Why Australia must avoid austerity

I spend far too much time out of Australia. But often when I read Australian economic and political commentary from abroad, I feel that the problem with our journalists is that they don’t go overseas often enough.

This particularly applies to Paul Sheehan, who opened his column in the Sydney Morning Herald last week with this shrill gem:

“When Joe Hockey was growing up and dreaming of becoming prime minister, he would not have imagined that his dream would lead him to joining a bomb disposal unit. Tomorrow, he will unveil the first bomb he must dismantle and it is almost nuclear in its capacity for destruction.”

Some of Sheehan’s rhetoric related to union politics, the carbon tax, the expense of the national broadband network, and so on. But his primary focus was the budget deficit, which he described as “much worse than Labor led us to believe, probably close to $50 billion”, and as “the real horror, dysfunction and narcissism of Kevin Rudd's contribution to Australian political history”.

I’m not going to debate (or defend) Kevin Rudd’s personality, but getting this hysterical over a $50 billion deficit in a $1.5 trillion economy? Oh come on: that is slightly less than 3 per cent of GDP (the precise GDP figure is $1.525 trillion, according to the Australian Bureau of Statistics). Comparable figures for some of our trading partners are 5.5 per cent for the USA, 6 per cent for the UK, and 10 per cent for Japan. Australia’s deficit for 2013 is almost 50 per cent below the expected average for the OECD of 4.8 per cent of GDP.

Of course, finding that out doesn’t require a trip overseas: all you have to do is search the web. But what a trip overseas might alert Sheehan to is the economic performance of the rest of the planet – and especially of those parts of it that, as he does, make the size of the government deficit the only stick by which economic performance is measured.

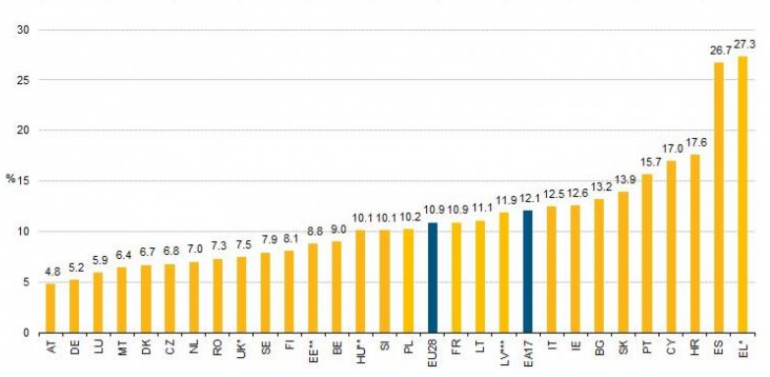

Okay, maybe you can do that without leaving the country either: Figure 1 is the European Commission’s overview of European Union unemployment rates. Australia’s unemployment rate of 5.8 per cent is less than half the average of 12.1 per cent for the core EU states, and would put it third in that list of 28 countries, behind only Austria (4.8 per cent) and Germany (5.2 per cent). It is less than a quarter of the rate in austerity-obsessed Spain – the country whose policies (aside from its inability to devalue) Australia would emulate were it to regard its government deficit as “the real horror” today.

Figure 1: European Union unemployment data for October 2013

If I had to pick economic policies that had resulted in “horror” and “dysfunction”, I would not pick Kevin Rudd and Julia Gillard’s stimulus packages – even with the Pink Batts fiasco – but the austerity policies of the EU that have resulted in almost one in eight job seekers being unemployed (and that’s on an incredibly restrictive definition of unemployment, which means much of actual unemployment turns up as a decline in the participation rate).

You wouldn’t know it from Sheehan’s spiel, but the policy that has led to that level of unemployment for Europe is precisely the ones he’s championing here: an obsessive focus on reducing the government deficit.

