What will cause land prices to fall?

Despite the important role that residential property plays in modern economies -- often accounting for a majority of household wealth and in countries such as Australia a majority of banking assets -- precious little is known about the sector's long-term dynamics.

Naturally that's understandable. Collecting property data was until recently quite difficult and homes are unique assets requiring complex statistical methods simply to derive a single house price index.

To the extent that long-run price indices exist they tend to be quite limited. Perhaps the most famous example is the Herengracht Canal Index from Amsterdam which dates back to 1628. Australia has its own long-run series courtesy of Nigel Stapledon which goes all the way to 1880.

New research by economists Katharina Knoll, Moritz Schularick and Thomas Steger tries to plug the information gap. They present new long-run house price estimates for 14 advanced economies since 1870.

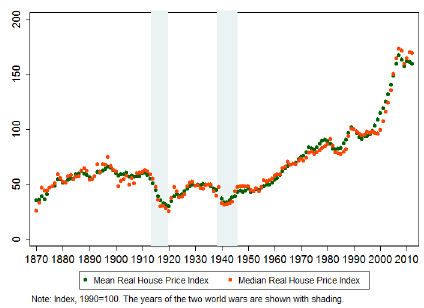

The countries assessed display some similar qualities but the strength of growth can differ significantly. Generally house prices follow a “hockey-stick” pattern -- real house prices remained broadly stable through the late 19th century until the middle of the 20th century and have increased significantly since then.

According to the authors, “real house prices have approximately tripled since the beginning of the 20th century, with virtually all of the increase occurring in the second half of the 20th century.” Real house prices in the 1960s, for example, were not much higher than they were prior to the First World War.

Mean and Median Real House Prices (1870 – 2012)

Of the countries assessed Australia was without peer, experiencing the strongest real house price growth; Germany the weakest. Real house prices in Australia have increased ten-fold since 1870 and consistent with the broader trends those gains were concentrated in the last six decades.

Germany is a bit of an outlier as far as advanced economies go, with real house prices declining by 0.8 per cent a year between the 1980s and 2012. Japan is another unusual country given its unique demographics.

Historically urban and rural property prices have moved in step, although in the short- to medium-term there can be significant variation. This suggests that at least historically urban and rural living have been considered substitutes.

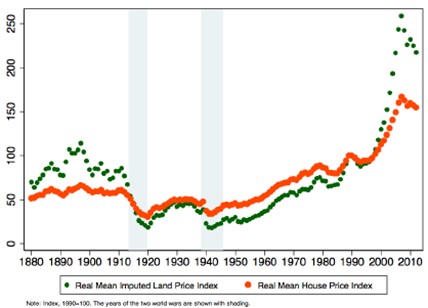

Perhaps the most important finding though relates to land prices. According to the authors, 81 per cent of the long-term rise in house prices can be explained by higher land prices. This jumps up to 90 per cent for Australia, 87 per cent for the US, 74 per cent for the UK and 95 per cent for Canada.

House prices and imputed land prices

Explaining why this has been the case is somewhat difficult. Certainly there can be country-specific factors -- in Australia, for example, it can take years to go through the planning and zoning process to release new blocks of land.

But the fact that the rise in land prices has been universal -- it has been observed throughout the sample -- indicates that there is another factor at play. The authors believe that transportation offers the best explanation.

Rail and motor vehicles -- in addition to the airplane and faster shipping -- drastically reduced transportation costs throughout the 19th century and the first half of the 20th century. This triggered an expansion of land development and the increased supply of economically usable land put downward pressure on land and property prices.

The second half of the 20th century has not seen a comparable decline in transportation costs. Cars and rail have improved but the impact has been more cosmetic than transformative, although air travel has become increasingly cheaper.

In that environment, land effectively becomes fixed and combined with restrictions on land use -- and financial deregulation -- has created the perfect environment for a property boom. At first glance this hypothesis makes sense and certainly appears likely.

But we shouldn't discount the effect on land use restrictions, which separate the likes of Australia and Canada -- with high restrictions -- from the likes of the US and Germany -- where housing supply is more flexible.

The authors also suggest that housing may simply be a superior good; by which I mean a good that households spend more on as they become more affluent. We shouldn't discount the possibility, particularly given the capitalist model of the economy -- and the modern concept of economic growth -- has really only existed for a brief period of time.

Their assessment begs the question: what will cause land prices to fall or at least normalise to longer-term price-to-income multiples?

First, restrictions on bank lending via a more highly regulated banking sector. To some extent Basel III may already drive this shift but there has obviously been extensive discussion in Australia regarding the Murray Inquiry (Murray must address the moral hazard in housing, July 16) and whether the Reserve Bank of Australia and the Australian Prudential Regulation Authority will introduce macroprudential policies (Another RBA warning on housing, October 10).

Second, ease zoning and land-use restrictions to free up new land and use the land available more efficiently. There's no good reason why this process takes years and really the only beneficiaries are property developers and state and local governments.

Third, remove measures which artificially increase demand. The first home owners grant, negative gearing and the capital gains exemption could all either be removed or wound back to remove economic distortions and ease the pressure on a relatively fixed housing supply.

Finally, transportation costs can be reduced. For example, this can be achieved via cheaper cars -- and fees associated with running and maintaining a vehicle -- and better public transport or even a scheme such as Uber.

An alternative approach to reducing transportation costs is simply for workplaces to reduce the need for travel full-stop. As information technology continues to improve and workplaces continue to adapt an increasing share of the population will likely work from home.

This, as with the creation of rail and motor vehicles, could potentially make a range of locations more economically viable and increase the supply of land for people to live in. Living in the city will no longer be as appealing.

Long-term property dynamics are interesting because the current situation operates so far outside those norms. Will we revert towards the mean? I have always had my doubts, although I've conceded that there is a considerable risk that the sector may underperform for a number of years.

Nevertheless, the cross-country comparison makes it clear that Australia isn't unique -- although our property growth has been stronger than other comparable countries -- and the rapid rise in property and land prices has been a global affair.

But that isn't a cause for complacency. High land prices remain a problem for the Australian economy; pricing out Australia's youth, creating systemic risks for the financial system and potentially creating barriers to entry for Australian businesses. Land prices might be a global problem but they are a bigger problem here than they are almost anywhere else.