Why... are gold prices not rising?

Summary: If the recent gold price fall isn't about Greece, US rate hikes or inflation, it's hard to be certain of the reason, but there is growing evidence the price decline may reflect official intervention. Governments are actively managing exchange rates and bond yields, while the Federal Reserve targets the stock market with monetary policy. Nearly half the recent fall came in one trading session after China revealed how much gold it was holding, and the price drop on Monday was allegedly triggered by one order to sell five tonnes of gold. |

Key take-out: Short- to medium-term investors need to be mindful of government policy goals and be wary of market moves that may conflict with these. |

Key beneficiaries: General investors. Category: Gold. |

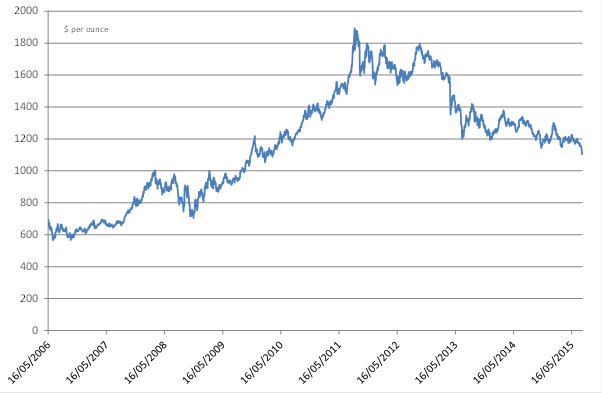

The gold price (in US dollars) has declined in every trading session since July 9 and is currently at its lowest point in a little over five years.

Chart 1: Gold price still falling

Now there are couple of interesting things about that price action. The first thing to note, is that a key support level around $US1190 has now been decisively broken. On the technicals (for those so inclined) there really isn't another strong support level until we get to about $1000. For chartists that means it's a pretty clean run down to that level.

So, why the fall? The most prominent reasons are the abatement of Greek fears, the imminent rise of US interest rates and the lack of any inflation. All sound reasonable though none fully explain the situation.

This is because the Greek crisis didn't trigger a gold price rise. Similarly, the US Federal Reserve has been talking about hiking rates for five years now. In any event, after a year or two of hiking, rates will still be ultra-low – so they won't in any way influence any investment decision or view on the economy. It's not like policy will all of a sudden become restrictive or anything.

That's not to say that rate hike talk isn't having an effect. The US dollar index is up 22 per cent over the last year alone – and there is a decent negative correlation between US dollar moves and commodity prices (ie US dollar goes up, gold prices goes down). So it is that gold is down about 17 per cent over the same period. Having said that the fall in gold on a longer timeframe predates the US dollar rise.

As for inflation? Well there is no consumer inflation, sure, but asset price inflation is rampant. The fact is we live in a high inflation world already.

So if the gold price fall isn't about Greece or US rate hikes – or inflation – then what is it about?

Well it's hard to be certain, but there is growing evidence that the price decline may in fact reflect official intervention. We already know that governments are actively managing exchange rates and bond yields through ultra-low rates and quantitative easing. Similarly, the Chinese and Japanese governments are very active in the equity market. That the Federal Reserve also targets the stock market with monetary policy is also well known. And we can't forget that regulators around the globe – including Australia – are also increasingly clamping down on property investors.

Which brings us to the second interesting observation on the price action. That is that nearly half the fall over the last couple of weeks, or $25, came in one trading session (Monday, July 20). This is a bizarre move and it raised quite a few eyebrows at the time.

Why? Because the move came directly after China revealed how much gold it was holding – for the first time in six years. Speculation has been rife – and the common wisdom is – that China would be an avid buyer of gold. As it turns out it was – announcing a 57 per cent lift in gold holdings over the last six years to 1658 tonnes. What got the markets' attention though wasn't that 57 per cent surge, but rather reports that stated Chinese gold holdings had declined slightly a percentage of official reserve holdings, from 1.8 per cent to about 1.65 per cent.

The problem is that China's official gold holdings actually rose from 1 per cent of the total as reported in 2009 – to 1.65 per cent (according to the World Gold Council). So the numbers doing the rounds aren't quite right. More to the point it's almost irrelevant in terms of the demand dynamics in the gold market, what proportion of total reserves China's holdings are anyway. All that matters is that they are buying a lot of gold – with a growth rate of more than 8 per cent per year. As it is China has the sixth largest holdings of gold in the world. That's what we know of – there is a common view in the market that actual holdings are higher.

Otherwise we know that central bank demand for gold is very strong around the world – and that doesn't appear to have abated in 2015 on World Gold Council figures.

That the gold price subsequently fell after China reported its gold holdings is odd enough. China has $US3 trillion in reserves and gold holdings are still low as a proportion of the total. Furthermore, it remains a committed buyer.

Yet another oddity is that the ‘flash crash' on Monday was allegedly triggered by one order to sell five tonnes of gold. At any time that is a large order. Yet to do it all at once (not staggering it), in a thin Asian market and on a day when Japan's market was closed (as opposed to Europe or the US) just seems bizarre for a seller who should have been trying to get the best price – even a forced seller could have waited for the European open, or staggered their order.

This is all very suspicious for an already opaque market that is dominated by official players.

For investors trying to make sense of recent events, or look for signals etc, we have to keep the above in mind. Front and centre.

At the very least it's remarkable that in a world of ongoing currency debasement and rampant asset price inflation that gold hasn't shot up alongside equities, property and bonds.

Here's the thing though, markets can detach from fundamentals for a long time, but fundamentals eventually reassert. A portfolio manager at one of the world's largest funds once said to me many years ago, that ultra-low rates and quantitative easing would change the nature of investing. The sheer volume of money sloshing around has to find a home. It doesn't just sit in the netherworld. In that environment, investments would swing in and out of fashion very quickly – bubbles would be blown, then evaporate, only to manifest elsewhere. Government policy would often be at the heart of these shifts.

In a world awash with liquidity – more money than at any time in history – this is what the bizarre price moves around gold signal. Gold otherwise has plenty of intrinsic value, if only because of the huge liquidity in investment markets. This is why central banks are avid buyers and why most of the large economies in Europe and the US hold such large sums of it.

It is increasingly clear though that short-medium term investors need to be mindful of government policy goals and be wary of market moves that may conflict with these – and this is what gold is telling us.