Why a permanent budget surplus is a poor fiscal model

Last week I showed that Australia’s net government debt to GDP ratio is nothing to panic about when compared to the rest of the world. We’re currently at under 12 per cent, whereas most OECD nations have ratios of 50 per cent and above.

But maybe that’s one reason Australia’s economy is relatively strong.

I also showed that most countries aren’t like businesses in that most countries have a net negative equity position -- their liabilities exceed their assets -- which is a situation that would have most companies on their way to being declared bankrupt.

But maybe most countries are headed for bankruptcy. That, after all, was the alarmist tone of Australia’s National Commission of Audit about the trend in Australia’s public debt, which will rise from 12 per cent to 16 per cent of GDP on a “business as usual” scenario.

So how to decide?

This is why economists develop models: to try out various hypothetical situations and see what happens. I’m a strident critic of how the mainstream develops its models, with mad assumptions like the one I pointed out last week by Robert Barro: that people leave bequests to enable their distant relatives to pay taxes:

“A network of intergenerational transfers makes the typical person a part of an extended family that goes on indefinitely. In this setting, households capitalise the entire array of expected future taxes, and thereby plan effectively with an infinite horizon…”

That sort of nonsense puts an imaginary rabbit in an imaginary hat, and then expects us to applaud when it’s pulled out of the hat by an imaginary invisible hand.

What I prefer to do is build a reasonable replica of the monetary world in which we actually live, and see what happens if various monetary settings are changed, which is why I developed the open-source program Minsky.

I’ve used it to take a simple model of a pure credit economy -- one in which banks are the only source of money -- and add in a government sector that finances itself by borrowing from its central bank. You can download the model from here (right click and choose “Save As”; if you left-click you’ll just get XML gobbledegook in your browser) and run it yourself using Minsky.

The real world is a lot more complicated than this simple model, of course (and these complications could be added to this model), but it will do for now to compare three situations: a government running a balanced budget; a government running a permanent surplus of 1 per cent of GDP; and a government running a permanent deficit of the same size.

The model has controls to vary government spending and taxation as a percentage of GDP, and how fast private banks issue loans (the smaller the number the more quickly they lend) and how fast private borrowers repay those loans.

