What's keeping markets and investors awake?

Robert Gottliebsen

What's keeping markets and investors awake?

| Summary: With positive economic signs few and far between, it's no wonder investors are feeling nervous and regulators are frustrated. In Australia, there's also a property market overhang. Does London have some answers? |

| Key take-out: American investors waiting for Donald Trump to make America great again are not holding their breath. Australian investors can only wait too, and see what's in store for property turnover. |

During the week I received a note from a friend in New York, which helped explain why the American market is so jittery.

The polarisation of investors into two camps is getting worse. My friend is in the “it is going to get tougher” camp – if he is right, then Wall Street will fall later in the year.

He says that the two main stays of recent domestic growth in the US are fading. The demand for and production of motor vehicles has crested and now appear to be on the decline. The same is beginning to occur in oil and shale-related investments as the oil price either falls or steadies at current low levels. Both oil and motor vehicles have excessive stock.

While it is true that American consumers and business fixed investment is continuing to advance, the gains involved in these sectors are small compared to the uplift that was filled by the automotive and oil sectors.

On the government side, spending on goods and services has been flat and the health care legislation will actually take money out of the community. My friend doesn't believe that the Trump tax proposal, when it finally emerges, will gain Congressional approval.

In that context, in theoretical economics, Janet Yellen at the Federal Reserve Bank should be lowering rates. But, in fact if my friend is right, it is probably better to increase the rates now so that there is room to reduce them should it be necessary. And at current US rates of interest rates, what Yellen does has almost no effect on the US economy. Although unemployment is low, wages are subdued because of the lack of collective bargaining.

On the other side of this debate, those who believe Trump will still “make America great” were buoyed by the Republican win in Georgia. As they see it, if the media's “fake news” was having an impact, then the Democrats would have won Georgia easily. They believe that the Georgia win will give Trump and the Republicans the opportunity to press ahead with their tax deductions, incentives for American industry, and the attraction of American funds held overseas to return home.

Every week that goes by, and there is no action, makes the markets more nervous. And they start to focus on the sentiments that my friend emailed me.

A growing sense of frustration

And there are still vast amounts of money pouring into US Treasuries, because people believe it is the safest place to go. Our market depends to a large extent on Wall Street, so we have a very direct interest in what is happening.

Indeed, you can sense the frustration in the central banking community in both Australia and the US. Our Reserve Bank governor is urging companies to invest and workers to ask for more money, but there is a deep caution. And that caution includes workers who do not want to jeopardise their job by pushing for higher wages. Only the public servants feel safe to do this.

And, in part, this reluctance to push for higher wages is related to the technology industry which is lowering operating costs and threatening jobs. This means, unless there is some major interruption, inflation looks like being subdued and that keeps the lid on interest rates.

And, of course, it also is one of the main factors maintaining the prices of houses in countries like Australia. There is great speculation in the real estate market that maybe we are headed for a collapse in house prices. I think the various banking mechanisms, including higher interest rates for investors and much higher-quality lending standards by banks, will curb the amount of money available for the housing market, and in turn that will cool prices in many areas.

But unless there is some major local or global economic catastrophe, I don't think it is going to cause a collapse.

A property call via London

But it is fascinating what has taken place in the UK. Like Australia, London has had a strong housing market which has priced first-home buyers out of the market. And to curb over enthusiasm, there are stamp duties and other taxes imposed on properties. It has not collapsed prices, but what it has substantially reduced the number of dwellings on the market. The number of home sales in England and Wales has slowed substantially. Overall sales are down by about 30 per cent from the peak.

In the last year, London turnover fell 18 per cent and there were even bigger falls in some areas. What vendors are doing is not slashing their price but waiting for a buyer. The rise in investment dwellings that has taken place in London (and which has also happened here) has meant that people are staying with their investment dwelling rather than selling them because they want to shift. That is also contributing to a lower turnover. I can recall similar periods in Australia when, if you wanted to sell quickly, you had to sacrifice your price. But if you were prepared to wait, and you had a good property, you would achieve the valuation.

We still have a very liquid market in Sydney and Melbourne, but London is a warning that may change. Of course, if it does, life becomes very tough for real estate agents, insurance companies, conveyancing groups, state governments and all those who have benefited from the high turnover, higher-price environment that has dominated domestic real estate for many years.

