What's going on with US markets?

|

Summary: Wall Street came off the boil on Friday, with the Dow recording its biggest drop in three months. US equity markets have been branded overvalued, and whether that's true or not, there's no doubt the current situation is highly unusual. Market strategists from State Street, Prime Value, Fortrend Securities and Henderson Maxwell weigh in on the argument and where to from here. |

|

Key take-out: Investment bank Morgan Stanley claims US equity markets have rolled into late cycle expansion, however, it's difficult to determine when the next phase in the cycle will begin. Investors should note that politics can jolt equities in the short-term, but history shows long-term and large-scale corrections often come down to market fundamentals on the back of things like rich valuations or debt crises. |

The overnight slip on Wall Street, with the Dow Jones index dropping more than 274 points, or 1.24 per cent, was put down to a combination of the Trump administration's ability to push through its agenda and the terror attacks in the centre of Barcelona.

With investors clearly rattled, the VIX "fear" index that gauges volatility on Wall Street spiked. So should we be worried? The word on the street is that US equities are overvalued. But when we talk to fund managers, it's a different story.

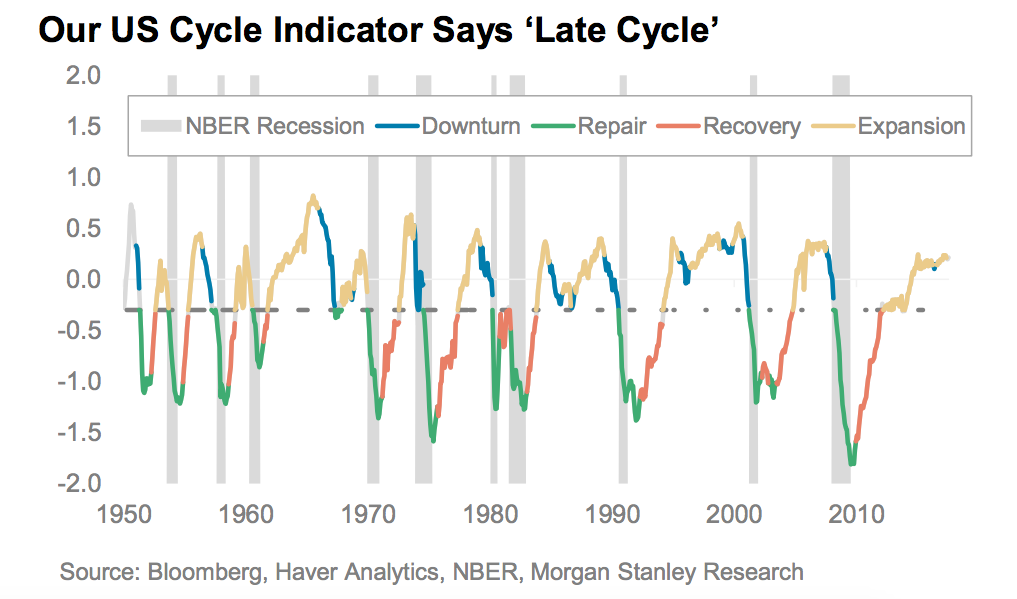

Earlier this month investment bank Morgan Stanley put out a note that said its US cycle indicator had ticked over to "late cycle" in an expansionary phase for equities. Downturn seems to be the next notch on the dial, but there appears room to move yet.

Is the party over? Should US investors be positioned for a sharper fall? Some think so.

The Morgan Stanley strategists who authored the report noted the current environment would typically favour large cap stocks over small cap, developed markets over emerging, a focus on value not growth, and a stronger US dollar.

This week the Dow toyed with a new record level above the 22,000 mark, which it first hit a several weeks ago. It didn't happen, despite the defusion of fears earlier in the week emanating from North Korea's threat to fire missiles and land them in waters off the US territory of Guam. For a while there, it seemed nothing could stop the Nasdaq from smashing its own records, which we've seen happen every month this year. But it too, along with the S&P 500, couldn't escape last week's events unscathed and is still more than 100 points off where it finished up last month.

ST Wong, a senior portfolio manager at Prime Value, says “it's probably fair to say this is a highly unusual environment in broad terms” when asked if there was a period this current one reminds him of.

