What's behind Wilson's LIC success?

Summary: The Future Generation Investment Company (FGX) and Future Generation Global Fund (FGG) have delivered some stellar results for investors and charities since their inception. Growth is coming in part from companies that make money independent of wider market conditions, and SMSF holders could benefit from considering FGX for market exposure. |

Key take-out: The FGX portfolio is made up of stock pickers, who are highly incentivised to put up their best ideas and stake their reputations on the stock selections they make. This has contributed to the LIC's performance. |

Key beneficiaries: General investors. Category: LICs. |

From the back of a Sydney Ferry on his way to work at 7:30am, Geoff Wilson sounds genuinely surprised at the performance of his two new pet projects Future Generation Investment Company (FGX) and Future Generation Global (FGG). “I had some fairly high expectations for them, but to be honest they exceeded those and then some and with half the volatility of the market,” he says. Catching himself in the excitement, Wilson goes on, “but FGG has only been operating for a short period so we can't draw any real conclusions yet”.

If you saw Wilson out on the campaign trail for the charitable funds you would have heard him say the LICs were a win-win-win. A win for the charities, a win for investors and a win for the managers and service providers giving back to the community. Three months into the life of FGG and close to sixteen months into the existence of FGX I can definitely confirm at least two of those wins. I can't speak for the warm and fuzzy feeling the managers and service providers have but I assume it is there. Shareholders are winning with the returns and charities have already received $1.64 million in donations.

Performance and case for investment

The performance of FGX has been nothing short of sensational in an incredibly difficult market as we are all too well aware. Why is this? The answer lies in the selection of managers. Speaking with Wilson, his outlook echoes a number of market participants at the moment. We are in a low growth environment. Interest rates are low, inflation is low and earnings growth will be low too. Right now we are seeing companies growing earnings through cost outs but there is only so much you can cut. Top line earnings are not growing.

Where is growth coming from? It's from companies that make money independent of the greater economy. For Wilson and his investing, these stocks are the likes of IPH Limited, Austal Limited and Eclipx Group. And this brings us to why FGX has performed as well as it has. The portfolio is comprised of stock pickers. It is a portfolio of professionals guiding funds - funds they make a living from, manage clients' money in and uphold their reputation with. These are also funds where performance fees apply to the unit holders except for FGX so the managers are heavily incentivised to perform and grow funds no matter the conditions.

For shareholders FGX has outperformed the All Ords Accumulation Index by 11.3 per cent since inception. What will also be pleasing for shareholders and will make financial planners wet themselves with excitement is the fact this performance was achieved with fraction of the volatility of the market. The standard deviation of the portfolio was 8.4 per cent compared to the market of 14.9 per cent.

It is common sense to think these two figures are counter intuitive. Generally speaking you would give up one for the other, higher performance means greater volatility and less volatility means lower performance. But not in this case.

This fact should get the attention of SMSF investors who have been losing sleep over the last 12 months. If you need returns and need market exposure to get those returns but have lost confidence (or never had it) picking your own stocks, but still want to have a sense of control instead of handing it all over to fund managers, then FGX would seem the logical answer.

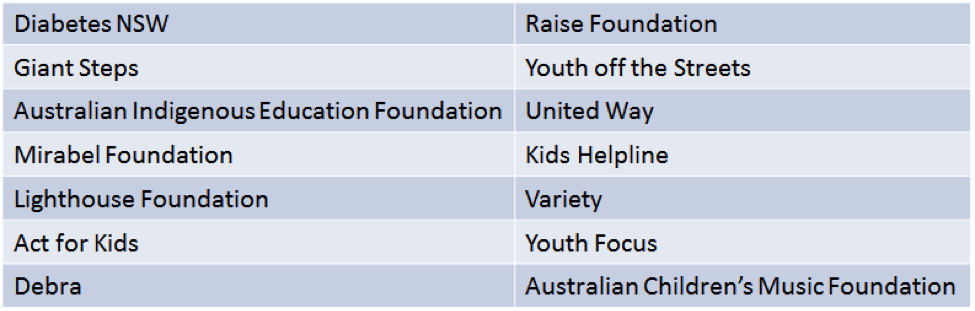

And don't forget the story you will be able to tell at BBQs this festive season when boring everyone with talk about your super. Not only are you beating the market but you are also involved in a fund that has donated $1.64m to charities for children at risk like Kids Helpline, Youth off the Streets and the Australian Indigenous Education Fund.

