Why credit ratings agencies don't make the grade

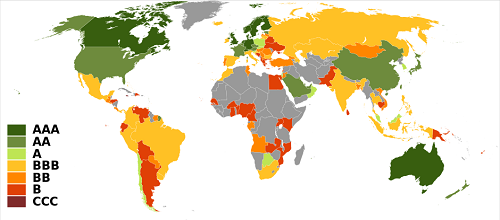

Foreign investors learn about the Australian economy from a variety of sources, but the credit rating agencies have a special place, as many investment managers are committed to following the rating agencies' assessments. Credit agency ratings are also used in prudential supervision. This gives special importance to Standard and Poors' latest pronouncements, reaffirming Australia's AAA rating.

The S&P press release begins by noting "the country's strong public policy settings, economic resilience, and significant fiscal and monetary policy flexibility" as well as its 'strong ability to absorb large economic and financial shocks, as was demonstrated during the global recession in 2009.'

So far, so good. Then come the caveats:

Australia's high external imbalances, dependence on commodity exports, and high household debt moderate these strengths...In our opinion, while Australia benefits from many fundamental strengths, its key credit weakness is the economy's high level of external liabilities. The banking system in particular has a high degree of external indebtedness and remains highly reliant on the ongoing backing of foreign investors...Meanwhile, Australia continues to run significant current account deficits...

Pressing the panic button? Not really. This is just having 'two bob each way', as S&P goes on to say:

In our opinion, however, the risks associated with Australia's high private-sector external debt are manageable because of the strength of the country's financial system, the high degree of foreign currency debt hedging, and an actively traded currency that historically has allowed external imbalances to adjust. Additionally, Australia's highly credible monetary policy framework remains able to help counter the impact of any economic shocks.

So we're OK after all? Not so fast.

Just in case you’re getting lulled into complacency, S&P concludes with some warnings and a line-in-the-sand threat:

We could lower the ratings if external imbalances were to grow significantly more than we currently expect, either because the terms of trade deteriorates quickly and markedly, or the banking sector's cost of external funding increases sharply. Such an external shock could lead to a protracted deterioration in the fiscal balance and the public debt burden. It could also lead us to reassess Australia's contingent fiscal risks from its financial sector. We could also lower the ratings if significantly weaker than expected budget performance leads to net general government debt rising above 30 per cent of GDP.

What would a country have to do to get a clean bill of health? Australia's banks are no longer obtaining new funding flows from overseas, and their outstanding balances are smaller than in 2008 (see graph below). Sure, the AAA government guarantee helped them to come through the crisis smoothly but the same thing could be provided again, if needed. The financial system was given the ultimate stress test in 2008 and came though well, unlike many countries. As for the warning on external imbalances, since 2008 the current account deficit is significantly smaller, as is the external income deficit.

Source: Reserve Bank of Australia.

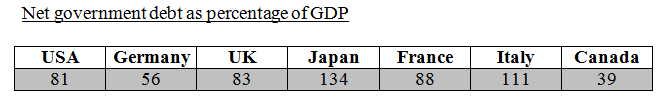

What about the 'line in the sand' on net government debt?

With the current level at just over 20 per cent of GDP, it would indeed be a major slippage if we were to find ourselves over 30 per cent, so for S&P to finish its press release with this hypothetical outlier is drawing a long bow. It's drama-queen stuff, but it has been picked up by the press, always happy to spotlight an impending disaster, no matter how unlikely.

Let's also put the current level (and even the 30 per cent line in the sand) in perspective. Here are the equivalent IMF figures for the G7 countries:

Source: IMF Global Stability Report, Table 1.1.1.1.

Remarkably, some of the key actors responsible for the 2008 financial debacle have managed to restore their reputations, and no rehabilitation is more remarkable than that of the Teflon-coated credit rating agencies. Leading up to 2008, they handed out AAA ratings to worthless mortgage securitisations (but of course these were a different sort of AAA rating: the debt issuers simply paid for it).

Nor were the country ratings much better: S&P's 'investment-grade' endorsements of bankrupt Greece survived well into 2010. The role of the credit rating agencies was under critical review well before the 2008 crisis but no satisfactory answer has yet been found for their undue influence and they are still accorded a role in the Basel prudential supervision arrangements.

Could it be that S&P is peeved because it recently lost its reputation-damning court case in Australia? It's little wonder that analysis of the sort produced by S&P for Australia evokes a derisive response. Can't they do better?

This piece was originally published at the Lowy Interpreter. Reproduced with permission.