What has been truly “nuclear in its capacity for destruction” has been the Maastricht Treaty, which back in the balmy days of 1992 imposed ceilings of 3 per cent of GDP on the allowable government deficit for members of the EU, and 60 per cent for the accumulated government deficit as a condition of joining the eurozone. In 1992, the non-orthodox economist Wynne Godley used rhetoric just as extreme as Sheehan’s today to describe what he saw as dysfunctional about these rules:

If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation. (“Maastricht and All That”, October 8th 1992)

Godley’s words would have, at the time, been treated by most as mere hyperbole. But unlike Sheehan’s hyperbole, Godley’s accurately described a future event. Starvation – and emigration as an alternative to it – are aspects of the human cost of the austerity drive that Maastricht has imposed on the people of Europe. The unemployment and poverty levels in Ireland, Spain and Portugal are a direct result of obsessing about achieving a government surplus during a private sector downturn.

The “successful” countries in this global crisis were the ones that didn’t suffer persistent double-digit unemployment, and are now growing though at only low levels: on both those criteria, Australia and the US qualify.

Why have they “succeeded”? Firstly, because increased government spending countered some of the downturn in private debt-financed spending. Secondly, because ultimately the private sector began to borrow again. The first effect was sensible government policy during any downturn; the second is storing up trouble for the future – but in the short term it causes a return to growth.

The failed economies were those which have hit well over 10 per cent unemployment rates, and which have shrunk massively and are now either still shrinking, or at best growing anaemically. On those criteria, austerity-obsessed Spain – and much of the EU – qualifies.

Why have they failed? Because the EU emphasis upon austerity prevented increased government spending from making up for the decline in private debt-financed spending, so that even now they are still suffering from private sector deleveraging. Worse, the government debt to GDP ratio is still rising, not because of rising government expenditure, but because GDP is falling faster than government spending.

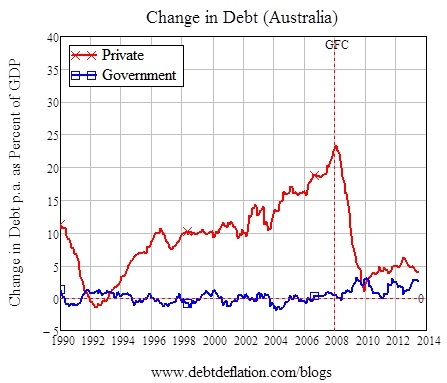

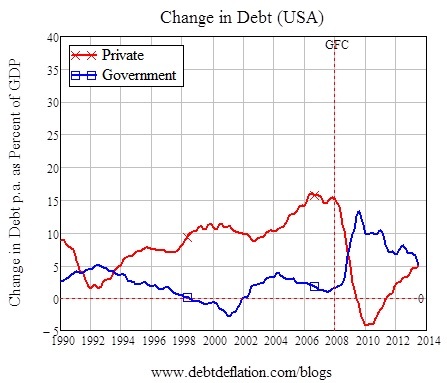

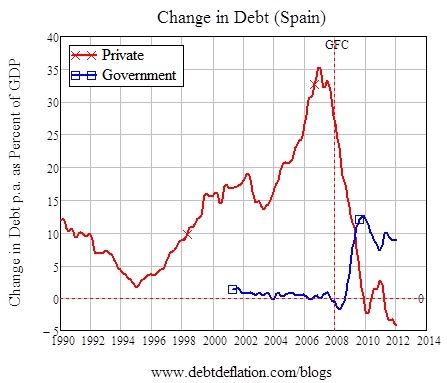

The next six charts tell that story vividly enough for even poorly-travelled journalists to comprehend – I hope.

