Where Fitch got it wrong on housing

A generation of first-time buyers is largely priced out of the property market, ratings agency Fitch Ratings declared last week, saying an explosion in housing investors has been at the expense of those wanting to make their inaugural entry into the market.

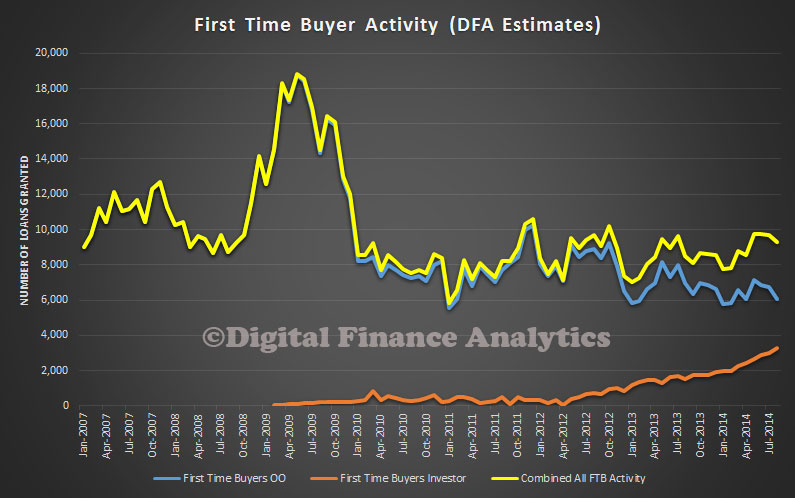

Official ABS figures certainly suggest first-home buyer numbers hit record lows in 2014. At the same time, investor loans in Australia now account for half of new loans.

What that data doesn't show though is that first-time buyers are investors.

There has been a growing trend in recent years for aspiring first-time home buyers to buy a property that is smaller than they require, or in a location in which they don't choose to live, and letting the property out while renting a more suitable residence. These owner-renters may live in a share household with friends, or live with family.

The ABS stats assume first-time buyers are owner-occupiers. The numbers are based on collated lender data. When an investor applies for a home loan, they are not asked whether they are a first-time buyer.

This partly explains why first-time homebuyer numbers are dropping so substantially in the official statistics while investor loans are accelerating.

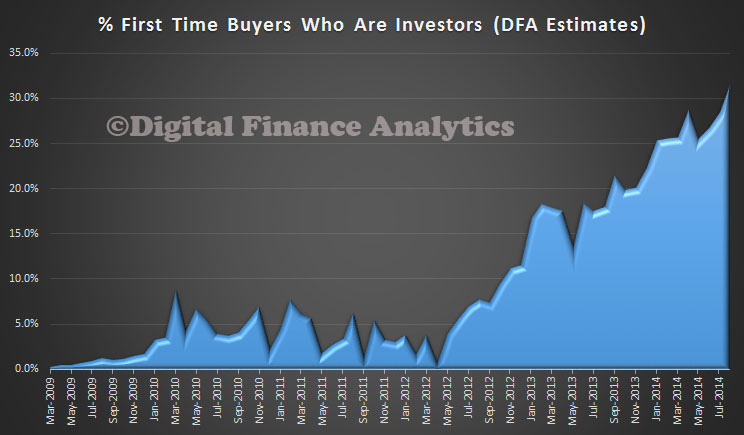

Digital Finance Analytics estimates around 30 per cent of potential first time buyers sidestepped owner-occupation and went straight for the investment option.

Source: Digital Finance Analytics

A survey of 26,000 households showed many first-time buyers were anxious they were missing out and bought property (usually a unit) while living at home as an ‘interim hedge' into the market. About one third had help from their parents, and some others bought with friends.

This phenomenon has been gaining popularity for around two years, predominantly in Sydney and Melbourne, and to a lesser degree in Brisbane. It doesn't feature in other states, DFA's Martin North says.

The latest rental report from the Domain Group forecasts upward pressure on rents through 2015, particularly in Sydney, after gross yields on units rose in Sydney and Melbourne over the December quarter.

Since the rules for the first-home owners government grant changed to apply only to new property in most states, there is less incentive to owner-occupy for first timers.

Source: Digital Finance Analytics

The ABS is investigating the quality and collection of first homebuyer data. Banks are supposed to report monthly on the total number of homes purchased by first home buyers, but there are concerns that some lenders are finding it difficult to identify first home buyers.

This is concealing the growing numbers of first-time buyers who are opting to buy-to-let, finding it easier to get a loan for an investment property with an income stream from rent and encouraged by Australia's controversial negative gearing tax incentives.

Fitch expects Australian home price growth to ease to 4 per cent in 2015 from 7 per cent in 2014, and says it expects rents to grow at a much lower rate.

But as the concept of renting everything from tools to pets to designer handbags gains acceptance, this new breed of owner-renter is likely to continue to grow, renting their terraces in Fitzroy or Paddington and owning a unit somewhere more affordable as they have their cake and eat it too.