Image 1: Charities benefiting from Wilson's strategy

Dividends and dividends looking forward

FGX declared its first dividend in October of 2 cents per share. Speaking with Wilson he did say it would take a few years to build up the profit reserves to a decent level. At the moment the challenge with the dividend is determining an acceptable payout ratio. FGX is reliant on the underlying funds banking realised profits to pay out as distributions. This of course is determined by those funds' ability to perform in the difficult environment going forward. Currently looking into the profit reserves you can anticipate an interim dividend in the same ballpark as the final dividend if not a little bit higher. This will grow with time.

What are they all holding?

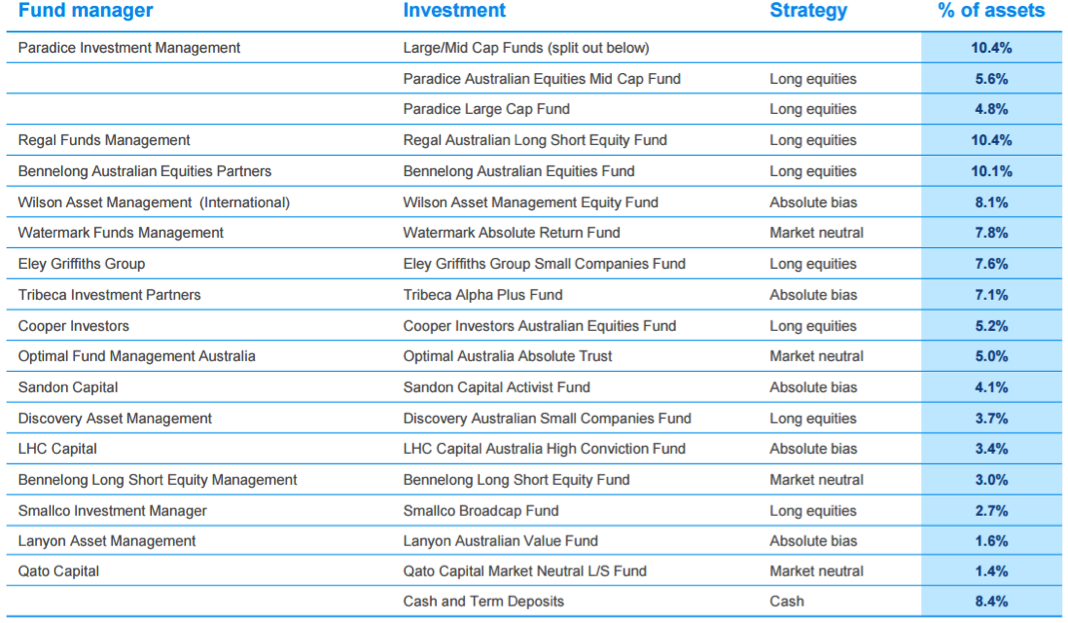

One of the risks I see with FGX is the lack of transparency with the holdings. They have amassed a “who's who” when it comes to the Australian funds management space - David Paradice and his team have the biggest allocation - but you cannot easily see what these managers are holding.

As investors you are putting your trust in the investment committee who put their trust in the fund managers. Those managers then direct the funds into the best ideas they have. How much cross over is there? How big is the Australian market, with 16 funds all looking independently for the best investment ideas? If you are holding FGX as part of your portfolio and are building individual stock holdings around it, how will you know what your total exposure is?

I have no doubt the managers are all selecting the best stocks they possibly can for their investors according to their mandate and the investment committee at FGX is in turn selecting the best mix of managers. But a greater look-through for shareholders would help to build further trust. At the moment the monthly updates profile a manager and tell you about their approach. This covers off the typical “top down bottom up fundamental value” talk, but perhaps showing the top five or ten holdings would give investors a better sense of the philosophy in action.

Image 2: Who are the entrusted managers and the funds?

At the time of writing FGX is currently trading at NTA. Arguably you would expect this to trade at a premium in the future if the performance continues, especially with the PR machine that is Wilson behind it. You don't need to see a great discount to NTA to get excited about the investment case here. Being able to buy this at fair value is all the incentive you should need. Even Wilson himself topped up recently.