Which Australian gold stocks sparkle?

Summary: The slide in the Australian dollar has been a win for gold miners, with some stocks benefitting more than others. Analysts are positive on Evolution Mining, given its impressive production numbers and strong cash flow, while OZ Minerals is trading at less than half its asset value. |

Key take out: Newcrest Mining's balance sheet looks more stretched, with Deutsche Bank analysts concerned about the high costs of its Papua New Guinea mine project. |

Key beneficiaries: General investors. Category: Commodities. |

* The below recommendations are from Barron's.

Australian mining stocks are in the pits as China's slowdown crushes iron ore and coal prices, taking down heavyweight stocks like BHP Billiton (ticker: BHP.AU) and Rio Tinto (RIO.AU) with them.

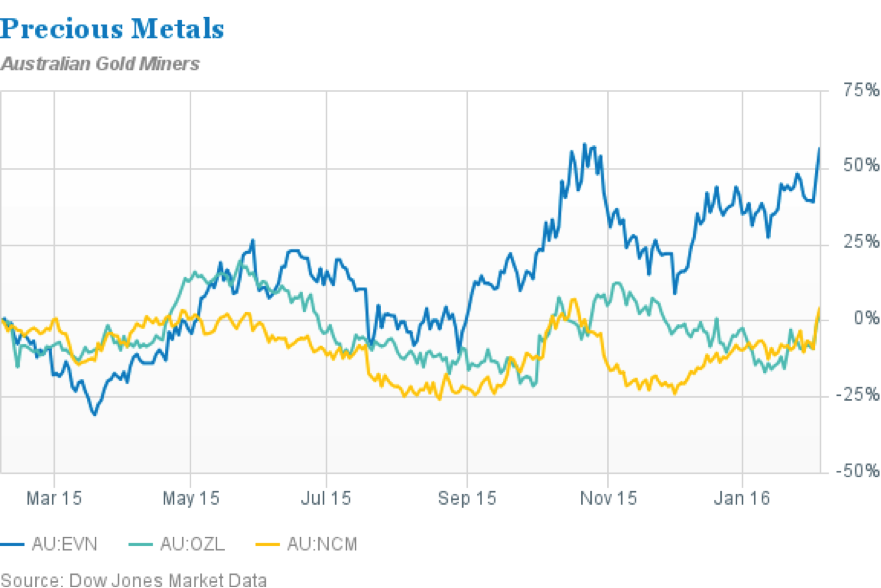

But amid the gloom, gold mining stocks have soared thanks to a rebound in prices for the precious metal, a weak Australian dollar and a flurry of acquisitions that have allowed several mid-tier miners to rapidly grow their production. Some of the share price moves have been impressive, with Evolution Mining (EVN.AU) and Northern Star Resources (NST.AU) up 53 per cent and 56 per cent, respectively, over the past 12 months. St Barbara (SBM.AU), named after the patron saint of miners, has soared 610 per cent over the past year.

The slide in the Australian dollar has been a boon for gold miners in the Lucky Country. The Aussie has dropped to $0.70 against the US dollar from a high of $1.10 in mid-2011. That has boosted the Australian dollar price of gold, which is currently fetching roughly $AU1,600 an ounce compared to $AU1,480 an ounce in mid-2011. The Australian dollar price of the yellow metal fell as low as $AU760 an ounce in mid-2007. As revenues have climbed, costs have fallen as fuel prices have slumped and the cooling of Australia's mining boom has taken the heat of wage costs. This means fatter margins for gold miners.

Don't expect a reversal in the currency's fortunes soon. Analysts expect the Aussie will fall further on concerns about the hit to Australia's growth from the waning of the mining boom and the prospect of more interest rate cuts by the Reserve Bank of Australia. Despite a recent upward correction, National Australia Bank reckons the Aussie is still overvalued and sees it weakening to $0.66 by mid-2016. The bank's strategists see it trading between $0.65 and $0.75 for the rest of the year as sentiment towards commodity currencies heads south.

Some gold miners glitter more than others. Evolution, which owns and operates seven gold mines across New South Wales and Western Australia, delivered record quarterly production in the December quarter. The solid performance allowed the country's second-biggest listed gold miner to upgrade its production guidance for the 2016 financial year and lower its cost forecasts.

Evolution's December quarter report underscored the healthy margins enjoyed by Australian gold miners: The miner's all-in-sustaining-cost (AISC) – a closely watched industry yardstick – was AUD1,016 an ounce, while its achieved gold price was AUD1,536 an ounce. That's a margin of over AUD500 an ounce. One bull on the stock is Morgan Stanley's Steffan Hansen. He thinks the shares could go as high as AUD2.65 in a best-case scenario if higher gold prices, favorable FX movements and lower operating costs all align. His base case price target is a more modest AUD1.70. Hansen says Evolution is enjoying strong cash flow from the Aussie dollar gold price. The company is also one of Australia's lowest cost gold producers and has scope to raise dividends from their current 2 per cent later in the year.

The shares also look inexpensive at seven times 2016 forecast earnings.

UBS analyst James Brennan-Chong likes Melbourne's OZ Minerals (OZL. AU), a copper-gold miner, which he says should generate healthy cash flow over the next couple of years. The company produced roughly 31,000 ounces of gold in the December quarter. The company is seeking to unlock value in its stockpiles of gold ore, undertaking a successful trial in December of its Prominent Hill plant to process those stockpiles. OZ Minerals' share price could be supported by plans to develop its Carrapateena copper-gold exploration project. The stock trades at a price less than half its asset value, which puts it among Australia's cheapest mining plays. It's also debt free with $AU553 million in cash. UBS has an $AU4.41 share price target.

Melbourne peer Newcrest looks a tougher call. Deutsche Bank's Brett McKay says while Australia's largest gold miner has kept output high (it's targeting gold production of between 2.4 million ounces and 2.6 million ounces in the 2016 financial year), its balance sheet looks stretched with $2.9 billion of debt reported at its half-year results. It's not helped by its high cost Hidden Valley mine in Papua New Guinea, with the joint venture partners considering strategic options for the business which is aiming to operate at a free cash flow neutral or better position. McKay, who thinks the mine may be closed this year on safety concerns, rate Newcrest a Sell with a price target of $AU11.90.

* This report was originally published by Barron's and is reproduced here with permission.