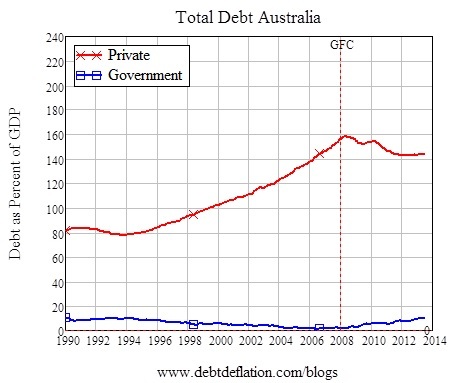

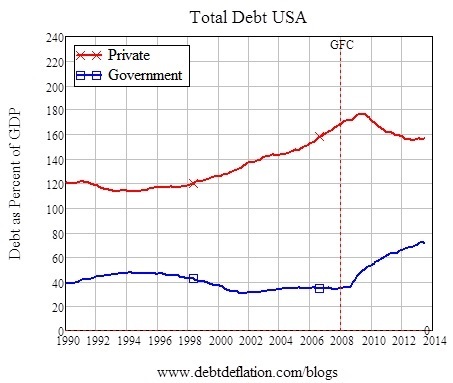

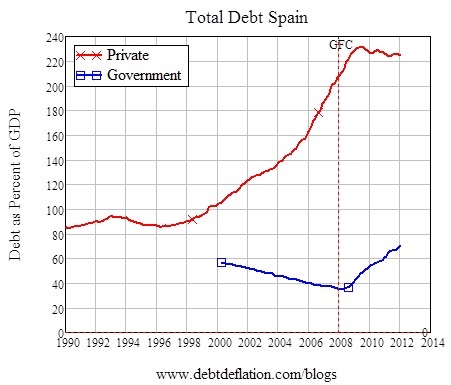

Firstly, virtually across the planet, private debt substantially exceeds government debt – even after the global financial crisis. Secondly, before the crisis, a blowout in private debt generated a false prosperity, during which governments reduced their debt levels (or kept them low despite follies like, in the USA’s case, the Iraq War), not because they were “good economic managers”, but because they were banking as taxes some of the money that households and firms borrowed into existence during the decade and a half of speculative excess that began in 1994 and ended so spectacularly in 2007-08.

Figure 2: Private debt dwarfs public debt in Australia

Figure 3: Private debt dwarfs public debt in the USA

Figure 4: Private debt dwarfs public debt in Spain

The crisis began when the private sector stopped borrowing – as I predicted it would:

Things can’t continue as normal, when normal involves an unsustainable trend in [private] debt. At some point, there has to be a break – though timing when that break will occur is next to impossible … At some point, the debt to GDP ratio must stabilise – and on past trends, it won’t stop simply at stabilising. When that inevitable reversal of the unsustainable occurs, we will have a recession. (“Debtwatch May 2007: Booming on Borrowed Money”)

Australia’s came out best amongst the OECD countries partly because it never experienced private sector deleveraging – which reflected differences in our institutions (such as the fact that we have variable mortgage rates here versus fixed in the USA), a rapid government stimulus, and restarting a housing bubble using the First Home Vendors Boost. The USA is hardly doing well, but it is doing far better than most of the EU firstly because its government stimulus countered the private sector deleveraging, and then because the private sector began borrowing again – stimulating the economy now while shoring up trouble for later.

But the EU in general, and southern Europe in particular, has suffered from both private sector deleveraging and a public sector obsessed with reducing its debt now – thus causing a double-headed recession rather than a single-headed one.

Figure 5: Change in Australian debt before and after the GFC

Figure 6: Change in US debt before and after the GFC

Figure 7: Change in Spanish debt before and after the GFC

I would far rather see governments acknowledging the problem of private debt, and doing something concrete to reduce it – since the financial sector should never have been allowed to create much of that debt in the first place. But as a second best policy, government spending should buffer the impact of the decline in private sector deleveraging. To do otherwise is to turn a serious recession into a genuine Depression – as Europe has done.

Behind the veneer of apparent fiscal prudence, that is what hysterical articles like Sheehan’s are encouraging – in utter denial both of the actual cause of the crisis and, more importantly for a journalist, in ignorance of what even casual empiricism shows has been the actual impact of austerity.

Steve Keen is Associate Professor of Economics & Finance at the University of Western Sydney and author of Debunking Economics and the blog Debtwatch.