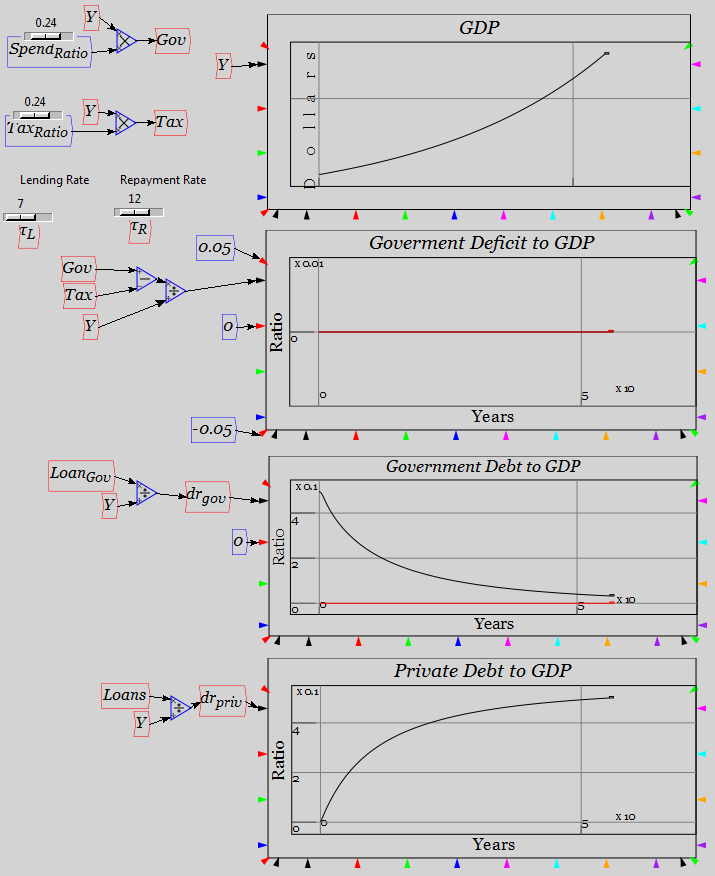

The default settings are government spending and taxation equal to 24 per cent of GDP (so the government budget is balanced), private bank loans doubling every seven years and repayment doubling every 12 years (so that the level of credit-based money is growing over time).

At these default settings, you get the outcome shown in Figure 1. GDP grows over time, the government deficit is always zero, and the government debt to GDP ratio falls from its initial level of 50 per cent towards zero. Private debt rises from zero to 50 per cent of GDP, but stabilises. Everything looks hunky-dory.

Figure 1: A balanced-budget government

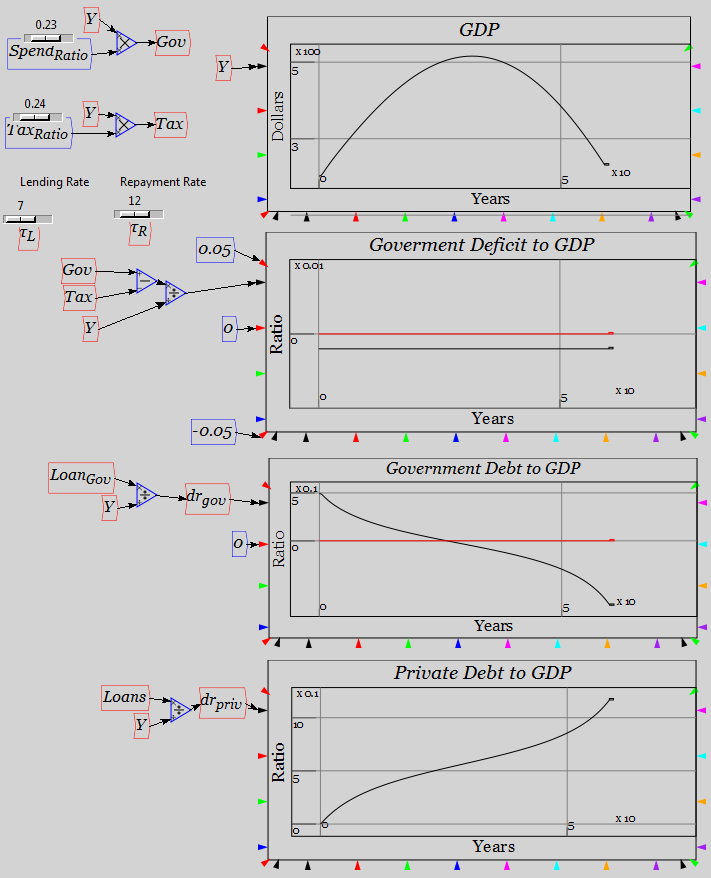

But let’s try to improve things. Let’s have government spending fall to 23 per cent of GDP, and keep taxes at 24 per cent of GDP, so that the government runs a permanent 1 per cent surplus.

What happens? See Figure 2.

Figure 2: A permanent 1 per cent surplus

Whoops! Government debt goes negative (as in Sweden or Finland) but GDP collapses (and private debt is much lower initially, but then goes exponential). What went wrong?

By running a permanent surplus of 1 per cent of GDP, the government is taking 1 per cent of GDP’s worth of the money supply out of circulation every year. Unless this is countered by private banks lending more money, the economy runs out of cash. Only if the banks really ramp up their lending rate (and borrowers slow down their repayment rate) does the level of money in the economy continue to grow.

