What The FTX Wipeout Teaches Us

Investors and observers of the crypto and digital asset space could be forgiven for wishing 2022 away and hoping for a quiet end to the year.

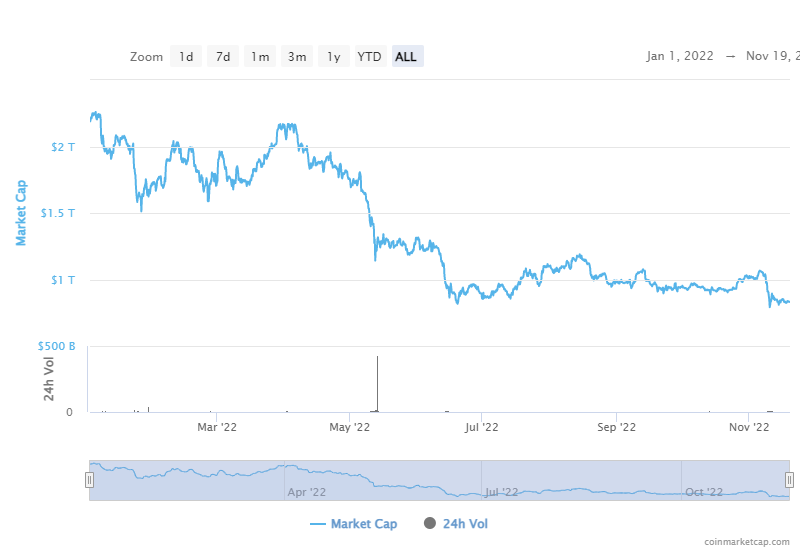

But those hopes were dashed this month. The FTX wipeout is the latest in a string of high-profile crypto crashes this year including Terra/Luna, BlockFi, Celsius, 3AC and Voyager, and is being called crypto’s “Lehman Brothers” moment. The overall crypto market cap has fallen more than 60 per cent from a high of $US2.2 trillion at the start of the year to around $US830 billion on 19 November.

Its significance shouldn’t be underestimated. A quick recap:

2 November: Coindesk reported Alameda Research, the crypto trading firm owned by Sam Bankman-Fried, the founder and CEO of FTX.com, held a significant amount of FTT, FTX’s native crypto token on its balance sheet.

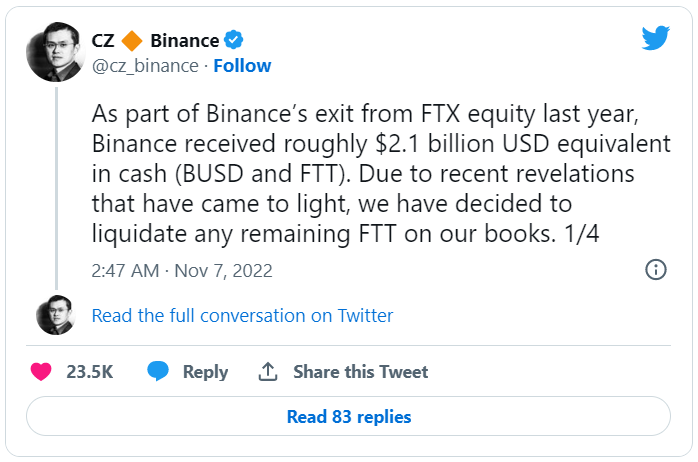

6 November: Changpeng Zhao (aka “CZ”), the CEO of Binance, the world’s largest crypto exchange by volume, announced via Twitter that Binance would liquidate its FTT holding due to “recent revelations that have come to light”.

Then began an extraordinary tweet exchange between CZ and Alameda’s CEO Caroline Ellison who offered to buy Binance’s FTT holding for $US22 per token. As the market began to digest the implications, FTX funds outflows rose and FTT exchange balances soared indicating sellers preparing to liquidate. FTT’s price began to fall.

8 November: With the market price of FTT down more than 70 per cent, in a remarkable turnaround, Bankman-Fried announced, also via Twitter: "Things have come full circle, and FTX.com’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for FTX.com (pending DD etc.)".

It appeared that Binance was now coming to the rescue only two days after announcing its liquidation of FTT. But this proved to be a false dawn. Within a day, Binance pulled the pin:

10 November: FTX froze withdrawals and suspended new customer on-boarding. In a last-ditch attempt, Bankman-Fried also said that he was in discussions with Justin Sun, founder of the crypto token Tron, but to no avail.

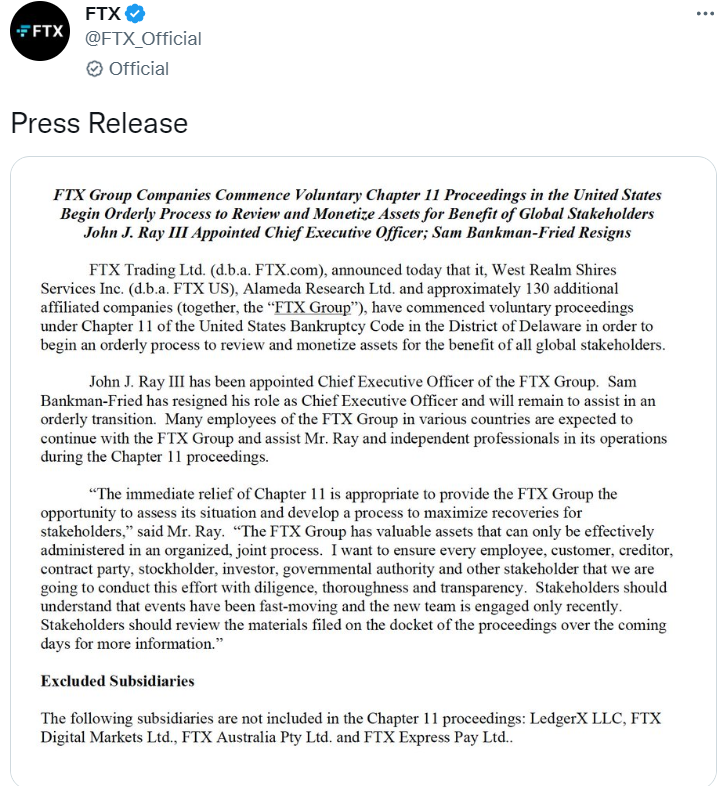

11 November: Bankman-Fried stepped down as CEO and FTX filed for bankruptcy, with its Australian subsidiaries entering voluntary administration:

