Why electricity is not a rip-off

Henny 'The Sky is Falling' Penny is multiplying and out in full song, claiming the demise of Australian manufacturing is down to the, apparently, exorbitant cost of energy in Australia, inflated by the influx of renewables.

But is that true and exactly where does the cost lie?

Expanding on my article yesterday I thought it appropriate for this week’s charts of the week to take a historical look at the wholesale market price of electricity generation to see whether it might be responsible for driving manufacturing out of the big states of NSW and Victoria.

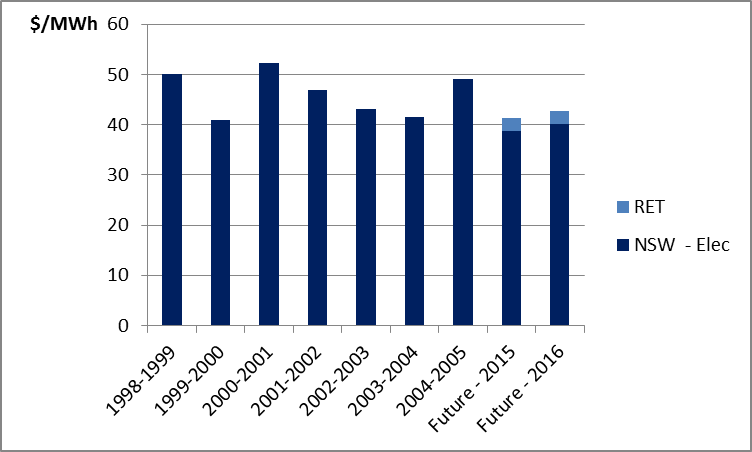

Firstly, let’s take a look at historical NSW wholesale prices, adjusted for inflation to 2013 dollars, compared to current ASX Baseload Futures prices for 2015 and 2016.

As you can see, even taking into account the extra cost of the Renewable Energy Target faced by energy intensive industry, NSW real wholesale energy costs are not higher than what prevailed a decade ago before we started seeing manufacturing's mass exodus.

Figure 1: NSW historical wholesale electricity market prices (in 2013 dollars) relative to 2015 and 2016 base futures

Sources: Historical prices from Australian Energy Market Operator adjusted for inflation using Reserve Bank inflation calculator, futures prices from https://asxenergy.com.au/; RET cost is based on SKM-MMA modelling adjusting for 90 per cent exemption for energy intensive, trade-exposed industry for costs beyond 9500GWh.

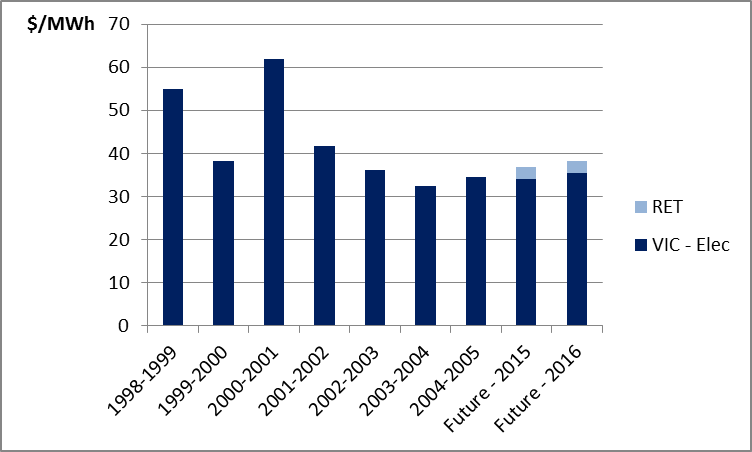

And below is the chart for Victoria, again illustrating that wholesale energy costs incorporating the RET are not noticeably higher.

Victorian historical wholesale electricity market prices (in 2013 dollars) relative to 2015 and 2016 base futures

Sources: Historical prices from Australian Energy Market Operator, futures prices from https://asxenergy.com.au; RET cost is based on SKM-MMA modelling adjusting for 90 per cent exemption for energy intensive, trade-exposed industry for costs beyond 9500GWh.

Now of course this leaves out the other big part of the electricity cost equation which is the cost of the poles and wires. This has gone up considerably and is worthy of scrutiny.

But what is clear is the cost of actually generating the electricity, including that from renewable sources, is not spiralling out of control and therefore driving problems for energy-intensive manufacturing in our two biggest states.

The one place where wholesale electricity prices have been abnormally high relative to historical levels (stripping out the effect of the carbon price) over the past two years has been Queensland.

Indeed, average daily prices have exceeded $100 per megawatt-hour for four of the past eight days (and $96 on a fifth day). This is highly unusual given that demand has generally been well below available generating capacity. But this is a function of problems with effective competition and big generators exploiting an internal transmission constraint, not any effect from renewable energy policies.