Why bank returns will get slimmer

|

Summary: The domination of Australia's major banks means they have consistently delivered greater returns by global comparison. However, our big four banks are now trading at declining premiums, and structural changes means Australia's banking sector may begin to look a lot more like that of its foreign peers. |

|

Key take-out: Australia's banking system could start to look a lot more like that of its foreign peers: much lower ROE for investors and higher mortgage rates for both owner-occupiers and property investors. |

|

Key beneficiaries: General investors. Category: Investment Strategy. |

Returns on equity (ROE) for Australia's major banks has declined in recent years, following capital raising across each of the majors, with the banks now trading at a declining premium against their book value.

The good news for domestic investors is the premium is still sizeable, particularly by international standards. But the premium is well below what was considered normal before the onset of the global financial crisis. The bad news is the return on investment (ROI) in the banking sector is likely to moderate further in the next few years.

The price-to-book (PB) ratio basically compares the market value of the bank against the book value of its capital. It is commonly used as a measure of a bank's health and so any decline, even from such an elevated level, warrants some discussion.

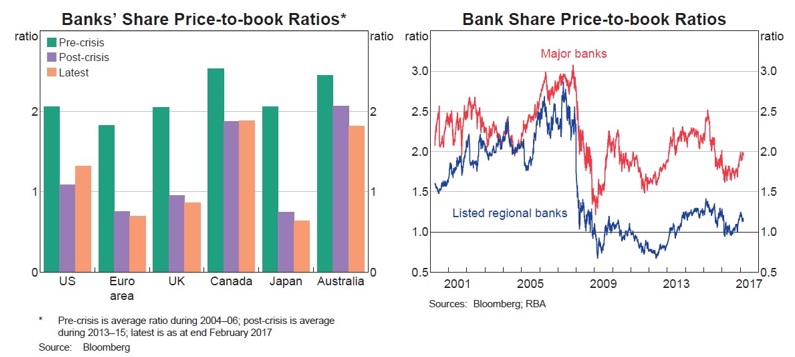

As shown below, banks in the developed world have experienced declining PB ratios post-GFC. No major region has been able to reach pre-GFC levels. The banking sector was overvalued in the lead-up to the GFC and this was reflected in the unsustainable build-up of leverage throughout the global financial system.

It's also worth noting that the major banks' PB ratios trade at much higher premiums than the smaller regional banks. This gap emerged in the aftermath of the GFC and has persisted ever since.

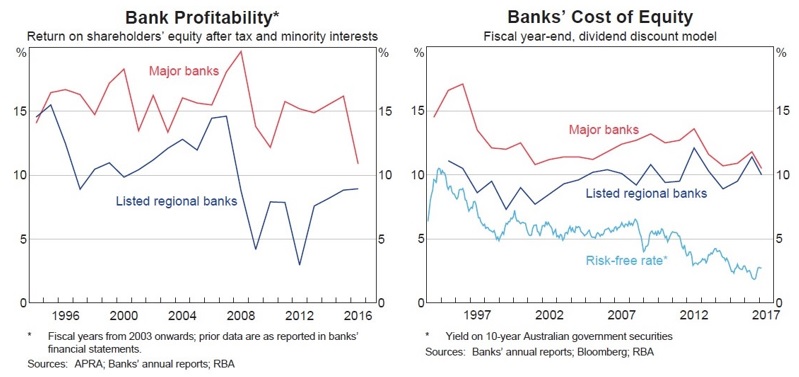

Australian banks have consistently delivered greater ROE than banks in most other countries. According to research by the Reserve Bank of Australia (RBA), the major banks averaged a ROE of 17.5 per cent in the 15 years leading up to the GFC and an average of 15 per cent in the years that followed.

This partly reflects the lack of competition in the Australian banking sector, which is dominated by four banks of similar size that compete in only a nominal fashion, combined with the massive rise in household debt that occurred during this period. More recently, the Sydney and Melbourne property boom, driven by investor lending activity, has supported ROE over the past four years.

Over the past year, however, ROE has fallen quite steeply as the major banks raised additional equity to meet tighter capital standards set by the Australian Prudential Regulation Authority (APRA). Since this increase is viewed as permanent – with capital requirements likely to go higher in the future – it appears unlikely that Australia's major banks will be able to achieve the ROE that many investors have become accustomed to without taking on additional risk.

This will be exacerbated if APRA introduces tighter restrictions on investor lending in the residential mortgage market. This poses a significant risk to the banks' ROE; so too does the inevitable moderation in dwelling prices due to a tighter regulatory environment and rising mortgage rates.

There has also been a narrowing of the spread between ROE and cost of equity (COE). COE can best be understood as the minimum return that investors seek to invest in an asset – in this case shares in one of the major banks. The spread between ROE and COE represents the premium or bonus return that an investor receives above and beyond their requirement to invest.

Despite historically low interest rates, which theoretically should reduce both the expected ROE and the cost of obtaining finance, the COE has remained largely unchanged since the late 1990s. Investors are more sceptical about the banking sector and that is reflected by an equity risk premium that has increased by almost 300 basis points since the GFC.

We are seeing the effects of this in the share prices of Australia's major banks. The price-to-earnings (PE) ratios for banks in the S&P/ASX 200 sit below those of non-banks and the spread has widened significantly over the past three years.

In part, this reflects a weaker outlook for bank earnings, but also ongoing concerns surrounding the European banking sector and the domestic shift towards banks holding greater capital against their mortgage assets.

Important structural changes are currently taking place within Australia's banking sector. We are already beginning to see the effects of tighter regulations. Higher capital requirements and higher funding costs, particularly from abroad, are combining to create a challenging operating environment. The major banks have passed on these higher costs in the form of higher mortgage rates and that is a process that is likely to continue as the banks seek to protect their profitability and ROE.

Some of our banks are also looking to scale back their exposure to lower return assets, such as international banking and wealth management. If left to their own devices, the major banks could double down on the residential property market – but a tighter regulatory environment makes that difficult.

We may be facing an environment in which investors need to revise their expectations of bank performance. For example, it is quite plausible their ROE could fall below the COE over the next few years, leading to a decline in the PB ratio and prompting a rethink about the market valuation of Australia's major banks.

Australia's banking system could start to look a lot more like that of its foreign peers: much lower ROE for investors and higher mortgage rates for both owner-occupiers and property investors.