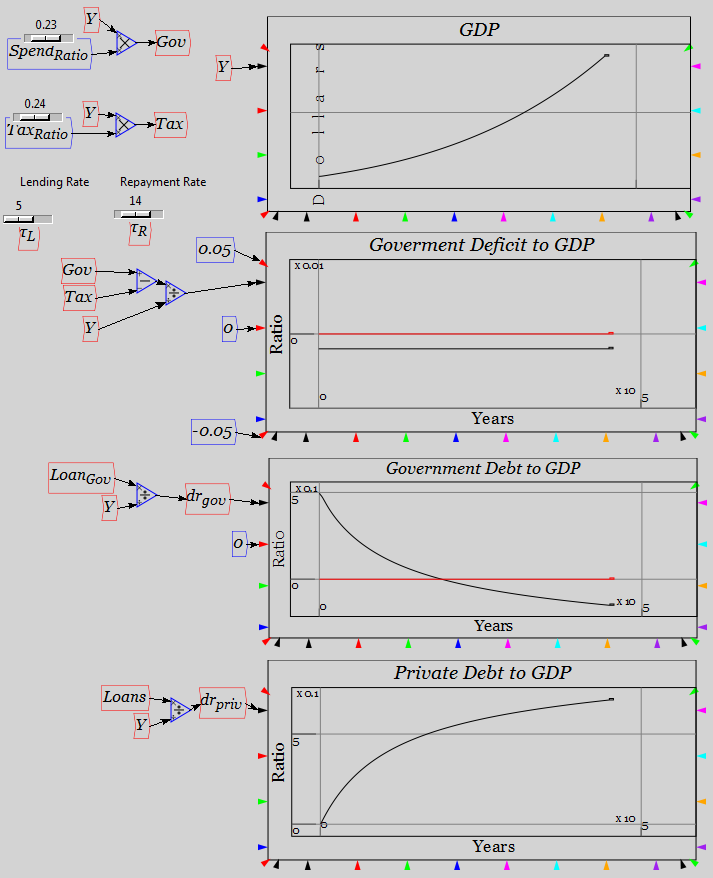

Figure 3 shows how this could happen. Rather than doubling every seven years, lending doubles every five. And rather than repayment doubling every 12 years, it does so every 14.

Faster private debt growth then counters the permanent government surplus, and GDP continues to grow. Public debt falls and ultimately becomes negative, so the government has a positive net equity position. But that comes at the expense of a higher level of private debt to GDP than in the balanced budget case shown in Figure 1.

