involves investing in the 10% of funds with the worst past performance, with the expectation that these funds will recover and provide higher returns due to mean reversion.

The 'Loser Strategy' outperformed other strategies with an annualized return of 10.40%, compared to the 'Median Strategy' at 9.77% and the 'Winner Strategy' at 8.04%.

Mean reversion is the concept that funds which have underperformed in the past are likely to recover and perform better in the future, while those that have outperformed may see a decline.

Avoiding funds based on recent outperformance can be beneficial because hiring recent outperforming managers and firing underperforming ones is often counterproductive, as these trends tend to reverse.

Funds with high expense ratios are often consistent underperformers, so excluding them from investment strategies can help improve overall returns.

Investors can simplify the process by using managed portfolios, like those offered by InvestSMART, where an investment committee handles fund selection and rebalancing, often using cost-effective exchange-traded funds.

An alternative is to use model portfolios managed by experts, which can help achieve long-term savings goals without the need for active fund selection by the investor.