And a message for defined benefits pensioners

And finally, a number of Eureka Report readers may be the recipient of defined benefit private pensions. Under these arrangements, which were set up when there were reasonable benefit limits in superannuation, the actuary looks at the pool of money that is in a superannuation fund and stipulates the required pension.

The Tax Office is writing to those who have such funds (and they are not widespread) telling them that from 2017-18 they can only have $1.6 million per person backing their defined benefit pensions. That means the pensions may fall sharply if there are funds supporting pensions above $1.6 million.

However, others are in the fortunate position where the amounts over $1.6 million can be transferred to accumulation or paid out as lump sums. Many will be very happy to get their hands on the money that has been tied up. Those in accumulation phase will pay 15 per cent tax, but they will not be forced to distribute.

They will control their distributions because they will not be defined. That can be an advantage to a lot of people, because they can now save in the 15 per cent tax shield of superannuation and not be forced to pay out high pensions.

Investment markets and key developments over the past week

- Global shares mostly rose over the last week, despite falls in energy shares, as economic data was good and there was good news for Trump's pro-growth agenda in the US. However, Australian shares fell thanks to a combination of falling oil prices hitting resource stocks, "fear of Amazon" weighing again on retailers and worries (mistaken in my view, given it will take so long) that China's inclusion in MSCI share benchmarks will see funds flow out of Australian shares. Bond yields were flat to down, the plunge in the oil price continued and this along with a slightly stronger $US weighed on the $A.

- Oil price plunges, inflation still MIA, interest rates to remain low, good news for Australian consumers. The oil price has been trending down since February amid concerns that rising non-OPEC production will offset OPEC production cuts. This hit the headlines over the last week as the decline pushed beyond 20 per cent. While oil is oversold and sentiment towards oil is so negative it's positive pointing to a bounce it's hard to get particularly excited. Particularly with steadily rising shale production in the US putting a cap on price upside. More broadly the weak oil price highlights the broader lack of inflationary pressure globally which will keep interest rates low. However, low oil prices mean low petrol prices and this is positive for consumers. In Australia, if current oil prices are sustained the retail price of petrol could fall towards $1.10 a litre. This implies a saving for the average family's weekly petrol bill of around $6 compared to January.

- Which is good news given the self-inflicted wound flowing from higher electricity prices in Australia. And if oil prices stay low or fall further it will mean lower gas export prices which could take pressure off the domestic gas market. One can only hope!

- The inclusion of Chinese mainland (or A) shares in MSCI's share benchmarks is another sign of the opening up of the Chinese share market and its integration globally, but it has a long way to go. The inclusion only relates to large cap shares accessible by foreigners via the Hong Kong share connection. Initially the weight of Chinese shares in the MSCI emerging market index will be just 0.7 per cent whereas right now the Chinese share market is 9 per cent of total global share market capitalisation and it won't start phasing in to May next year. Full inclusion may take 5-10 years. And the initial index related flows into the Chinese share market flowing from the move are likely to be less than half typical daily turnover in the Chinese share market. So don't expected a huge short term impact. However, the impact on Chinese shares will grow over time as the exposure in the MSCI indexes is likely to rise. And it's another sign that China is now becoming an integral part of the global financial system. Over time the increasing participation of foreign institutional investors will help promote the rights of Chinese shareholders and help enhance the liquidity and reduce the speculative tendencies in the Chinese share market.

Major global economic events and implications

- While the noise around President Trump continues to swirl, the past week confirmed that his policy agenda remains on track with the Senate having released its draft Obamacare reform bill and close to a vote on it, Treasury Secretary Mnuchin and House Speaker Ryan confirming tax reform remains a top priority, a draft executive order on the health industry focussing easing in regulations and Republican election victories providing impetus to Trump's agenda. Meanwhile, existing home sales, home prices and the leading index rose and jobless claims remain ultra weak. Major US banks also passed the first stage of the Fed's latest bank stress tests, as would be expected in this environment.

- Eurozone consumer confidence rose to its highest in 16 months and French business confidence rose to a 6 year high.