Figure 3: 1 per cent government surplus countered by higher private lending

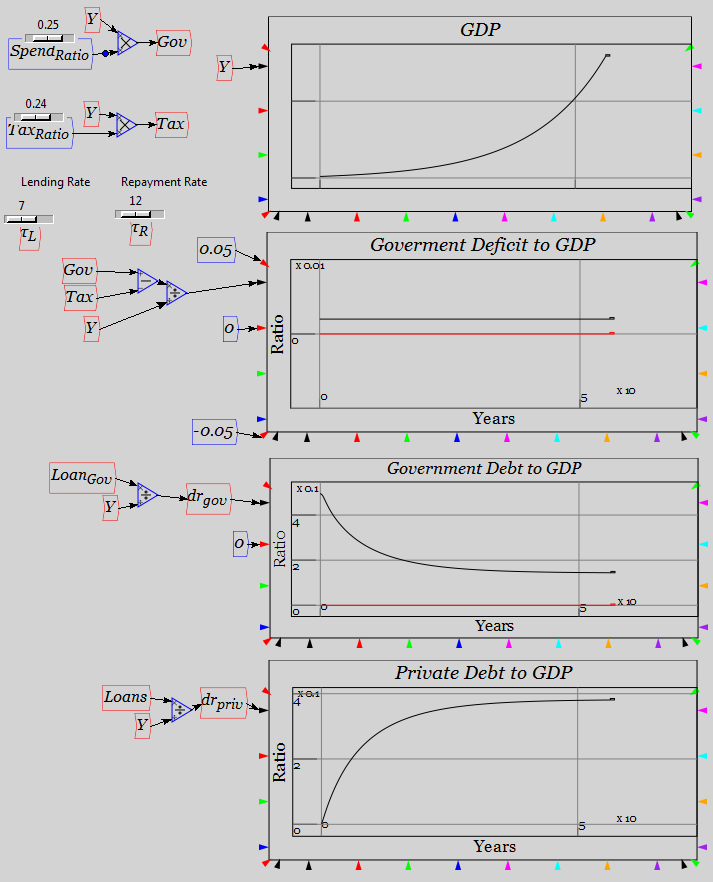

What about the scenario the National Commission of Audit is trying to avoid, where the government runs a permanent deficit of (say) 1 per cent of GDP?

That situation is shown in Figure 4. GDP continues to grow, public debt stabilizes at about 14 per cent of GDP, and private debt is lower than with either a balanced budget, or a budget surplus with high private lending.

Figure 4: 1 per cent government deficit

The takeaway from this simple model is that the correct analogy for the government is not that it is like a business (or like a household), but that it is like a bank.

Private banks and the government can both create money by their activities; banks by lending, and governments by running deficits. If we insist that the government actually takes money out of the economy every year by running a surplus, then the other has to compensate to make up for it, or the money supply will evaporate.

And how well have banks done that in practice? The global financial crisis is your answer to that question.

In this simple model, all bank lending supports genuine investment -- the building of factories which generate income that enables those loans to be serviced and repaid.

In the real world, banks lent mainly to finance speculation on asset prices, firstly in the dot-com bubble and then in the subprime fiasco. That enabled falling levels of public debt to GDP and, for a while, governments looked like they were being “good corporate managers” as government debt ratios fell.

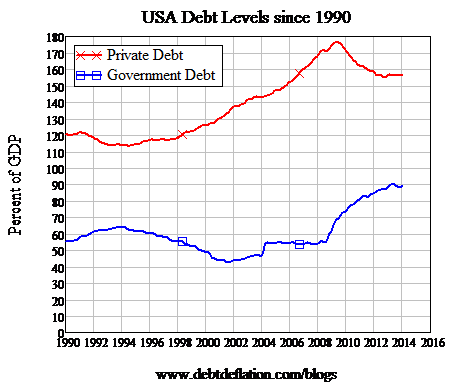

But the comeuppance was a rising level of private debt to GDP, which ultimately stopped growing when the Ponzi schemes it financed fell over. Then government debt rose, countering the fall in private debt that was reducing the amount of money in circulation (see Figure 5).

Figure 5: US government debt fell as private debt grew—and then the financial crisis occurred

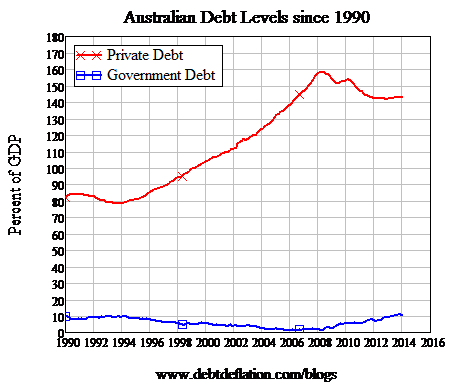

Australia avoided a recession during the crisis because private debt continued to grow, but even so the same pattern is evident. Falling government debt was possible from 1993 till 2008 because private debt grew enormously (and financed a housing bubble as it did). Then from 2008 onwards, a rising level of government debt countered slower growth in private debt.

Figure 6: Australian government debt fell before the crisis, then rose after it

Which would you prefer: a world in which monetary growth depends solely on asset price bubbles financed by private lending, or one in which monetary growth also comes from government spending on welfare and public infrastructure? It’s time we asked sensible questions about government spending, rather than mythical ones like that posed by politicians who mistakenly think that the government should operate like a business firm.