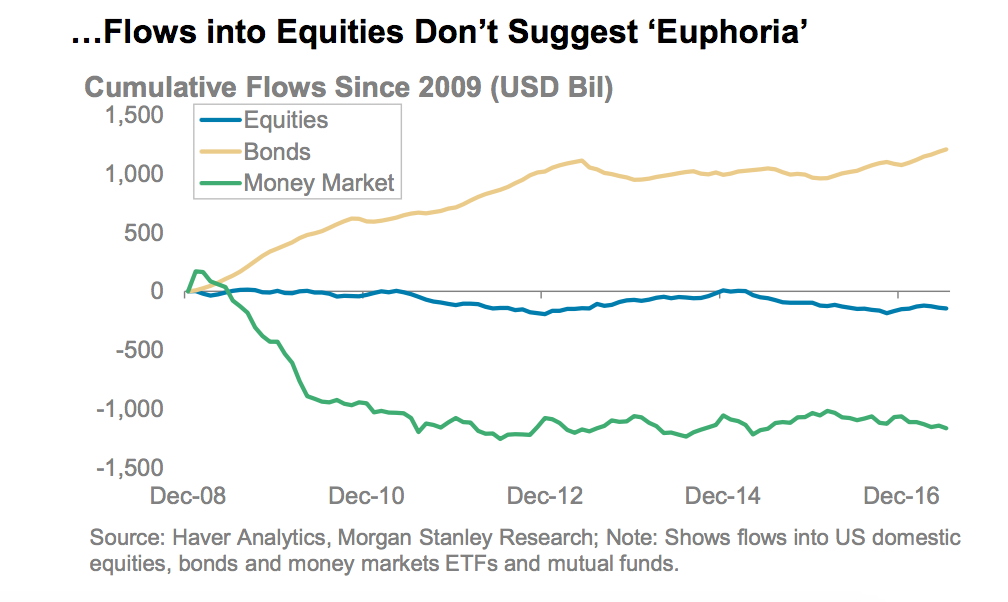

Fortrend Securities CEO Joe Forster refers to US equities markets travelling in the fashion of “steady as she goes”. The investment manager, who focuses solely on the US, believes high valuations to the north are not reflective of euphoria, at least for equities, and it's more likely the US bond market with the problem.

A financial advisor in Australia who invests in the US for clients, Tony Davison of Henderson Maxwell, says fundamentally US markets have been “overvalued for weeks now” and politics might be dominating for the short-term “but it always comes back to market fundamentals”.

“The market is obsessed with Donald Trump but half the fall last week happened before the guy had even opened his mouth,” says Davison.

“We had been selling in portfolios for two weeks because a correction just had to happen sometime. The question should be, if you got a 5-8 per cent sell-off, which there always is, what would you be buying?”

Two of the market strategists we spoke to point out how paramount the US dollar is to gauge the bigger picture. For the past six months, the US dollar has been tracking down, while US equities have been swimming upstream.

Davison notes the change in direction in the past couple of weeks. The US dollar had been signalling money out of the States, but now, “the flow change has really yet subtly abated”.

“If the US dollar kept tracking down, that's absolutely one of the key indicators we look at because it's all to do with liquidity, and FX is one of the most liquid markets globally,” adds Wong.

US equities clearly have bite, and their markets are more than proud to bare their teeth, which have taken their own supersized form. The FAANGs – as Facebook, Amazon, Apple, Netflix and Google (Alphabet) are known – have been propping up the Nasdaq and the S&P 500 for some time, and this is a growing cause for concern for some. From the start of January to the end of July, the FAANGs accounted for around 28 per cent of the S&P 500's total return.

“The fundamental issue is you have liquidity coming into the market for a long duration and you are on the cusp where that liquidity could be drained,” says Wong.

“I struggle to think of similar situations – I would probably look back to the GFC 10 years ago or the Russian or Asian debt crises around 20 years ago where liquidity was quickly drained. The forex market reacts very quickly and violently and that trickles down to equity markets.”

In what was a widely celebrated record high, at the start of August, the heavyweight Dow Jones index cracked 22,000 points. This was a prize for running a slow and steady race for the better part of five years.

A lesser celebrated milestone, but perhaps of equal-to-greater significance, was the Dow Jones Transportation Average (DJT) reaching an all-time high in mid-July. The DJT is down more than 4 per cent from its all-time high, and while that alone doesn't spell disaster, analysts have noted it's a divergence in a world of record-reaching indices. Fans of Dow Theory believe Transports are the heartland of US markets, comprising 20 out of the 30 companies on the Dow, and a bull market can't continue if Transports are on a downward trajectory.

Wong says to focus on companies that are “resilient, robust and with strong balance sheets” which have a better chance of bouncing back in the event of a sell-down.

“Economic expansion has been going on in the US for several years, but at the same time, it's unusual the Fed is looking to tighten monetary policy at quite a late stage of the cycle, so that obviously puts some doubt into market thinking about where to now for US markets,” says Wong.