Australian economic events and implications

- ABS home price data confirmed continued strength in the March quarter but a lot has happened since then with bank rate hikes for investors and interest only borrowers, tighter lending standards and evidence the Sydney and Melbourne property markets have started to cool. Skilled vacancies remained strong in May pointing to continued solid jobs growth for now.

- More bank mortgage rate hikes, but cuts for owner occupiers paying principle and interest. The drip feed of bank rate hikes has continued but it's worth putting this in perspective. Reflecting regulatory pressure and banks managing their risks the rate hikes have been for investors and more recently for interest only (IO) borrowers. See the chart below. In the last week banks have been cutting their variable rates for owner occupiers on principle and interest (P&I) loans. (Note that the chart below relates to standard variable rates, discounted rate are around 0.75 per cent lower.) While the hike in investor and interest only rates (of around 0.3 per cent for investor P&I loans, 0.75 per cent for investor IO loans and 0.5 per cent for owner occupier IO loans since November) are a dampener they are modest compared to past rate hiking cycles, investors can get up to half of it back from the tax man and nearly 80 per cent of owner occupiers are interest only and they have seen a cut. The main uncertainty relates to the impact on interest only owner occupiers – but, of course, if there is a problem there in terms of repayments as they move across to P&I that threatens overall economy growth, the RBA can simply offset the increase in mortgage costs by cutting the cash rate again (and yes – for owner occupiers it's likely the banks would pass it on).

- News that South Australia will add to the Federal Government's bank levy adds to concerns that a Pandora's box has been opened in Australia. It's understandable that businesses will fear that if they are in an industry that does well and is unpopular they will be hit with a higher tax rate. Good tax policy seeks to minimise distortions with a single tax rate across all industries and we seem to be moving away from that.

Next Week

Craig James, CommSec

The 2016-17 financial year draws to a close

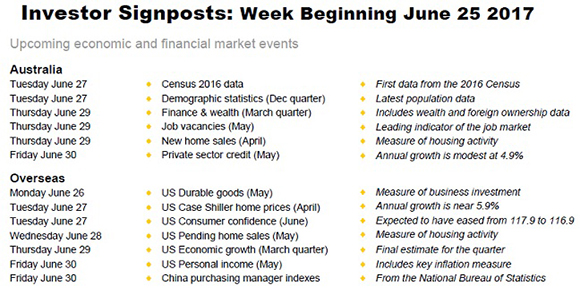

The financial year is drawing to a close, but there are no ‘first tier' indicators to either close out the year or usher in the new financial year. In the coming week, most interest will be on the latest demographic information.

- In Australia, the week kicks off on Tuesday when the Australian Bureau of Statistics (ABS) releases the first data from the 2016 Census. Across Australia housing conditions are decidedly mixed. So the latest figures will throw new light on the true state of underlying demand for homes. At the same time the ABS will release the December quarter population figures – figures that you would expect would be newly calibrated with the latest Census data.

- The NSW, Victorian and ACT economies are leading the way at present because population growth in each economy is either near or above the decade-average – lifting the demand for homes as well as economic and social infrastructure.

- On Tuesday, ANZ and Roy Morgan publish the usual weekly consumer confidence figures. Lower petrol prices may have lifted spirits in the past week. Consumer confidence is merely OK at present.

- On Thursday, the ABS releases the quarterly job vacancies data – a key leading indicator of the job market. And just like the monthly job advertisements data, the job vacancies figures have for some time signalled an improvement in labour market conditions. It is clear that these positive signals are now being reflected in the official data on employment and hours worked.

- Also released on Thursday is the “Finance and Wealth” publication from the ABS. The data includes estimates of household debt and financial wealth as well as statistics such as foreign ownership of shares and bonds and cash holdings of superannuation funds. Wealth in Australia is at record highs.

- And also on Thursday the Housing Industry Association releases the latest data on new home sales. If the data shows that more homes are being sold, then this could reinvigorate the early stage of the housing pipeline such as new applications to build homes.

- On Friday the Reserve Bank releases the Financial Aggregates publication, a publication that includes data on private sector credit (effectively, data on outstanding loans across the economy).

Overseas: The 2017 year is almost half over

While in Australia the focus in the coming week is on how the 2017-18 year has finished, overseas the key interest is on reviewing the performance of the first half of the 2017 calendar year.