The significance of the FTX fiasco cannot be underestimated. FTX was one of the largest crypto exchanges worldwide, and Bankman-Fried a darling of the crypto space having personal wealth estimated at $US16 billion just prior to recent events.

He was considered something of a “white knight” as he threw lifelines to other distressed crypto businesses, either directly or via Alameda. He also displayed political affiliations, having donated to Democratic candidates and aligned causes.

But in the end, it turned out that the emperor had no clothes.

2022 has also been likened to the “dot com” crash during the early 2000s in which the tech-heavy NASDAQ fell almost 80 per cent peak to trough after the bubble burst. With the overall crypto market down “only” 60% per cent the sell-off may yet have further to run if comparisons apply.

For crypto investors looking to maintain exposure (or brave investors wanting to take advantage of lower prices), the FTX wipeout and other recent fiascos provide valuable, if painful, lessons.

The most important is the crypto cliche “not your keys, not your coins”. Crypto and digital assets based on blockchain technology are controlled by whoever possesses the cryptographic keys to the addresses where the assets are held. Crypto held by any centralised exchanges or other intermediaries on behalf of investors is therefore controlled by those centralised intermediaries.

Once FTX suspended withdrawals, users with FTT or other tokens stored on FTX wallets had no ability to retrieve their crypto. This is because the keys to FTX wallets were held by FTX and not the individual user directly. Only FTX could transfer crypto held in FTX wallets.

Experienced crypto investors typically only transfer crypto to an exchange when ready to sell within a short timeframe and withdraw any crypto purchased on exchange immediately upon trade settlement to a secure crypto wallet from reputable manufacturers such as Ledger or Trezor.

Self-sovereignty is the safest way to hold crypto assets but also requires a certain level of IT literacy and user confidence. The “user experience” (aka “UX”) for crypto wallets is still in its infancy (some might say poor). But as with most innovative technology, this will improve over time until the UX fades away, much like the ease with which most of us can navigate a modern mobile phone.

The other key lesson is that crypto is an emerging asset class based on new and evolving technology with uncertain outcomes and significant risk. If Bitcoin (BTC) and Ethereum (ETH) represent the “blue chips”, then everything else (like FTT) is further along the risk curve:

- BTC is a distributed proof-of-work digital commodity whose base layer blockchain is the most secure, and therefore the most likely to become a settlement layer for storing value.

- ETH is a distributed (but less than BTC) proof-of-stake smart contract platform that is the most widely adopted (right now) for a variety of decentralised applications such as DeFI, NFTs and others.

While BTC and ETH both have history and staying power, even their market prices are significantly down during the present bear market cycle.

Consider FTT, FTX’s native token. Issued by FTX, FTT conferred benefits to traders using FTX’s exchange including fee discounts and loyalty rewards. While FTX itself thrived, so did FTT. But as soon as the market perceived issues with FTX’s balance sheet and the absence of collateral supporting FTT, the floor fell from under FTT’s feet as holders scrambled for the exit, effectively akin to a “bank run”. A similar race for the door occurred during the Terra/Luna chaos earlier this year.

BTC conversely has no centralised issuer at all. The decentralised Bitcoin network protocol encodes a fixed and predictable supply schedule that is secured by the decentralised network nodes. Altering the protocol would require a magnitude of computing power that would likely render the resulting altered blockchain worthless. Its value comes solely from market demand based on a belief that a decentralised, immutable digital ledger is a better form of asset registration, storage and exchange in a digital world than other forms.

The speed with which crypto markets can react to liquidity issues can leave “bag holders” with no time to divest their holdings. Risks abound and never has the phrase “caveat emptor” been so appropriate. It’s a jungle out there and self-sovereignty and education are the two most important rules for smart crypto investors.

Frequently Asked Questions about this Article…

The FTX wipeout teaches investors the importance of self-sovereignty in crypto investments. The phrase 'not your keys, not your coins' highlights the risk of storing crypto on centralized exchanges. It's crucial to control your cryptographic keys by using secure wallets like Ledger or Trezor to avoid losing access to your assets during exchange failures.

The FTX collapse is likened to the Lehman Brothers moment because it represents a significant failure in the crypto space, similar to how Lehman's bankruptcy marked a pivotal point in the 2008 financial crisis. It underscores the vulnerabilities and risks within the crypto market, leading to a broader loss of confidence.

The FTX fiasco has contributed to a significant decline in the overall crypto market, with the market cap falling over 60% from its peak. It highlights the volatility and risks associated with crypto investments, prompting investors to reassess their strategies and the security of their holdings.

Holding crypto on centralized exchanges poses risks such as losing access to your assets if the exchange faces liquidity issues or suspends withdrawals, as seen with FTX. It's essential to transfer crypto to secure wallets where you control the keys to mitigate these risks.

The FTX collapse is compared to the dot-com crash as both involve significant downturns in emerging markets driven by speculative investments. Just as the NASDAQ fell nearly 80% during the dot-com bubble burst, the crypto market has seen a substantial decline, suggesting potential further volatility.