“There are probably areas of the market you would be concerned about and I'm calling out the IT sector as one where valuations have blown out significantly on a sector basis. These are mega-cap tech companies, and if they do correct, liquidity could easily flow out quite quickly.”

In saying that, Wong doesn't think flows into US equities on balance are indicative of euphoria. He remains positive so long as economic growth in the US continues, albeit below expectations.

Forster certainly isn't seeing stock market euphoria and is more inclined to view the bond market with scepticism.

“The most palatable investment for countries like Saudi Arabia is just to buy treasuries and that's why all the money has been going there,” says Forster.

“That's why US 10-year treasuries are yielding 2.2 per cent and stocks are more likely around 6 per cent. The earnings yield on stocks is more than double what you get on bonds – they are very, very attractive in comparison then.”

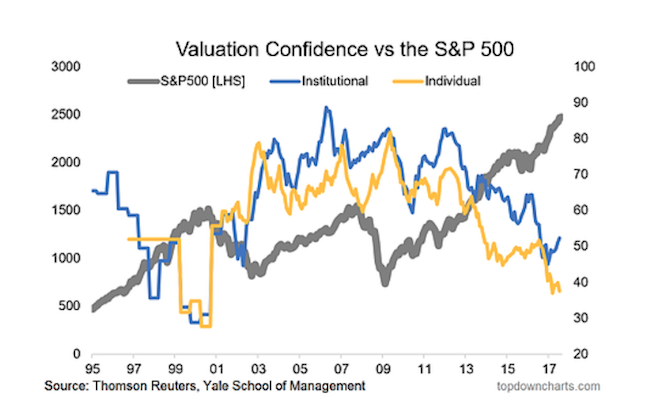

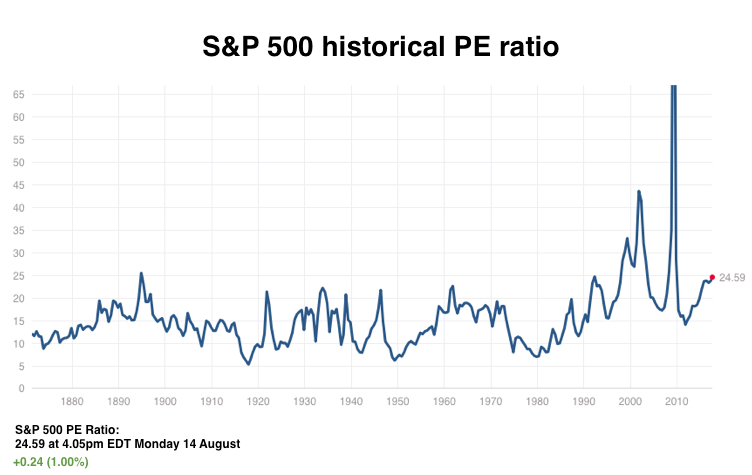

The S&P 500 is currently trading on a price to earnings multiple of almost 25, compared to the ASX which has a PE of less than 17. This is high on a historical basis, but Forster gives more weight to recent history than the norms of last century.

“There was a time in the last three decades [in the US] when 10-year treasuries were at 10 per cent and PEs were beyond 10,” he added.

“I don't buy the story Morgan Stanley sells that we are at the tail-end of the cycle,” says Forster.

Forster thinks the issue of PE ratios will subside if the US Government manages its debt effectively. And while everyone else is focused on the PE ratios of mega-cap companies, he is looking somewhere else.

“Without risk, PEs should be at 10, and I also think PEs would be 20 if debt levels came down so it's really up to how the government manages debt.

“Food and consumer actually looks overvalued because it's trading at a PE of 20-21 and there's just no growth and their sales decline over years, so we would much rather be involved in communications companies like AT&T or Comcast, Google or Facebook even, where there's a 30-40 per cent growth rate for 20-plus PEs.”

Both Forster and Toby Warburton, head of active quantitative equities at State Street Asia Pacific, refer to synchronised global growth across the US, Europe and Asia as a good measure for the health of the global economy, even if the growth is quite subdued.

Warburton doesn't think the US economy is in a “wildly expansionary phase” and admits US equities are “elevated, not in bubble territory” though strong earnings must start coming through to justify valuations.

“The improving economy gives equities more room to run, but we need to see the fundamentals coming through at the company level,” says Warburton.

“We have found areas in healthcare and some stocks in technology, but importantly, you want to find stocks in those sectors not taking on the high valuations that some of those big names are – growth, but not the really risky growth.

“We specifically like companies that are manufacturers and making things, not just trading on expectations of super-fast growth.

“I think the problem is people haven't really priced in risk – they haven't been expecting anything derailed by longer-term improvements.”

As always, it will be a case of wait and see.