- The week begins on Monday in the US with May data on new orders for durable goods – goods like cars and computers that have a ‘shelf' life' greater than three years. Economists tip a 0.5 per cent fall in orders after the 0.8 per cent fall in April orders.

- In the US on Tuesday the CaseShiller measure of home prices is released with consumer confidence data. The usual weekly data on chain store sales is also released. The influential Richmond Federal Reserve survey is also released on Tuesday with service sector gauges for the Texas economy.

- In the US on Wednesday the usual weekly data on mortgage applications is released together with advance data on international trade and inventories in the retail and wholesale sales sectors. In addition the pending home sales index is released.

- On Thursday in the US the final estimate of economic growth for the March quarter is issued. Annual growth is artificially low at 1.2 per cent with the underlying rate of growth closer to 2 per cent.

- And on Friday in the US, the May data on personal income and spending is released with the main interest centred on the Federal Reserve's preferred measure of inflation. The final estimate of consumer sentiment for June is also issued together with the influential Chicago purchasing managers index.

- In China on Friday the National Bureau of Statistics will release purchasing manager survey results for manufacturing and services sectors.

- Over the week, it is also worth noting that the San Francisco Federal Reserve President John Williams will be in Australia delivering a range of speeches.

Financial markets

It may come as a surprise, but the Australian sharemarket is set to post its strongest financial year performance in three years. Total returns on shares – as measured by the All Ordinaries Accumulation index – have lifted by 11.7 per cent so far in 2016-17 after 2 per cent growth in 2015-16 and 5.7 per cent growth in 2014-15. The ASX 200 index has lifted 8.3 per cent with the All Ordinaries up 7.4 per cent.

While the Aussie sharemarket has lifted over the past financial year, other markets have done far better. The US Dow Jones index has lifted by 19 per cent in 2016-17 while the UK has gained almost 15 per cent and the Japanese Nikkei has risen by around 29 per cent. The Australian sharemarket ranks 55th of 73 bourses over the past year. Greece has been notable amongst the gainers, up 53 per cent.

Commodity prices have been decidedly mixed over 2016-17. The CRB futures index has fallen 13 per cent over the year with oil down 12 per cent, gold down 6 per cent and sugar down 36 per cent. But iron ore prices have lifted 2 per cent, thermal coal has rise by 42 per cent and base metal prices have generally firmed over the period with lead, zinc and copper up between 18-25 per cent.

The Aussie dollar is on course for its least volatile year against the US dollar in 27 years. The range has been just US6.25 cents (from US71.52c to US77.77c). Over the financial year the Aussie has lifted 1.8 per cent, making it just one of 45 currencies to lift against the greenback.

In terms of the official cash rate, there was only one change – the quarter per cent cut in the cash rate in August. The 1.5 per cent cash rate is the lowest since records began in 1959.

Longer-term rates have been more volatile over 2016-17. Ten-year bond yields fell to as low as 1.85 per cent in August but rose as high as 2.99 per cent in March before settling near 2.40 per cent in the past month.

Craig James is chief economist at CommSec.

Readings & Viewings

Is Qantas the world's best airline? The winner starts with a Q, but there's no flying kangaroo. Sadly, our national carrier doesn't even make the top 10.

And American Airlines is pushing back on an investment play from Qatar.

Why a hard Brexit could crush Britain's strawberry fields forever.

Meanwhile, the biggest US banks have cleared their first hurdle in the Fed's stress tests, but one is lagging on a key measure of leverage.

Warren Buffett's $US400 million Canadian bet.

Two days after the announcement of Amazon's bid for Whole Foods, the market capitalisation for both companies increased by $14.7 billion.

Amazon will start selling Nike shoes directly for the first time.

Alibaba taps user data to drive major growth spurt.

Harley-Davidson could be looking to buy Ducati.

Here's a personal lesson learned from Uber, from a company insider.

And this company has no air bag protection, at least on a financial level.

But we may not need them in the future anyway. Here's Musk's supersonic public transport plan.

Gold mining is going hi-tech. Here's how Barrick, the biggest gold producer, is joining forces tech giant Cisco as part of a “digital reinvention” of its global mining operations.

Here is a clean coal plant that may not burn coal.

Lastly, emojis for zombies, T-Rex and Colbert are almost here.